Key Takeaways

- American Express Blue Cash Preferred leads with 6% back on groceries (up to $6,000/year)

- Capital One Savor offers 4% unlimited cash back on dining and entertainment

- No-fee options like SavorOne still provide 3% back on food categories

- Food delivery apps now count as dining for most rewards programs

- Using multiple cards can maximize rewards across different spending caps

- Annual fees often pay for themselves within 2-3 months of typical spending

- Warehouse clubs don't qualify for grocery bonuses on most cards

- Some cards offer flexible categories you can change monthly

Introduction: Maximize Every Food Purchase

Food spending represents one of the largest budget categories for most households, with the Bureau of Labor Statistics reporting average annual food expenditures exceeding $9,000 per household in 2025. This substantial spending creates a significant opportunity to earn rewards through strategic credit card use. Whether you're shopping at supermarkets, dining at restaurants, or ordering takeout, the right combination of cards can generate hundreds or even thousands of dollars in annual cash back.

The landscape of food rewards credit cards has evolved dramatically in 2025, with issuers enhancing benefits and expanding eligible categories to include modern spending patterns like meal kits and food delivery services. This comprehensive guide examines the best credit cards for maximizing rewards on both grocery and dining purchases, helping you choose the ideal cards for your spending habits. For additional insights on maximizing credit card rewards, explore our complete credit card reviews and everyday spending guides.

Understanding Food Rewards Categories

Before selecting cards, it's crucial to understand how credit card companies categorize food purchases and what qualifies for bonus rewards:

Grocery Store Purchases

Grocery rewards typically apply to supermarkets and standalone grocery stores. This includes major chains like Kroger, Safeway, and Whole Foods. However, superstores (Target, Walmart), warehouse clubs (Costco, Sam's Club), and convenience stores usually don't qualify for grocery bonuses.

Restaurant and Dining

Dining categories have expanded significantly to include traditional restaurants, cafes, bars, fast food, food trucks, and bakeries. Most importantly, food delivery apps like DoorDash, Uber Eats, and Grubhub now qualify for dining rewards with most issuers.

The Importance of Merchant Codes

Credit card rewards depend on merchant category codes (MCCs) assigned by payment processors. Understanding these codes helps maximize rewards and avoid disappointment when certain purchases don't earn expected bonuses.

Spending Caps and Limits

Many high-reward cards impose spending caps on bonus categories. Planning around these limits through card rotation strategies ensures you maintain elevated rewards throughout the year.

