Key Takeaways

- Citi Double Cash and Wells Fargo Active Cash lead with 2% cash back on everything

- Blue Cash Preferred offers unmatched 6% back on groceries (up to $6,000/year)

- Rotating category cards like Discover it can earn 5% in quarterly categories

- The average American can earn $600-1,200 annually with the right cash back strategy

- No-annual-fee cards now rival premium cards in earning rates

- Combining 2-3 cards optimizes rewards across all spending categories

- Sign-up bonuses range from $200-500, effectively doubling first-year returns

- Cash back is not taxable income, making it more valuable than it appears

Introduction: The Cash Back Revolution in 2025

Cash back credit cards have evolved from simple 1% rebates to sophisticated rewards systems that can return 2-6% on everyday purchases. In 2025, with inflation impacting household budgets, maximizing cash back on routine spending has become essential financial strategy. According to Bureau of Labor Statistics data, the average American household spends $72,967 annually, meaning optimized cash back strategies can return $1,500-2,000 yearly.

This comprehensive guide analyzes the best cash back credit cards for everyday spending in 2025, comparing flat-rate cards, category bonuses, and rotating rewards to help you maximize returns on every purchase. Whether you're buying groceries, filling your gas tank, or shopping online, we'll show you how to turn routine expenses into meaningful cash returns. For more ways to optimize your finances, explore our credit card reviews and travel rewards guide.

Understanding Cash Back Card Categories

Before diving into specific cards, it's crucial to understand the three main types of cash back cards and their optimal use cases:

Flat-Rate Cash Back Cards

These cards offer the same percentage back on all purchases, typically 1.5-2%. They're perfect for simplicity seekers and those who want one card for everything. No tracking categories or activation required—just swipe and earn.

Tiered Category Cards

These cards offer higher rates in specific categories (like 3% on dining, 2% on groceries) with a base rate on everything else. Ideal for people with predictable spending patterns who can maximize bonus categories.

Rotating Category Cards

Quarterly rotating categories offer 5% cash back but require activation and planning. Perfect for maximizers willing to track categories and adjust spending habits quarterly.

Customizable Category Cards

Newer cards let you choose your bonus categories, adapting to your lifestyle. These offer flexibility between the simplicity of flat-rate and rewards of category cards.

