Key Takeaways

- Chase Sapphire Reserve leads with 3x points on travel/dining and $300 annual travel credit

- Capital One Venture X offers exceptional value at $395 with unlimited 2x miles and lounge access

- No foreign transaction fees are essential—saving 3% on all international purchases

- Premium cards with $400+ fees often provide $1,000+ in annual value through perks

- Transfer partners multiply point values by 2-5x compared to cash redemptions

- Entry-level options like Chase Sapphire Preferred offer premium perks at lower cost

- Stack multiple cards to maximize earning across different spending categories

Introduction: Elevate Your International Travel Experience

International travel in 2025 demands more than just a passport—it requires strategic financial tools that enhance every aspect of your journey. The right travel rewards credit card transforms ordinary purchases into future adventures while providing essential protections and luxurious perks. According to IATA projections, international travel has surged 125% above pre-pandemic levels, making travel rewards more valuable than ever.

This comprehensive guide examines the best travel rewards credit cards specifically optimized for international travelers in 2025. We'll analyze earning rates, redemption values, travel protections, and premium perks to help you select cards that maximize every dollar spent abroad. Whether you're a digital nomad, business traveler, or vacation enthusiast, we'll show you how to travel smarter and more luxuriously. For additional travel resources, explore our airport lounge guide and credit card reviews.

Essential Features for International Travel Cards

Before diving into specific cards, understanding what makes a credit card ideal for international travel helps inform your decision:

No Foreign Transaction Fees

Foreign transaction fees typically add 3% to every purchase made outside the US or in foreign currencies. On a two-week European vacation with $5,000 in spending, that's $150 in unnecessary fees. Every card on our list waives these fees entirely, essential for international travelers.

Global Acceptance and Chip Technology

Visa and Mastercard enjoy near-universal acceptance worldwide, while American Express and Discover face limitations in some regions. All recommended cards include EMV chip technology required for European automated kiosks and contactless payment capabilities increasingly common globally.

Travel Protections and Insurance

Premium travel cards include trip cancellation/interruption insurance, baggage delay coverage, rental car insurance, and emergency medical coverage. According to ValuePenguin research, 1 in 6 travelers file insurance claims, making these protections invaluable.

Currency Conversion and ATM Access

Look for cards offering favorable currency conversion rates and worldwide ATM access. Some premium cards reimburse ATM fees globally, ensuring cash access without penalties in countries where cards aren't universally accepted.