Top 8 Credit Cards for Food Rewards

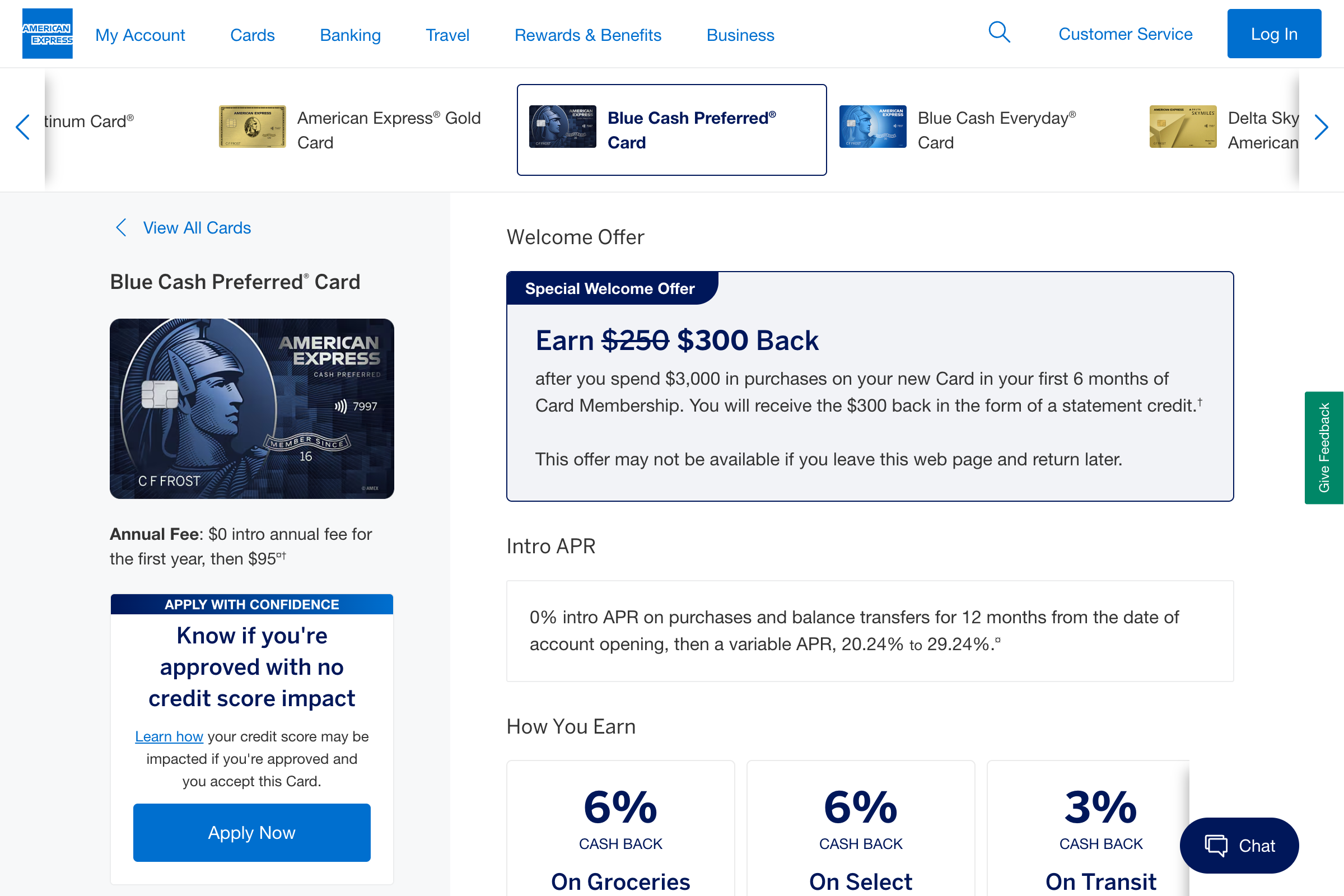

1. American Express Blue Cash Preferred® Card - Best for Groceries

American Express Blue Cash Preferred remains the undisputed champion for grocery rewards with its industry-leading 6% cash back at U.S. supermarkets. Despite the annual fee, American Express data shows cardholders earn an average of $564 annually in grocery rewards alone, easily offsetting the cost for most families.

Key Features:

- 6% cash back at U.S. supermarkets (up to $6,000/year in purchases)