Best Cash Back Cards for Everyday Spending

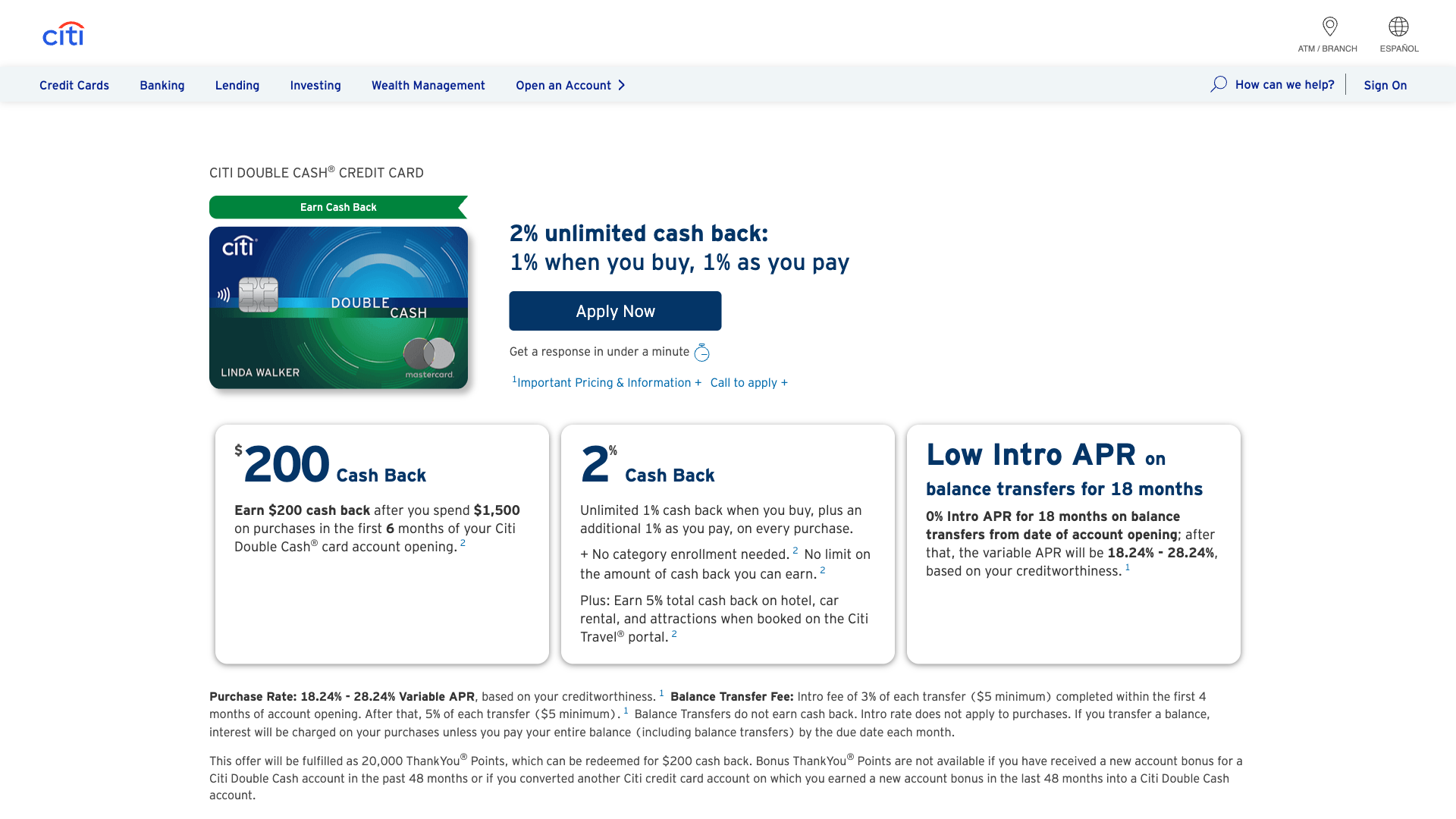

1. Citi Double Cash - Best Flat-Rate Cash Back

Citi Double Cash revolutionized cash back with its unique two-step earning: 1% when you buy, 1% when you pay. This effectively 2% rate on everything makes it the benchmark for flat-rate cards. Citi's data shows Double Cash cardholders earn 40% more cash back than traditional 1.5% cards.

Cash Back Features:

- 2% cash back on all purchases (1% when you buy + 1% when you pay)

- No annual fee ever

- No categories to track or activate

- No earning caps or restrictions

- Cash back never expires

- 0% intro APR for 18 months on balance transfers

- Access to Citi Entertainment presale tickets

- Convert to ThankYou points with eligible Citi cards

- Free FICO Score access

Annual Fee: $0 | Sign-up Bonus: $200 (spend $1,500 in 6 months)

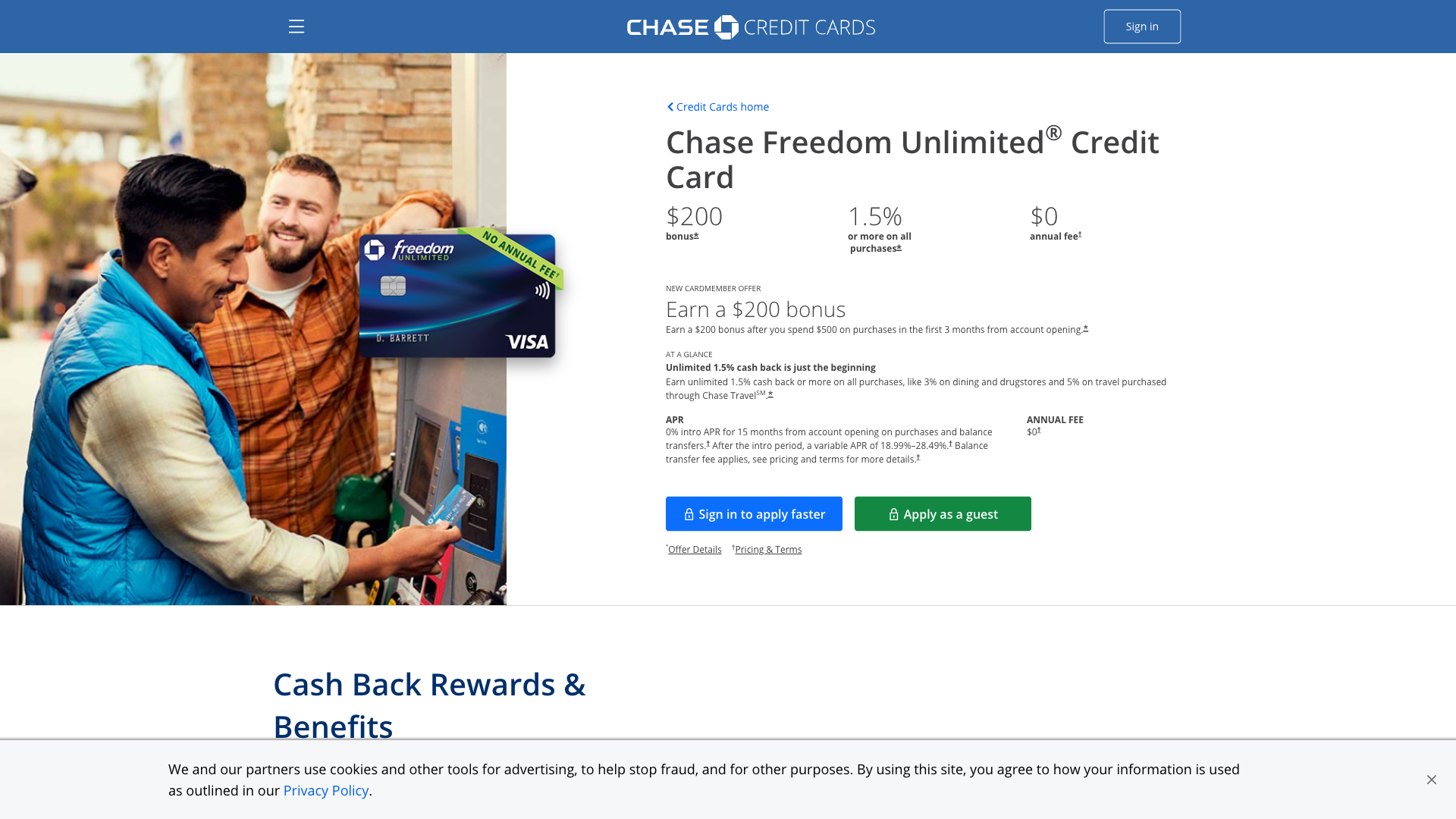

2. Chase Freedom Unlimited - Best Bonus Categories + Flat Rate

Chase Freedom Unlimited combines solid flat-rate earning with enhanced categories, making it versatile for all spending. The addition of 3% on dining and drugstores plus 5% on travel booked through Chase elevates it beyond basic cash back cards. Chase reports that Freedom Unlimited users earn 30% more than single-rate cards.