Best Travel Rewards Cards for International Adventures

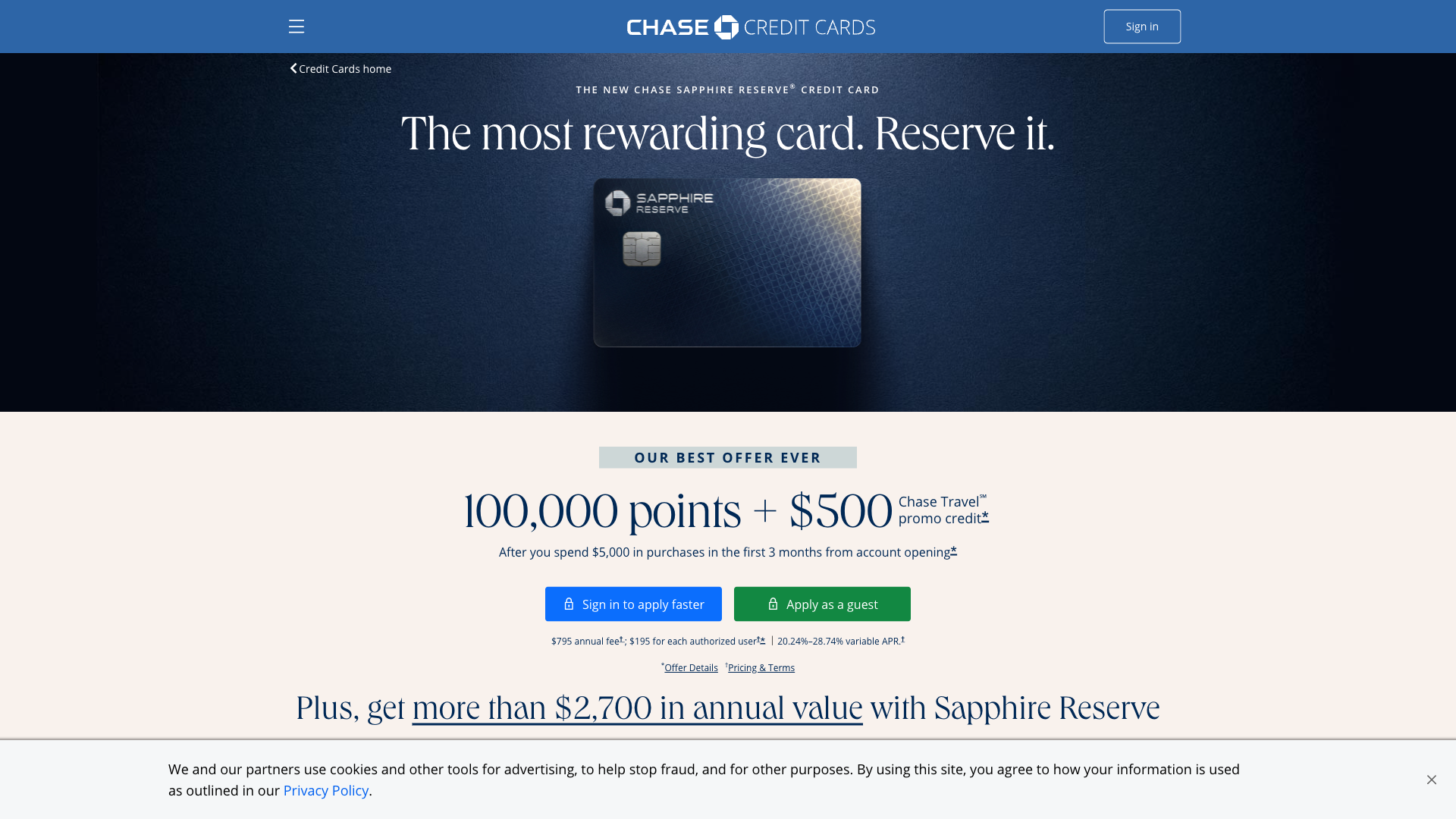

1. Chase Sapphire Reserve - Best Overall International Travel Card

Chase Sapphire Reserve remains the gold standard for international travelers with its comprehensive benefits package and valuable points earning. The card's travel protections rival standalone insurance policies while its lounge access network spans globally. Chase data shows Reserve cardholders redeem 65% of points for international travel.

International Travel Benefits:

- 3x points on travel and dining worldwide

- $300 annual travel credit (effective $250 annual fee)