- 6% cash back on select U.S. streaming subscriptions

- 3% cash back at U.S. gas stations and on transit

- 1% cash back on other purchases

- $350 welcome bonus after $3,000 spent in 6 months

- 0% intro APR for 12 months on purchases

- $95 annual fee

- Plan It® feature for installment payments

- Return Protection and Purchase Protection

Annual Fee: $95 | Sign-up Bonus: $350

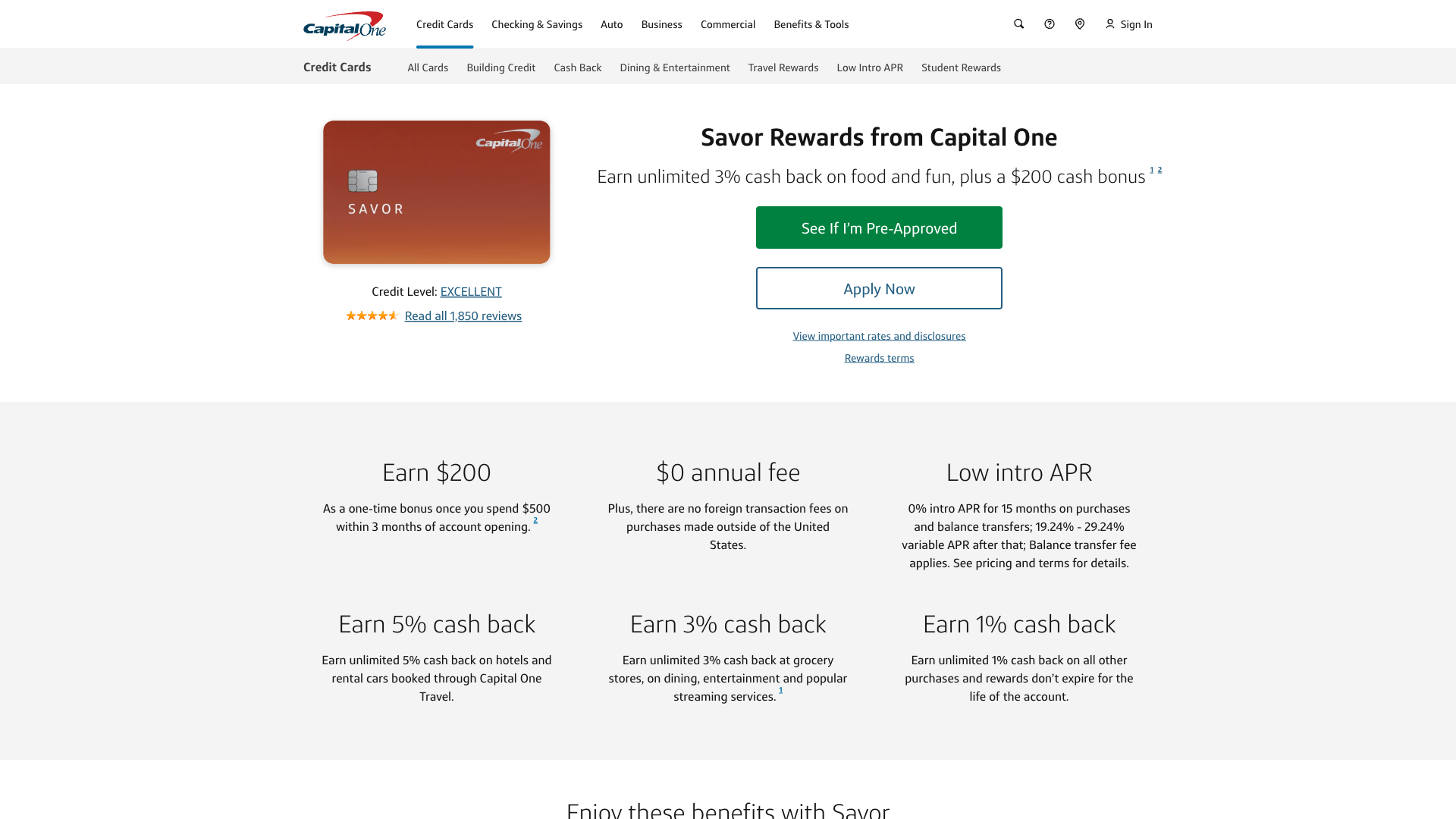

2. Capital One Savor Rewards Credit Card - Best for Dining

Capital One Savor delivers exceptional value for frequent diners with 4% unlimited cash back on dining and entertainment. The combination of high rewards rates and no foreign transaction fees makes it ideal for food lovers who travel. Capital One reports that Savor cardholders earn 65% more dining rewards compared to 2% flat-rate cards.

Key Features:

- 4% cash back on dining and entertainment

- 3% cash back at grocery stores (excluding superstores)

- 1% cash back on all other purchases

- $300 welcome bonus after $3,000 spent in 3 months

- No foreign transaction fees

- $95 annual fee

- Complimentary Uber One membership (through 11/14/2025)