Cash Back Features:

- 5% on travel through Chase Ultimate Rewards

- 3% on dining and drugstores

- 1.5% on all other purchases

- No annual fee

- 0% intro APR for 15 months on purchases and balance transfers

- Earn 5% on Lyft rides through March 2025

- No minimum to redeem for cash back

- Cash back doesn't expire as long as account is open

- Combine with Sapphire cards for enhanced value

Annual Fee: $0 | Sign-up Bonus: $200 (spend $500 in 3 months)

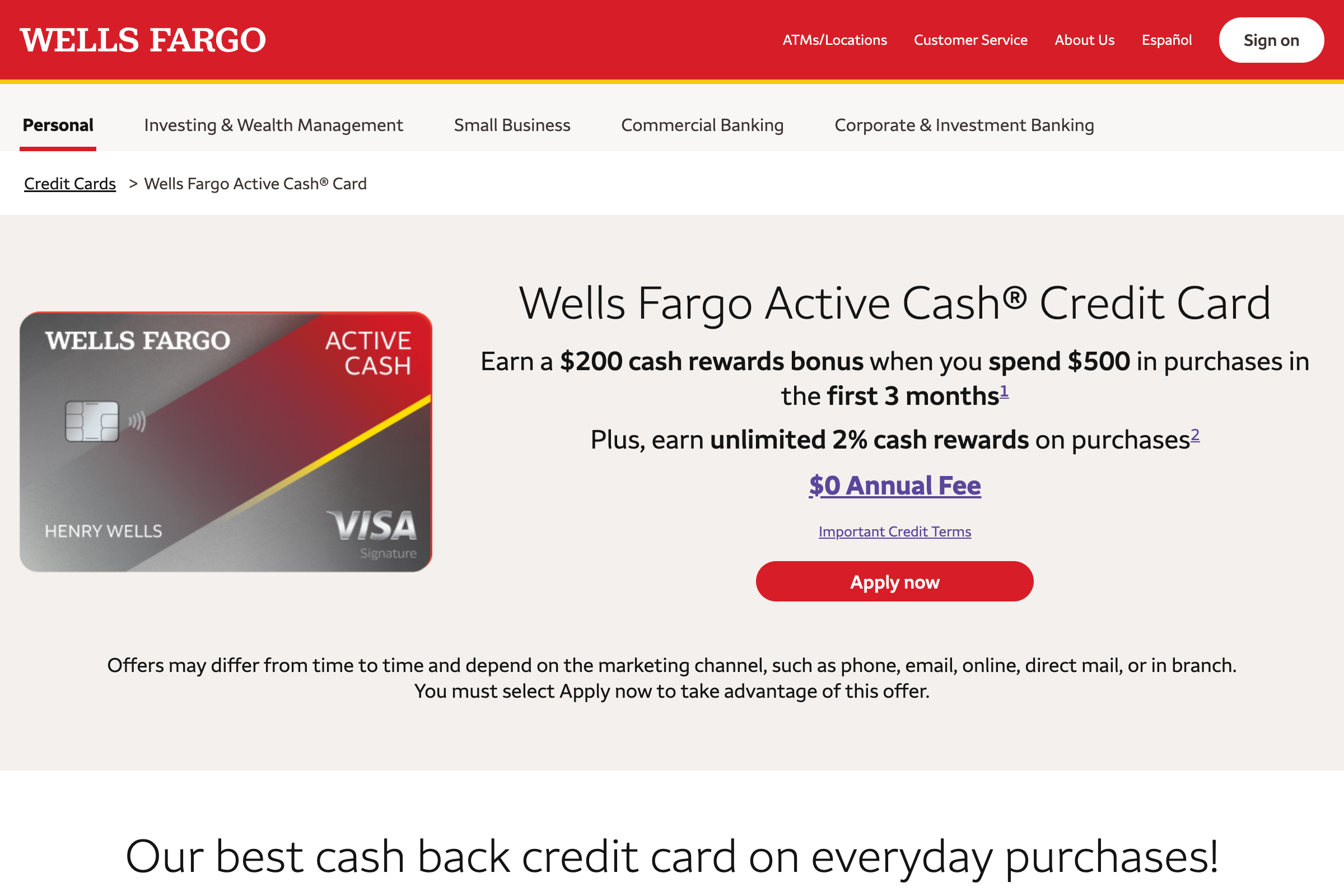

3. Wells Fargo Active Cash - Best Simple 2% Card

Wells Fargo Active Cash offers straightforward 2% cash rewards on all purchases with no hoops to jump through. The card's simplicity, combined with a generous sign-up bonus and intro APR period, makes it perfect for cash back beginners. Wells Fargo data shows Active Cash adoption exceeded projections by 200% in its first year.