- Priority Pass Select lounge access with unlimited guests

- No foreign transaction fees on any purchase

- Trip delay reimbursement up to $500 per ticket

- Emergency medical and dental coverage abroad

- Points worth 50% more through Chase Travel portal

- Transfer to 14 airline and hotel partners

- Global Entry/TSA PreCheck credit every 4 years

Annual Fee: $550 | Sign-up Bonus: 60,000 points

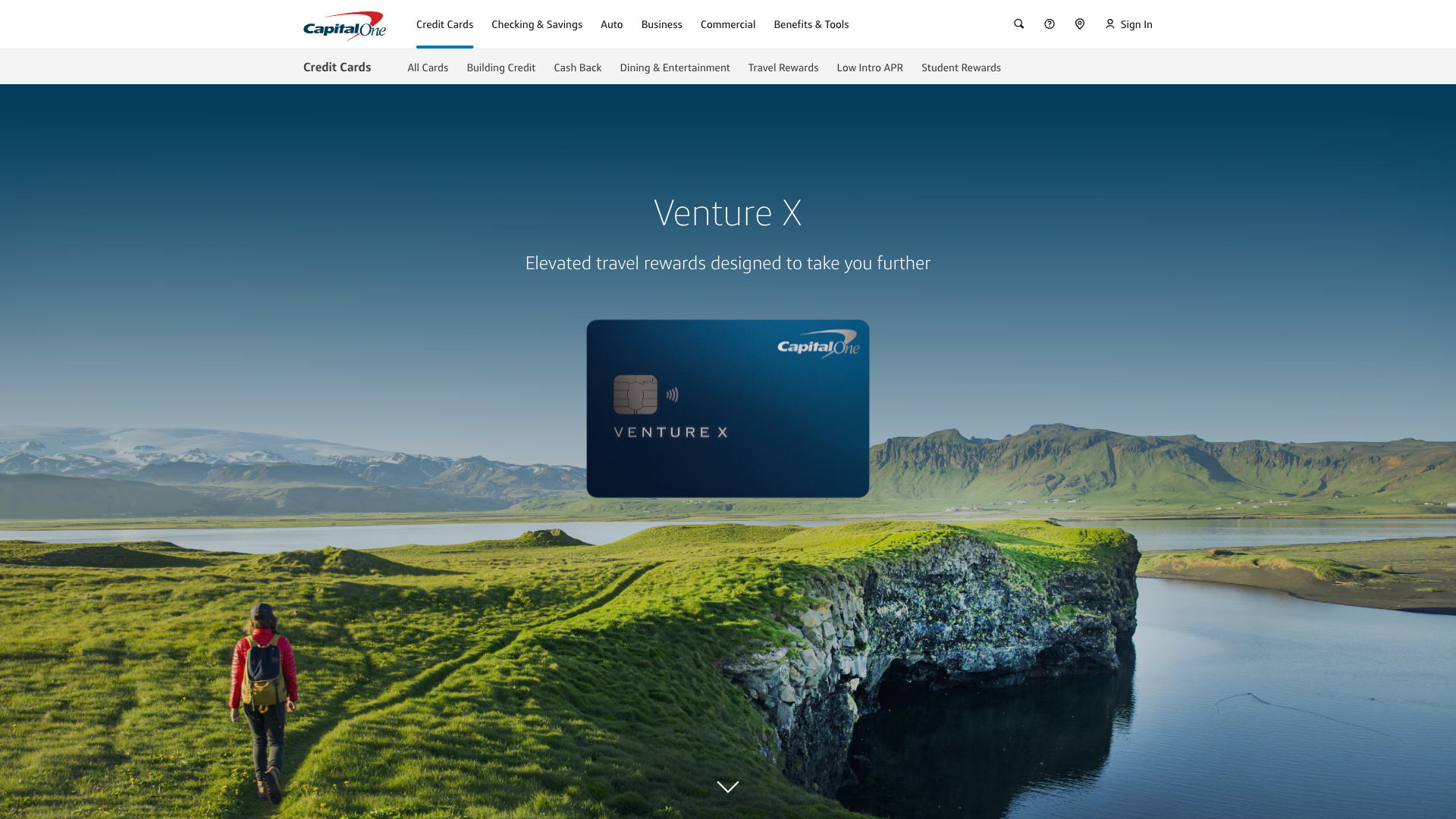

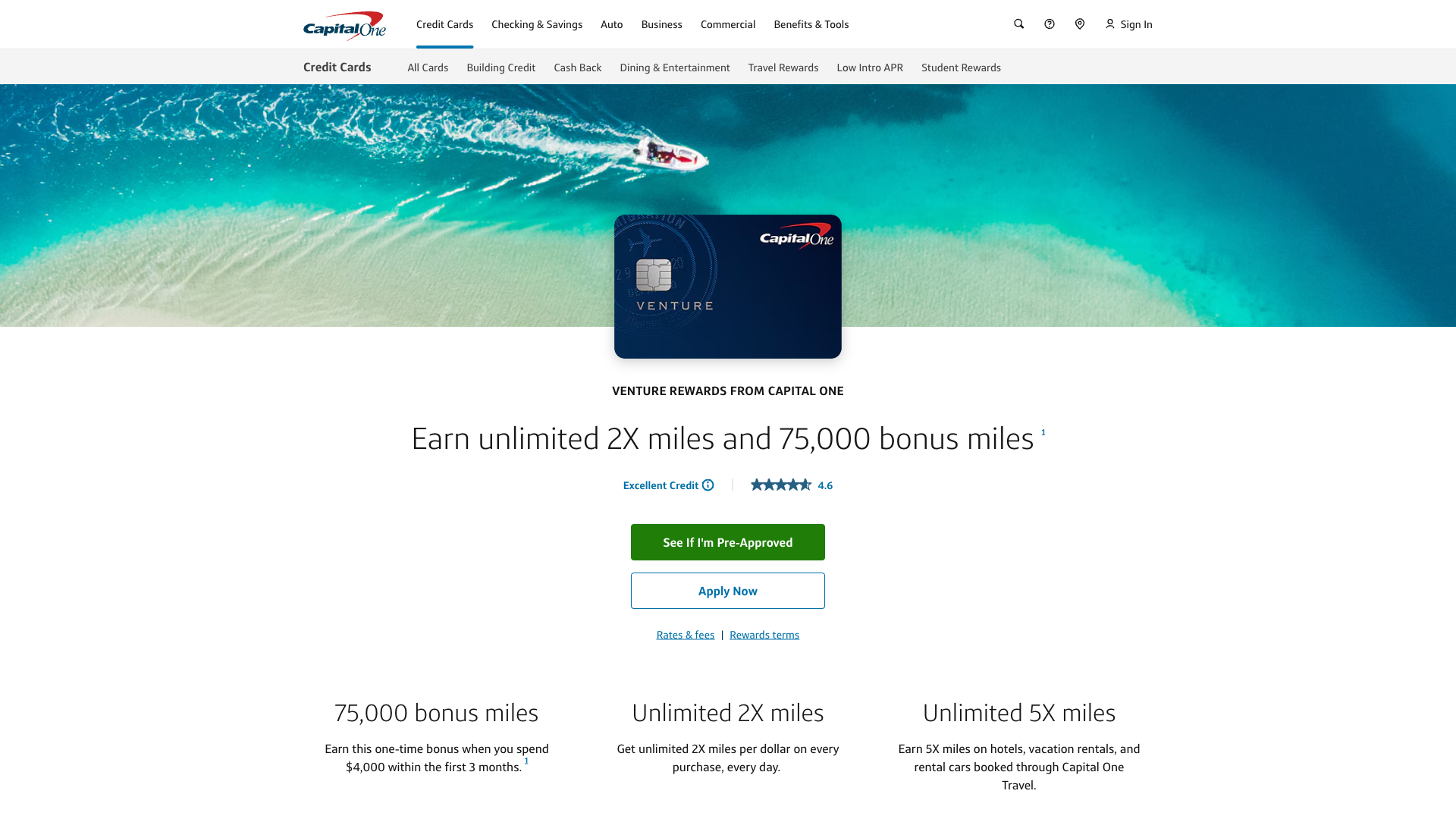

2. Capital One Venture X - Best Value Premium Travel Card

Capital One Venture X disrupted the premium travel card market with exceptional value at a lower annual fee. Unlimited 2x miles on all purchases makes it perfect for travelers who spend across various categories. Capital One reports that Venture X cardholders travel internationally 40% more than other customers.

International Travel Benefits:

- Unlimited 2x miles on every purchase worldwide

- 10x miles on hotels and rental cars through Capital One Travel

- $300 annual travel credit for Capital One Travel

- 10,000 anniversary bonus miles (worth $100)