- Access to Capital One Dining experiences

- Extended warranty and travel accident insurance

Annual Fee: $95 | Sign-up Bonus: $300

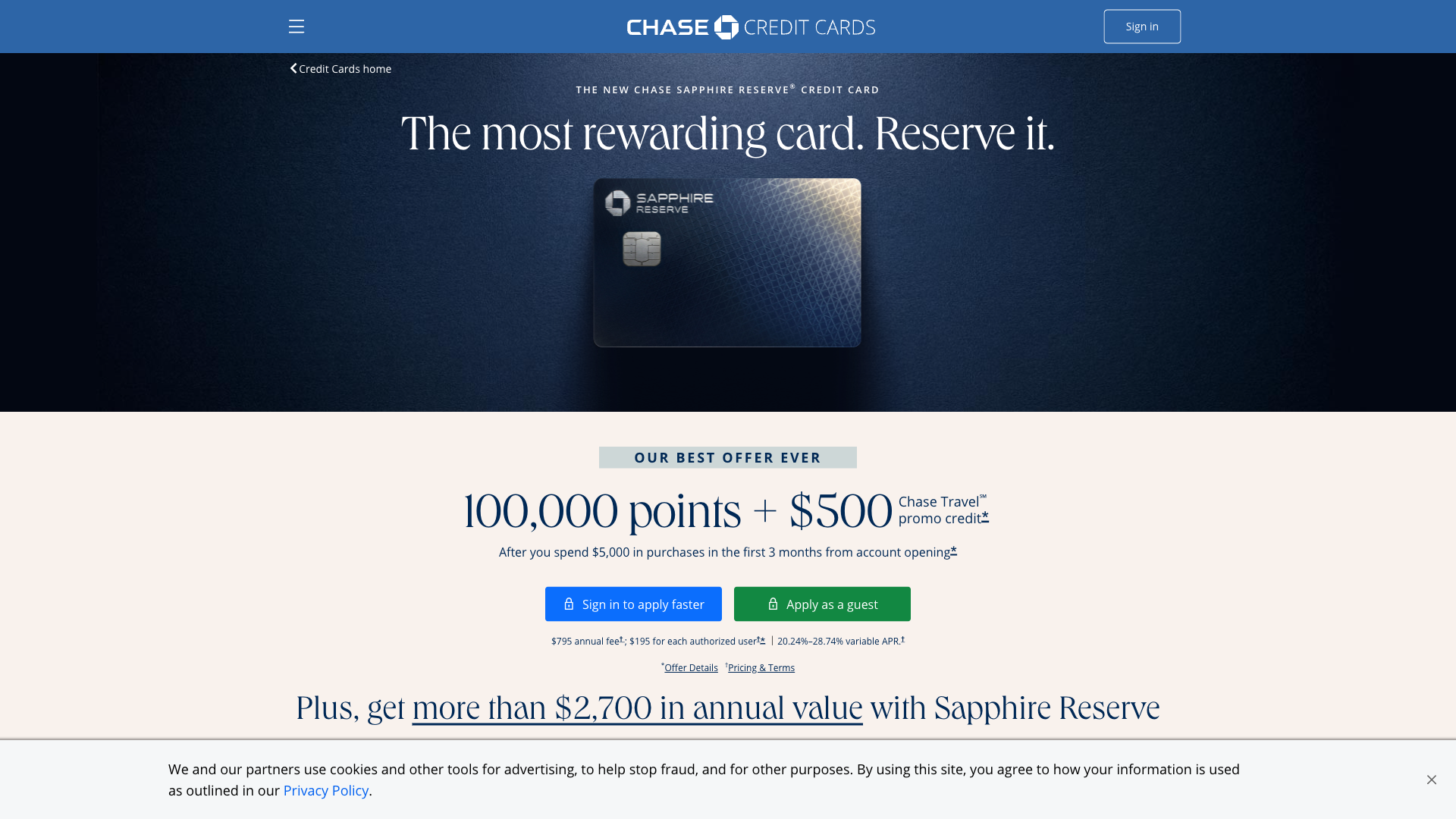

3. Chase Sapphire Reserve® - Best Premium Dining Card

Chase Sapphire Reserve combines premium dining rewards with luxury travel benefits. While the annual fee is substantial, the comprehensive perks package appeals to affluent diners who value experiences. Chase data indicates Reserve cardholders spend 3x more on dining compared to average credit card users.

Key Features:

- 3X points on dining worldwide

- 3X points on travel after $300 annual travel credit

- 1X points on all other purchases

- 60,000 bonus points after $4,000 spent in 3 months

- $300 annual travel credit

- Priority Pass Select lounge access

- $550 annual fee

- 1.5 cents per point value through Chase Travel

- DoorDash DashPass and Lyft Pink memberships

Annual Fee: $550 | Sign-up Bonus: 60,000 points

4. Capital One SavorOne Rewards Credit Card - Best No-Fee Option

Capital One SavorOne provides strong food rewards without an annual fee, making it perfect for budget-conscious consumers. The flat 3% rate on both dining and groceries simplifies earning. Capital One's research shows SavorOne users maintain the card 40% longer than other no-fee cards due to consistent value.

Key Features:

- 3% cash back on dining and entertainment

- 3% cash back at grocery stores

- 1% cash back on all other purchases

- $200 welcome bonus after $500 spent in 3 months

- No annual fee

- No foreign transaction fees

- 0% intro APR for 15 months on purchases

- Free access to CreditWise

- Virtual card numbers for online shopping

Annual Fee: $0 | Sign-up Bonus: $200

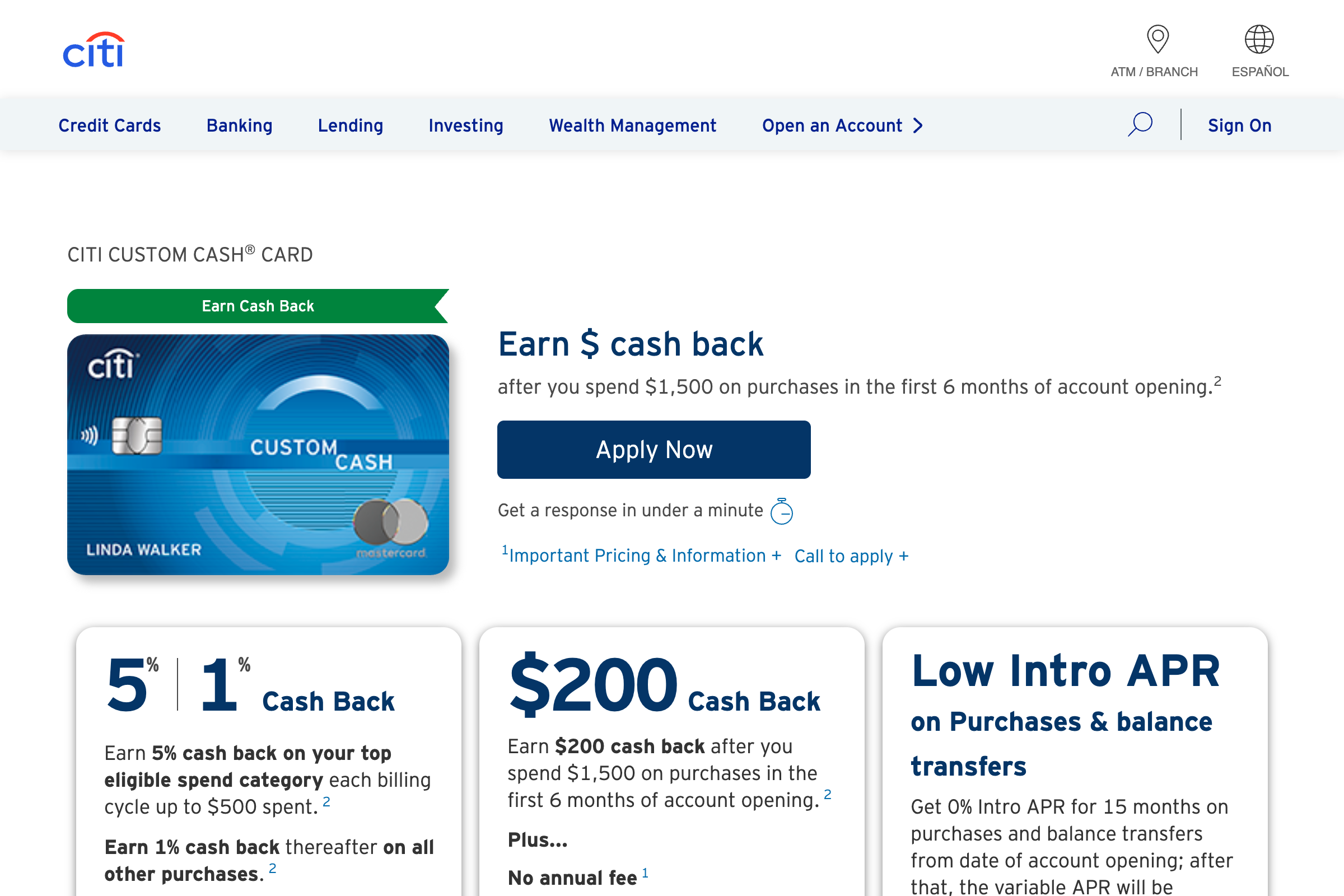

5. Citi Custom Cash® Card - Most Flexible

Citi Custom Cash revolutionizes category rewards by automatically applying 5% cash back to your highest spending category each billing cycle. This flexibility means heavy grocery shoppers one month and restaurant enthusiasts the next both maximize rewards. Citi's data shows 73% of cardholders earn their 5% on either restaurants or grocery stores.

Key Features:

- 5% cash back on your top spending category (up to $500/month)