Cash Back Features:

- Unlimited 2% cash rewards on all purchases

- No annual fee

- $200 cash rewards bonus (spend $500 in 3 months)

- 0% intro APR for 21 months on purchases and qualifying balance transfers

- No categories to track or quarterly activation

- Cell phone protection up to $600

- Visa Signature benefits

- My Wells Fargo Deals for extra savings

- Redeem rewards at any amount

Annual Fee: $0 | Sign-up Bonus: $200 (spend $500 in 3 months)

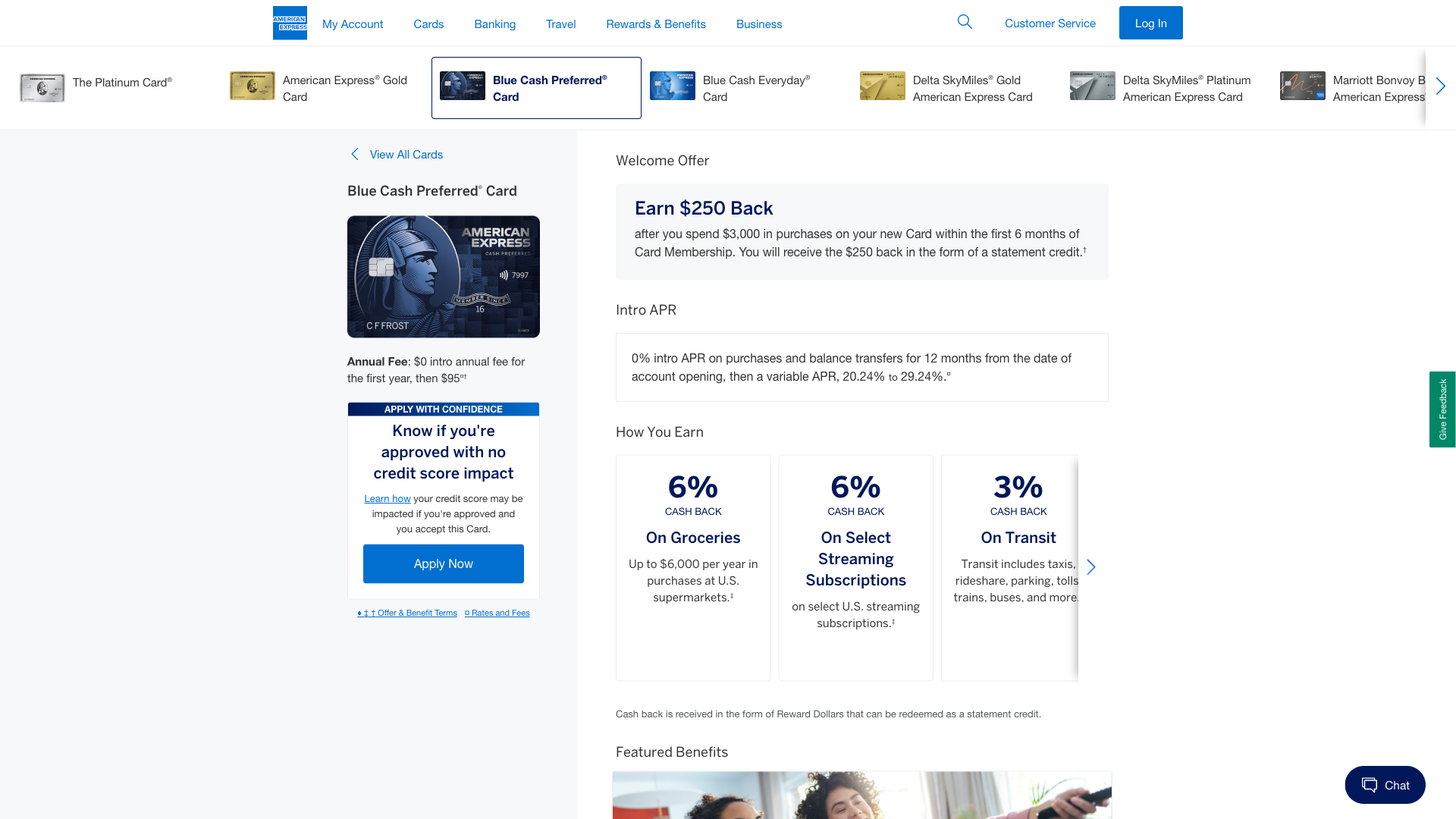

4. American Express Blue Cash Preferred - Best for Groceries & Streaming

Blue Cash Preferred dominates grocery cash back with an unmatched 6% rate (on up to $6,000 in purchases annually). The addition of 6% on streaming services makes it essential for modern households. American Express data shows the average cardholder earns $450 annually after the annual fee.

Cash Back Features:

- 6% cash back at U.S. supermarkets (up to $6,000/year)

- 6% cash back on select U.S. streaming subscriptions

- 3% cash back on transit and U.S. gas stations

- 1% cash back on all other purchases

- $350 statement credit sign-up bonus

- 0% intro APR for 12 months on purchases

- Return protection and purchase protection

- American Express Offers for additional savings

- Disney Bundle credit up to $84/year

Annual Fee: $95 | Sign-up Bonus: $350 (spend $3,000 in 6 months)

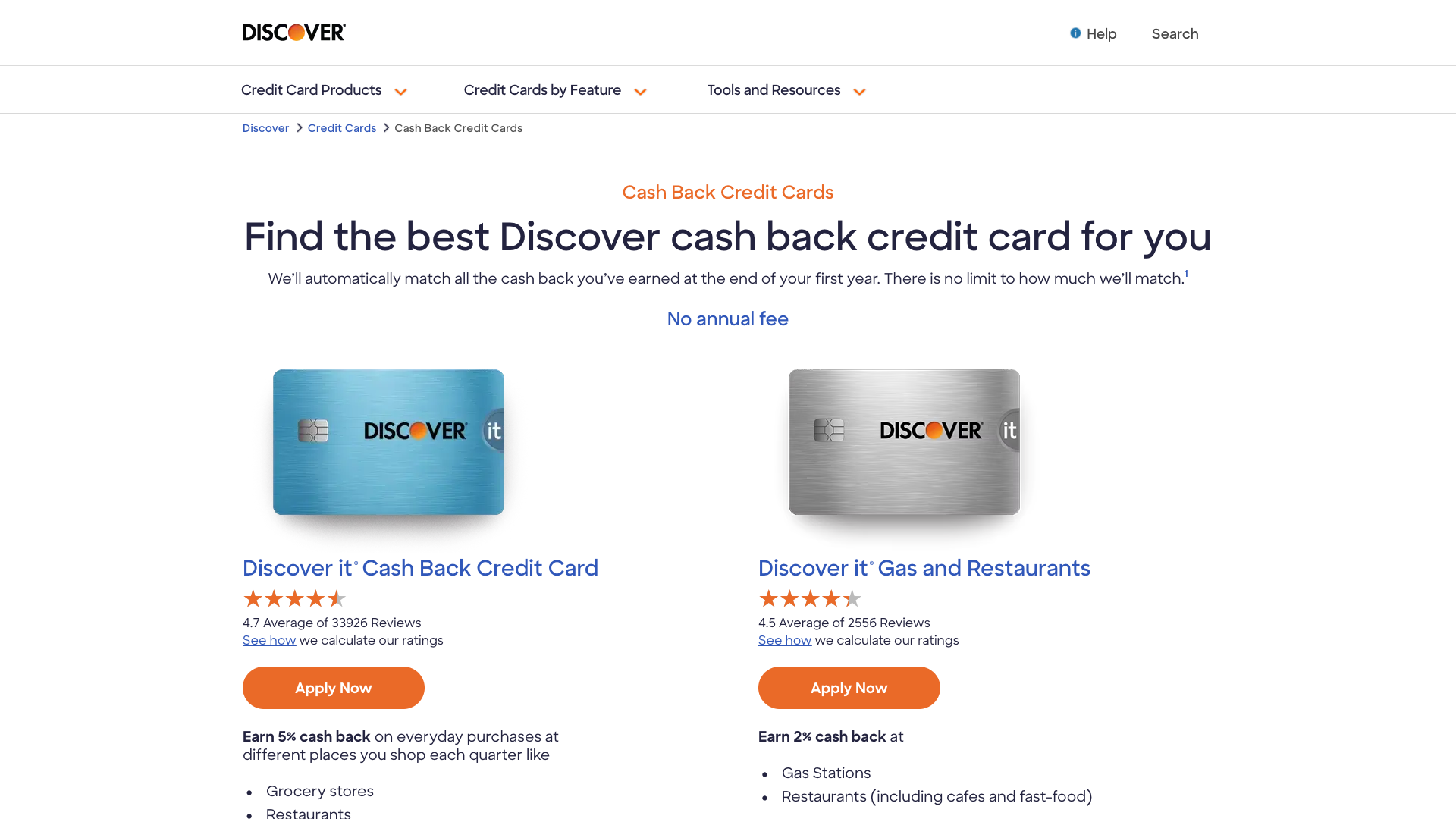

5. Discover it Cash Back - Best First-Year Value

Discover it Cash Back offers rotating 5% categories with a game-changing first-year match—effectively 10% cash back in categories and 2% on everything else. This makes it the highest-earning card for new cardholders. Discover reports that first-year cardholders average $487 in cash back rewards.

Cash Back Features:

- 5% cash back in rotating categories (activate quarterly)

- 1% cash back on all other purchases

- Cash back match at end of first year (doubles all earnings)