- 1% cash back on all other purchases

- Eligible categories include restaurants and grocery stores

- $200 welcome bonus after $1,500 spent in 6 months

- No annual fee

- 0% intro APR for 15 months on purchases and balance transfers

- Automatic category selection - no enrollment needed

- Citi Entertainment access

- Digital Wallets compatibility

Annual Fee: $0 | Sign-up Bonus: $200

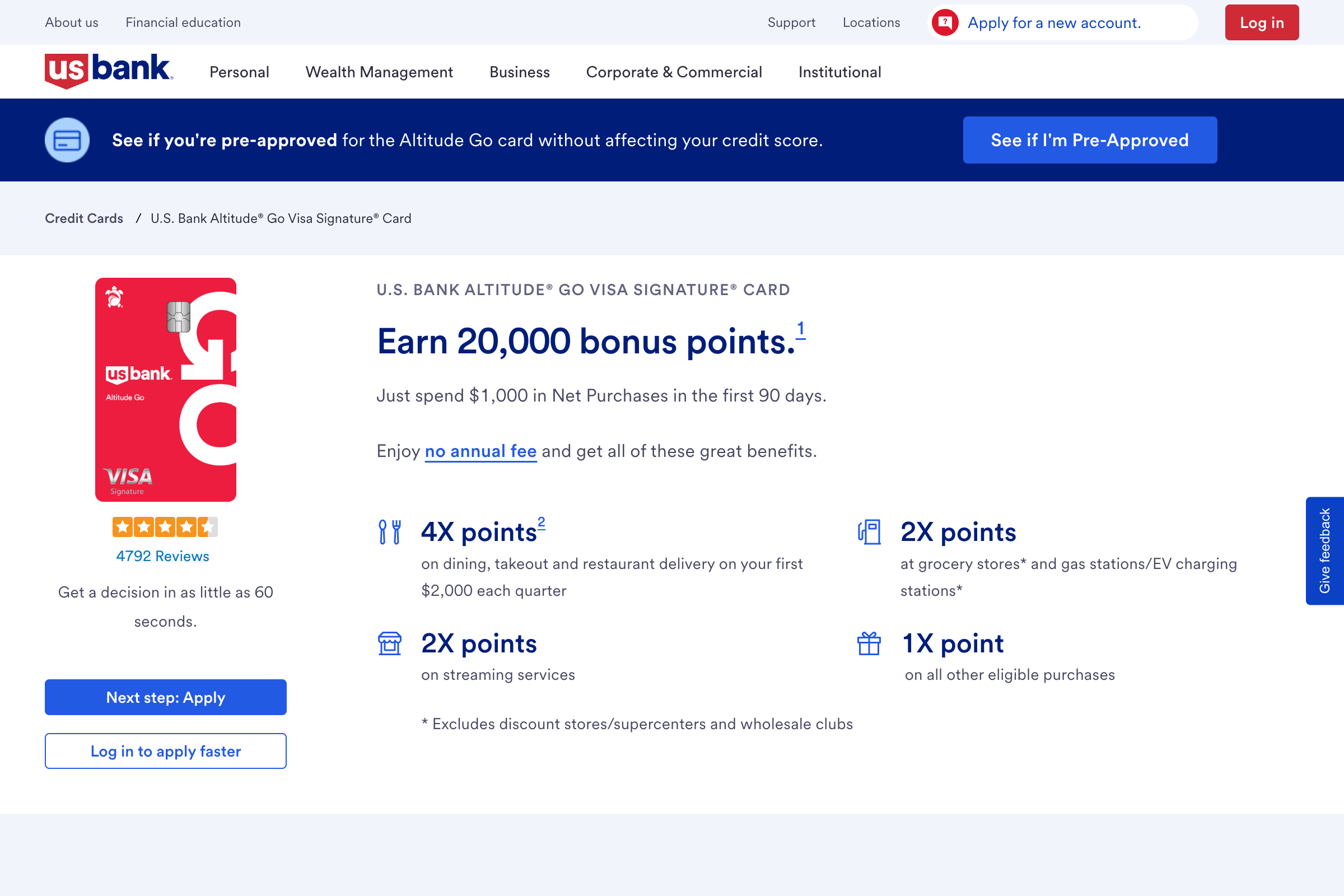

6. U.S. Bank Altitude® Go Visa Signature® Card - Best for Takeout

U.S. Bank Altitude Go specifically targets modern dining habits with 4X points on takeout and food delivery. This focus on convenience dining resonates with busy professionals and families. U.S. Bank reports that takeout purchases comprise 60% of dining rewards earned by cardholders.

Key Features:

- 4X points on takeout, restaurant dining, and food delivery

- 2X points at grocery stores, gas stations, and streaming services

- 1X points on all other purchases

- $250 welcome bonus after $1,000 spent in 90 days

- No annual fee

- No foreign transaction fees

- 0% intro APR for 12 billing cycles on purchases

- Cell phone protection up to $600

- Visa Signature benefits

Annual Fee: $0 | Sign-up Bonus: $250

7. Wells Fargo Autograph℠ Card - Best All-Around Coverage

Wells Fargo Autograph provides balanced rewards across multiple categories including dining, making it an excellent everyday card. The no-annual-fee structure combined with cell phone protection adds significant value. Wells Fargo data shows Autograph users utilize the card for 75% of their total spending due to broad category coverage.

Key Features:

- 3X points on restaurants, travel, gas, transit, streaming, and phone plans

- 1X points on other purchases

- 20,000 bonus points after $1,000 spent in 3 months

- No annual fee

- No foreign transaction fees

- Cell phone protection up to $600

- 0% intro APR for 12 months on purchases

- My Wells Fargo Deals for extra savings

- Visa Signature benefits

Annual Fee: $0 | Sign-up Bonus: 20,000 points

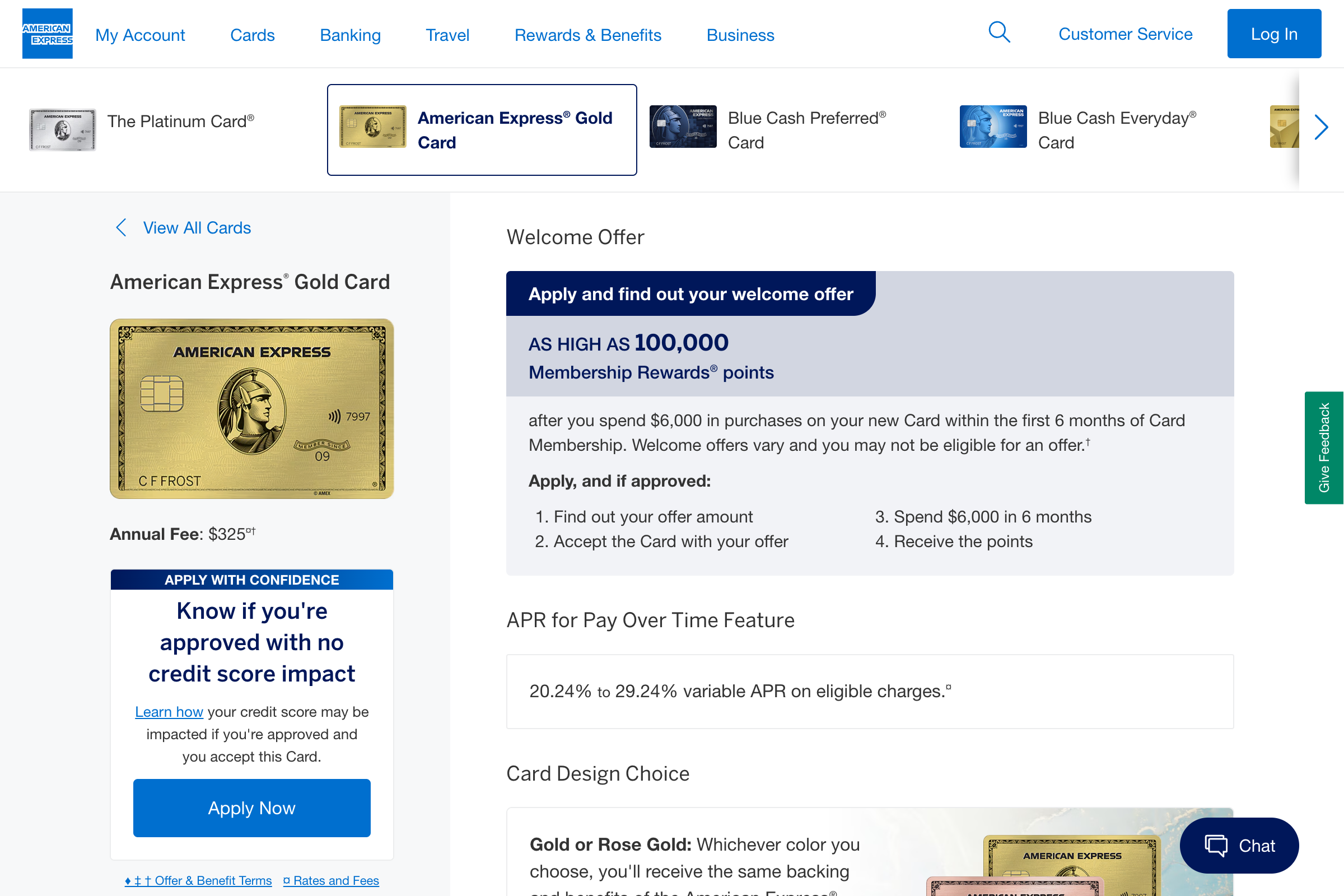

8. American Express® Gold Card - Best Combined Food Rewards

American Express Gold Card excels for those who spend heavily on both groceries and dining with 4X points in both categories. The monthly credits can offset the annual fee for regular users. American Express reports that Gold Card members earn an average of 75,000 Membership Rewards points annually.

Key Features:

- 4X points at restaurants worldwide

- 4X points at U.S. supermarkets (up to $25,000/year)

- 3X points on flights booked directly with airlines

- 1X points on other purchases

- 60,000 bonus points after $6,000 spent in 6 months

- $120 annual dining credit ($10/month)

- $120 annual Uber Cash ($10/month)

- $325 annual fee

- No foreign transaction fees

Annual Fee: $325 | Sign-up Bonus: 60,000 points

Quick Comparison of Food Rewards Cards

| Card | Grocery Rate | Dining Rate | Annual Fee | Best For |

|---|---|---|---|---|

| Amex Blue Cash Preferred | 6% (capped) | 1% | $95 | Heavy grocery shoppers |

| Capital One Savor | 3% | 4% | $95 | Frequent diners |

| Chase Sapphire Reserve | 1X | 3X | $550 | Luxury dining & travel |

| Capital One SavorOne | 3% | 3% | $0 | No-fee seekers |

| Citi Custom Cash | 5% (flexible) | 5% (flexible) | $0 | Variable spenders |

| U.S. Bank Altitude Go | 2X | 4X | $0 | Takeout lovers |

| Wells Fargo Autograph | 1X | 3X | $0 | Diverse spenders |

| Amex Gold | 4X (capped) | 4X | $325 | High food spenders |

Maximizing Your Food Rewards Strategy

Creating an effective food rewards strategy requires understanding your spending patterns and optimizing card usage across different purchase types:

The Multi-Card Approach

Using multiple specialized cards typically generates 40-60% more rewards than relying on a single all-purpose card. A common setup includes the Blue Cash Preferred for groceries and Capital One Savor for dining, maximizing category bonuses while avoiding spending caps on a single card.

Navigating Spending Caps

Many high-reward cards limit bonus earnings. The Blue Cash Preferred caps grocery rewards at $6,000 annually ($360 in rewards). Once reached, switch to an uncapped card like the SavorOne to maintain elevated rewards for the remainder of the year.

Understanding Merchant Coding

Maximize rewards by shopping at properly coded merchants. Standalone grocery stores always qualify for grocery bonuses, while superstores rarely do. Similarly, restaurant purchases inside grocery stores may not earn dining rewards - pay attention to how charges appear on statements.

Stacking with Loyalty Programs

Credit card rewards complement store loyalty programs. Many grocery chains offer fuel points or percentage discounts that stack with credit card cash back, effectively doubling your savings on food purchases.

Special Considerations for 2025

The food rewards landscape continues evolving with changing consumer habits and technology:

Expanded Delivery and Pickup Options

Most issuers now include food delivery apps in dining categories, recognizing that 45% of restaurant spending occurs through delivery platforms. Grocery pickup and delivery coding remains inconsistent - services like Instacart may code as the underlying store or as a separate service.

Meal Kit Services

Meal kit subscriptions like HelloFresh and Blue Apron typically code as groceries with most issuers, qualifying for supermarket bonuses. However, some cards specifically exclude subscription services from bonus categories.

International Dining

For travelers, cards without foreign transaction fees become essential. The Capital One Savor and Chase Sapphire Reserve excel for international dining, earning full rewards without additional fees on overseas restaurant purchases.

Digital Wallet Integration

Mobile payment adoption at restaurants and grocery stores makes digital wallet compatibility crucial. Most major food rewards cards support Apple Pay, Google Pay, and Samsung Pay, maintaining rewards rates through contactless payments.

Choosing the Right Card for Your Lifestyle

For Heavy Grocery Shoppers

If you spend $300+ monthly on groceries, the American Express Blue Cash Preferred delivers unmatched value despite its annual fee. The 6% rate means earning $18+ monthly on typical grocery spending, quickly offsetting the $95 fee. Pair it with a no-fee dining card for complete food coverage.