- No annual fee

- 0% intro APR for 15 months on purchases and balance transfers

- Free FICO Credit Score

- No late fee on first late payment

- U.S.-based customer service

- Freeze your account in seconds with mobile app

Annual Fee: $0 | Sign-up Bonus: Cash back match all first year

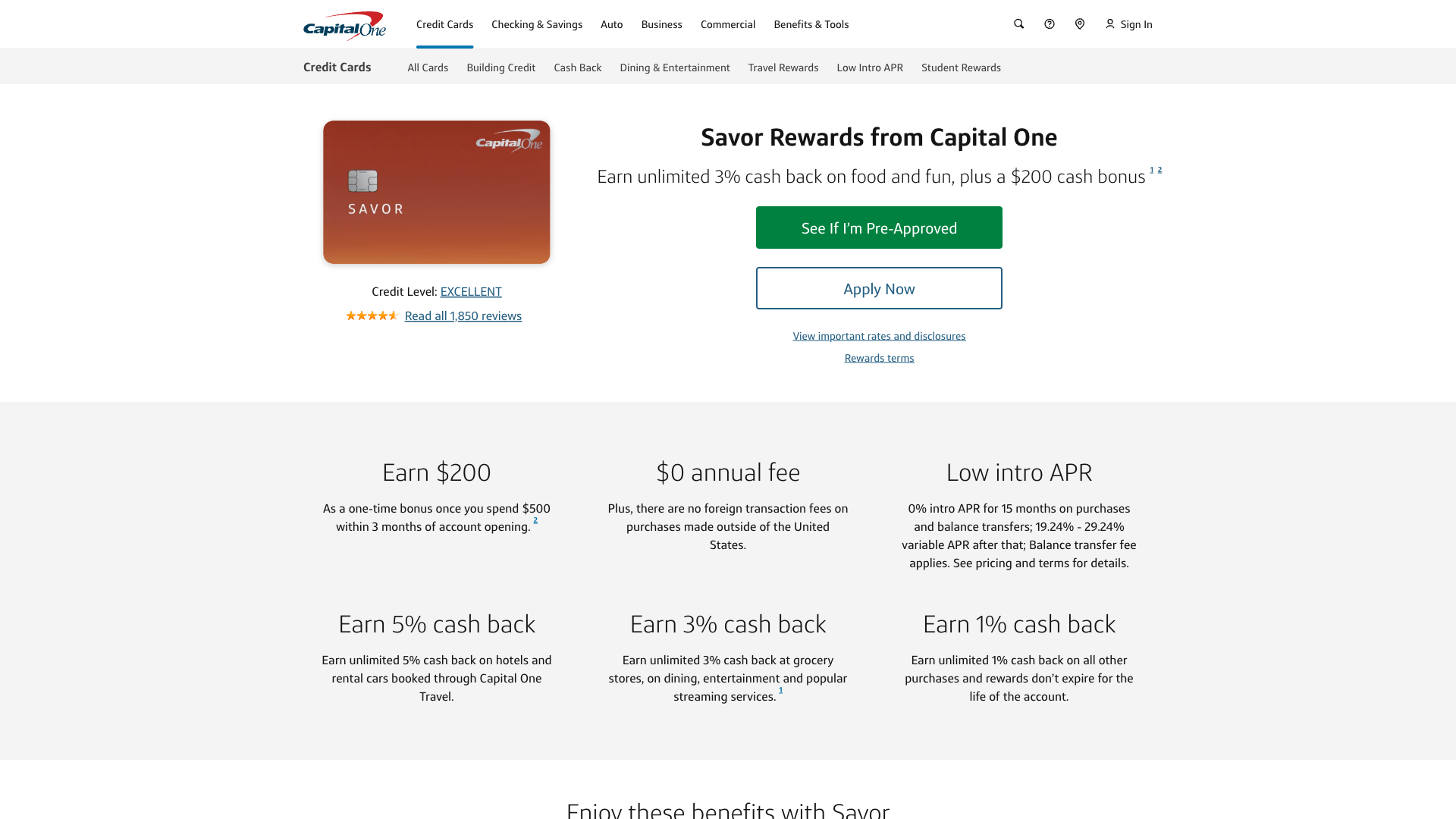

6. Capital One SavorOne - Best for Dining & Entertainment

Capital One SavorOne targets lifestyle spending with elevated rewards on dining and entertainment. With no annual fee and solid earning rates, it's perfect for social spenders. Capital One data shows SavorOne cardholders dine out 60% more than average consumers.

Cash Back Features:

- 3% cash back on dining and entertainment

- 3% cash back on popular streaming services

- 3% cash back at grocery stores (excluding superstores)

- 1% cash back on all other purchases

- No annual fee

- $200 cash bonus (spend $500 in 3 months)

- 0% intro APR for 15 months on purchases and balance transfers

- No foreign transaction fees

- Capital One Entertainment perks

Annual Fee: $0 | Sign-up Bonus: $200 (spend $500 in 3 months)

7. Bank of America Customized Cash - Best Flexible Categories

Bank of America Customized Cash lets you choose your 3% category each month from options like gas, online shopping, dining, travel, drug stores, or home improvement. This flexibility adapts to changing spending patterns. Bank of America reports that Preferred Rewards members can boost earnings up to 5.25%.

Cash Back Features:

- 3% cash back in your choice of category

- 2% cash back at grocery stores and wholesale clubs

- 1% cash back on all other purchases

- Up to 75% rewards bonus with Preferred Rewards

- No annual fee

- $200 online cash rewards bonus

- 0% intro APR for 18 billing cycles on purchases

- Change your 3% category monthly

- Combine earnings with other BofA cards

Annual Fee: $0 | Sign-up Bonus: $200 (spend $1,000 in 90 days)

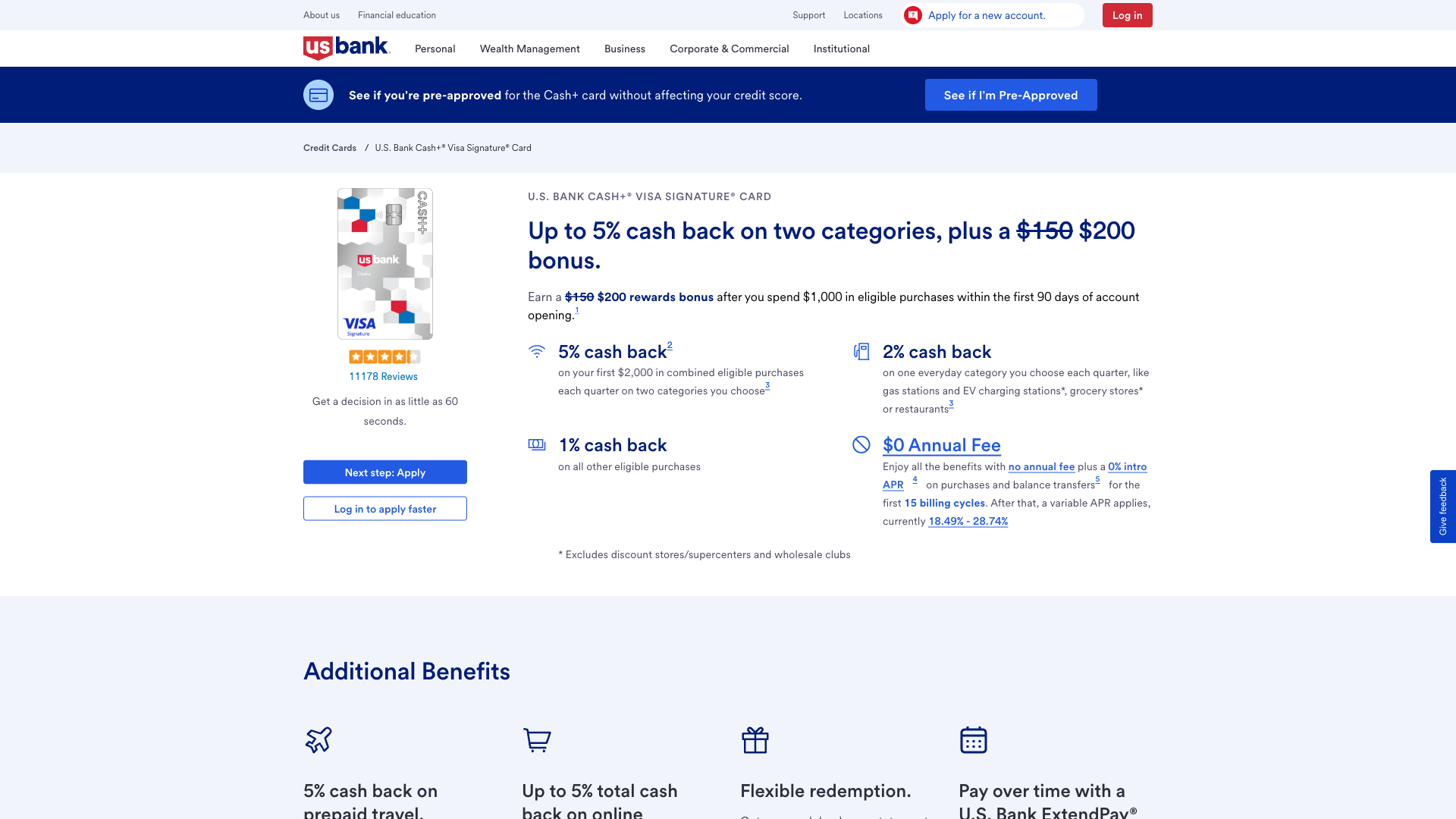

8. U.S. Bank Cash+ - Best for Unique Categories

U.S. Bank Cash+ offers unmatched customization with 5% cash back on two categories you choose from unique options like utilities, cell phone bills, and gym memberships. This fills gaps other cards miss. U.S. Bank data indicates Cash+ cardholders maximize categories 80% of the time.

Cash Back Features:

- 5% cash back on two categories you choose

- 2% cash back on one everyday category (gas, groceries, or restaurants)

- 1% cash back on all other purchases

- Unique 5% categories include utilities, cell phone, internet

- No annual fee

- $200 bonus cash back

- 0% intro APR for 15 billing cycles on purchases and balance transfers

- Quarterly category selection

- Visa Signature benefits

Annual Fee: $0 | Sign-up Bonus: $200 (spend $1,000 in 120 days)

Maximizing Your Cash Back Strategy

Understanding how to optimize cash back across multiple cards transforms good returns into great ones:

The Everyday Spending Portfolio

Build a three-card system: A 2% flat-rate card (Citi Double Cash) for general purchases, Blue Cash Preferred for groceries and streaming, and Capital One SavorOne for dining and entertainment. This combination can yield 3-6% on most spending without complexity.

Category Optimization

Track your spending for one month to identify your largest categories. BLS data shows the average household spends: 13% on food, 16% on transportation, and 33% on housing. Choose cards that maximize rewards in your top categories.

Sign-Up Bonus Strategy

Space out applications every 3-4 months to naturally meet spending requirements. A $200 bonus equals 10,000 points of 2% spending—front-loading your rewards significantly. Plan applications around large purchases or expenses.

Quarterly Planning

For rotating category cards, plan major purchases around 5% quarters. Stock up on gift cards during relevant quarters for year-round savings. Discover's gas station quarter can include gift card purchases for other retailers.

Quick Comparison of Cash Back Cards

| Card | Best Categories | Max Rate | Annual Fee | Sign-up Bonus |

|---|---|---|---|---|

| Citi Double Cash | Everything | 2% | $0 | $200 |

| Chase Freedom Unlimited | Dining, Drugstores | 5% | $0 | $200 |

| Wells Fargo Active Cash | Everything | 2% | $0 | $200 |

| Blue Cash Preferred | Groceries, Streaming | 6% | $95 | $350 |

| Discover it | Rotating 5% | 5% (10% Y1) | $0 | Match Y1 |

| Capital One SavorOne | Dining, Entertainment | 3% | $0 | $200 |

| BofA Customized Cash | Choice Category | 3% (5.25%*) | $0 | $200 |

| U.S. Bank Cash+ | 2 Choice Categories | 5% | $0 | $200 |

*With Preferred Rewards Platinum Honors tier

Cash Back Strategies by Spending Profile

Different lifestyles require different cash back approaches. Here's how to optimize based on your spending patterns:

The Family Household

Families with high grocery and gas spending should prioritize Blue Cash Preferred for 6% on groceries and 3% on gas. Pair with Citi Double Cash for everything else. Average family grocery spending of $5,000 annually yields $300 from groceries alone, easily justifying the annual fee.

The Urban Professional

City dwellers who dine out frequently and use ride-sharing should focus on dining rewards. Capital One SavorOne (3% dining) paired with Chase Freedom Unlimited (3% dining, 5% Lyft) maximizes urban lifestyle spending. Add Wells Fargo Active Cash for non-category purchases.

The Suburban Commuter

High gas and wholesale club spending calls for cards targeting these categories. Costco Anywhere Visa offers 4% on gas (on up to $7,000 annually) plus 2% at Costco. Combine with Bank of America Customized Cash set to gas for additional coverage.