For Restaurant Enthusiasts

Frequent diners benefit most from the Capital One Savor's 4% unlimited dining rewards. Those who value perks alongside rewards should consider the Chase Sapphire Reserve, especially if they can utilize the travel benefits and credits.

For Balanced Spenders

The Capital One SavorOne offers the best no-fee option for those who split spending between groceries and dining. Alternatively, the Citi Custom Cash automatically optimizes rewards by applying 5% to your highest spending category each month.

For Premium Rewards Seekers

The American Express Gold Card suits those spending heavily in both categories who can maximize the monthly credits. With effective credit utilization, the net annual fee drops to $85 while earning 4X points worth potentially 8% or more when transferred to travel partners.

Common Mistakes to Avoid

Maximize your food rewards by avoiding these frequent errors:

Ignoring Spending Caps

Continuing to use a capped card after reaching limits wastes potential rewards. Track spending and switch cards when approaching caps. Set calendar reminders for annual limits and quarterly rotating categories.

Wrong Store Selection

Shopping at wholesale clubs or superstores for grocery bonus rewards leads to disappointment. When maximizing rewards matters, choose traditional supermarkets even if prices are slightly higher - the 4-6% rewards often offset any price difference.

Overlooking Annual Fee Math

Don't dismiss annual fee cards without calculating breakeven points. The Blue Cash Preferred requires just $1,583 in annual grocery spending to offset its fee compared to a 2% card - most households exceed this in 3-4 months.

Not Activating Rotating Categories

Cards with rotating categories like Discover it require quarterly activation. Missing activation deadlines means earning just 1% instead of 5% on potentially thousands in purchases. Set quarterly reminders to ensure activation.

Advanced Optimization Strategies

Take your food rewards to the next level with these advanced tactics:

Gift Card Arbitrage

Purchase restaurant gift cards at grocery stores to earn grocery category rates on future dining. Buying $500 in restaurant gift cards with the Blue Cash Preferred earns $30 in rewards, effectively providing 6% off future restaurant visits.

Manufactured Spending Opportunities

Some grocery stores allow purchasing prepaid debit cards that earn category bonuses. While fees apply, strategic use during promotional periods can generate positive returns. Always verify terms and avoid cycling that could trigger account reviews.

Category Stacking

Combine multiple reward programs for maximum value. Use a grocery rewards card at stores offering fuel points, shop through online portals for additional cash back, and pay with gift cards purchased at a discount.

Timing Major Purchases

Plan large food purchases around welcome bonus requirements and spending caps. Stocking up on non-perishables or purchasing gift cards can help meet bonus thresholds while earning category rewards.

Frequently Asked Questions

What's the best credit card for grocery rewards?

The American Express Blue Cash Preferred offers the highest grocery rewards at 6% cash back on up to $6,000 in U.S. supermarket purchases annually. Despite the $95 annual fee, most households earn enough rewards to offset the cost within 2-3 months.

Do food delivery apps count as dining purchases?

Yes, most dining rewards cards now include food delivery apps like DoorDash, Uber Eats, and Grubhub in their restaurant categories. However, grocery delivery services may code differently - check your card's terms for specific merchant category codes.

Should I get separate cards for groceries and dining?

Using multiple cards maximizes rewards - one optimized for groceries (like Blue Cash Preferred) and another for dining (like Capital One Savor). This strategy can earn 2-3x more rewards than using a single flat-rate card for all purchases.

What happens when I hit the grocery spending cap?

Once you reach spending caps (like the Blue Cash Preferred's $6,000 limit), switch to another card for continued elevated rewards. The Capital One SavorOne or Citi Custom Cash are excellent backup options with no spending limits.

Are warehouse clubs considered grocery stores?

No, warehouse clubs like Costco and Sam's Club typically don't qualify for grocery bonuses on most cards. They're coded as wholesale clubs. Some cards like the Bank of America Cash Rewards specifically include wholesale clubs in their 2% category.

Can I change my rewards categories?

Some cards offer flexible categories - Bank of America Cash Rewards lets you change your 3% category monthly, while Citi Custom Cash automatically applies 5% to your highest spending category. Fixed-category cards like Blue Cash Preferred cannot be changed.

Do annual fees make sense for food rewards cards?

Annual fees often pay for themselves quickly with food spending. If you spend $400/month on groceries, the Blue Cash Preferred's extra rewards (vs. a 2% card) cover the $95 fee in just 3 months. Calculate your breakeven point before choosing.

Conclusion: Build Your Food Rewards Strategy

Optimizing credit card rewards on food purchases can generate hundreds or thousands of dollars in annual value. For most consumers, the American Express Blue Cash Preferred remains the best choice for grocery rewards, while the Capital One Savor dominates dining categories. Budget-conscious spenders should consider the Capital One SavorOne for solid rewards without an annual fee.

Remember that the best strategy often involves multiple cards tailored to your specific spending patterns. Track your food expenses for a month to identify whether groceries or dining comprises your larger category, then select cards accordingly. With strategic use and attention to spending caps, these cards transform necessary food purchases into valuable rewards that enhance your financial wellness. For more insights on maximizing credit card benefits, explore our comprehensive credit card guides and personal finance resources.