The Online Shopper

E-commerce enthusiasts should choose Bank of America Customized Cash set to online shopping (3%) as their primary card. Add Amazon Prime Rewards for 5% at Amazon and Whole Foods. Discover it's rotating categories often include Amazon and PayPal.

The Minimalist

Those wanting maximum simplicity should stick with one flat-rate 2% card like Citi Double Cash or Wells Fargo Active Cash. No categories to track, no optimization needed—just consistent 2% returns on everything.

Advanced Cash Back Optimization Techniques

Take your cash back earnings to the next level with these advanced strategies:

Payment Service Arbitrage

Use PayPal, Apple Pay, or Google Pay when they offer bonus rewards. Some cards code these differently, potentially earning category bonuses on purchases that wouldn't normally qualify. Always test with small purchases first.

Gift Card Strategies

Buy gift cards at grocery stores with Blue Cash Preferred for 6% back, or during Discover's 5% quarters at gas stations. This effectively earns elevated rates on any merchant. Stock up during bonus quarters for year-round savings.

Bill Payment Optimization

U.S. Bank Cash+ uniquely offers 5% on utilities and cell phone bills—categories most cards ignore. Plastiq or similar services can enable credit card payments for rent/mortgage, though fees may apply.

Redemption Maximization

Some cards offer redemption bonuses: Bank of America adds 3-11% when redeeming into BofA/Merrill accounts. Chase Freedom cash can convert to Ultimate Rewards points with Sapphire cards for travel redemptions worth 25-50% more.

Annual Fee Analysis

Calculate break-even points for fee cards. Blue Cash Preferred's $95 fee requires just $1,584 in grocery spending to break even versus the no-fee Blue Cash Everyday. Most families exceed this in two months.

Common Cash Back Mistakes to Avoid

Maximize your returns by avoiding these frequent errors:

- Forgetting to activate rotating categories: Set quarterly reminders for cards like Discover it and Chase Freedom Flex

- Carrying balances: Interest charges negate cash back rewards—always pay in full

- Using the wrong card: Keep a note in your wallet showing which card to use where

- Ignoring sign-up bonuses: These often equal 6-12 months of regular earnings

- Hoarding rewards: Cash back doesn't grow—redeem regularly for maximum value

- Overspending for rewards: Never buy something just for cash back

- Missing payment due dates: Late fees and penalty APRs destroy reward value

- Ignoring terms changes: Card benefits can change—stay informed about your cards

Cash Back vs. Other Reward Types

Understanding when cash back beats other reward types helps optimize your overall strategy:

Cash Back Advantages

Cash back offers unmatched simplicity and flexibility. No blackout dates, no redemption complexity, no devaluations. The value is transparent: 2% means $20 per $1,000 spent. Perfect for those who value simplicity or don't travel frequently.

When Travel Rewards Win

Travel cards can offer higher redemption values—often 2-5 cents per point through transfer partners. However, this requires research, flexibility, and advance planning. The Points Guy's valuations show travel points averaging 1.5-2x cash back value.

Hybrid Strategies

Some cards bridge both worlds. Chase Freedom Unlimited earnings can be redeemed as cash or transferred to Chase travel partners if you also have a Sapphire card. This flexibility lets you choose based on immediate needs.

Tax Implications of Cash Back Rewards

Good news for cash back earners: the IRS treats credit card rewards as rebates, not income:

Non-Taxable Rewards

Cash back earned from purchases is considered a discount or rebate, making it non-taxable. Whether you earn $100 or $1,000 in cash back, you won't receive a 1099 or owe taxes on these rewards.

Potentially Taxable Situations

Sign-up bonuses without spending requirements, referral bonuses exceeding $600, and rewards from bank account openings may be taxable. Business credit card rewards used for personal expenses could also face scrutiny.

Record Keeping

While purchase rewards aren't taxable, maintain records of redemptions for business cards or if you receive any 1099 forms. Most issuers provide annual summaries for easy tracking.

Future of Cash Back Credit Cards

The cash back landscape continues evolving with exciting trends for consumers:

Dynamic Category Rewards

AI-driven cards are beginning to automatically adjust reward categories based on your spending patterns. Expect cards that learn your habits and optimize rewards without manual selection.

Real-Time Redemption

Instant cash back at point of sale is emerging, allowing rewards to immediately offset purchases. This creates a true "discount" experience rather than waiting for statement credits.

Sustainable Spending Bonuses

Environmental consciousness drives new bonus categories for electric vehicle charging, public transportation, and sustainable brands. These align financial rewards with environmental values.

Integrated Financial Wellness

Future cards will combine cash back with budgeting tools, savings automation, and investment options. Expect holistic platforms that reward smart financial behavior beyond just spending.

Conclusion: Maximize Every Dollar in 2025

The best cash back strategy in 2025 combines simplicity with optimization. Start with a strong foundation like Citi Double Cash or Wells Fargo Active Cash for 2% on everything, then add targeted cards for your biggest spending categories. The Blue Cash Preferred remains unbeatable for grocery shoppers, while dining enthusiasts should grab Capital One SavorOne.

Remember that the best cash back card is the one that matches your spending patterns and lifestyle. Whether you prefer the simplicity of flat-rate rewards or the optimization potential of category cards, consistent use of the right combination can add $600-1,500 to your annual budget. Start with one card that fits your primary spending, master its benefits, then strategically add complementary cards. With inflation impacting household budgets, turning everyday expenses into cash back has never been more valuable. For more strategies to optimize your finances, explore our credit card guides and personal finance resources.