- Priority Pass and Plaza Premium lounge access

- Exclusive Capital One Lounges in major airports

- No foreign transaction fees anywhere

- Transfer miles to 15+ airline and hotel partners

- Hertz President's Circle elite status

Annual Fee: $395 | Sign-up Bonus: 75,000 miles

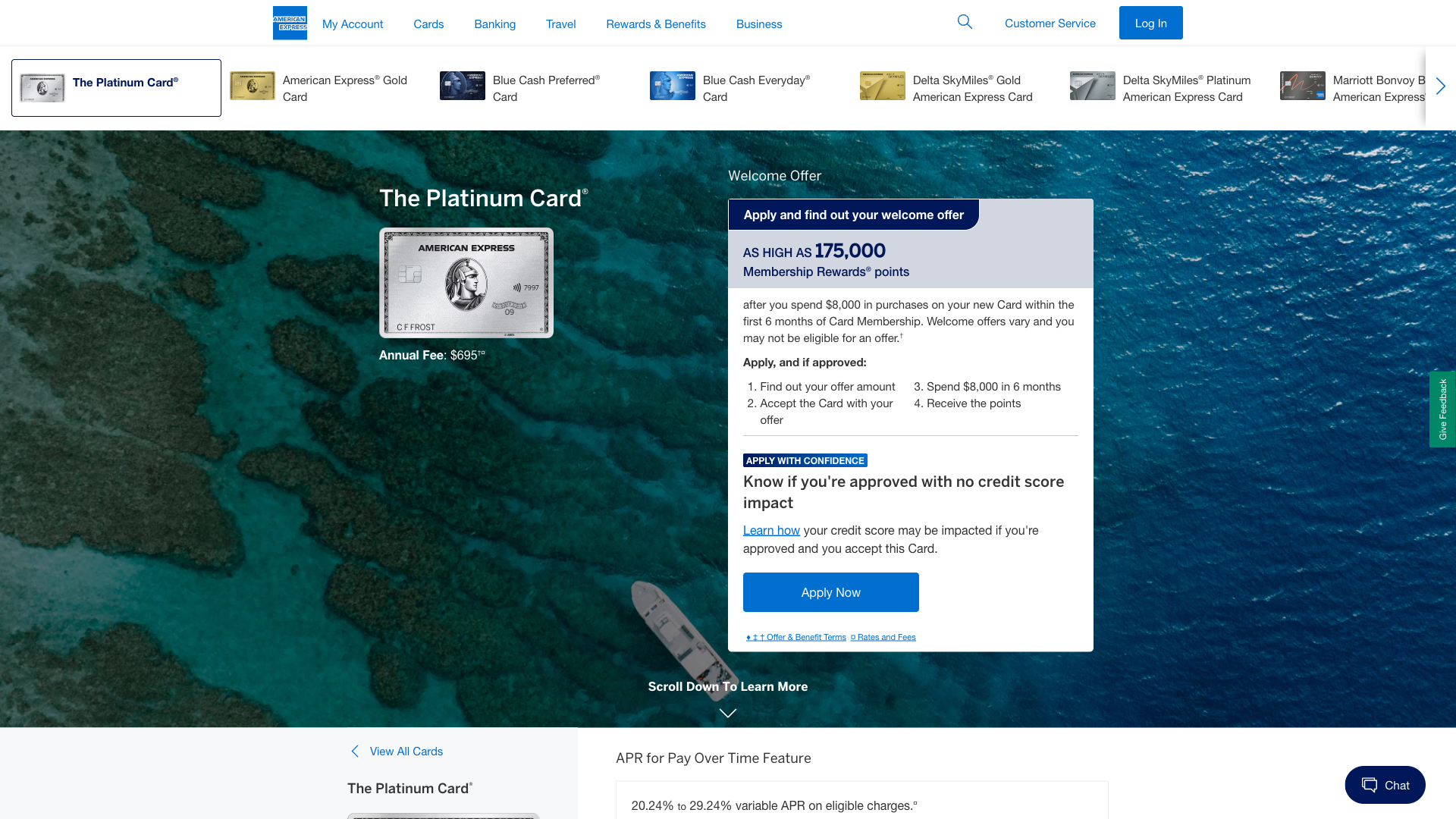

3. American Express Platinum - Best Luxury Travel Perks

American Express Platinum offers unmatched luxury travel benefits for international jet-setters. While the annual fee is substantial, frequent international travelers easily extract multiples of that value. American Express data shows Platinum members visit 3x more countries annually than average travelers.

International Travel Benefits:

- 5x points on flights booked directly with airlines

- 5x points on prepaid hotels through Amex Travel

- $200 airline fee credit annually

- $200 Uber credit ($15 monthly + $20 in December)

- $240 digital entertainment credit annually

- Centurion Lounge and Priority Pass access

- Hotel elite status with Hilton and Marriott

- Fine Hotels & Resorts benefits globally

- International Airline Program perks

- No foreign transaction fees

Annual Fee: $695 | Sign-up Bonus: 80,000 points

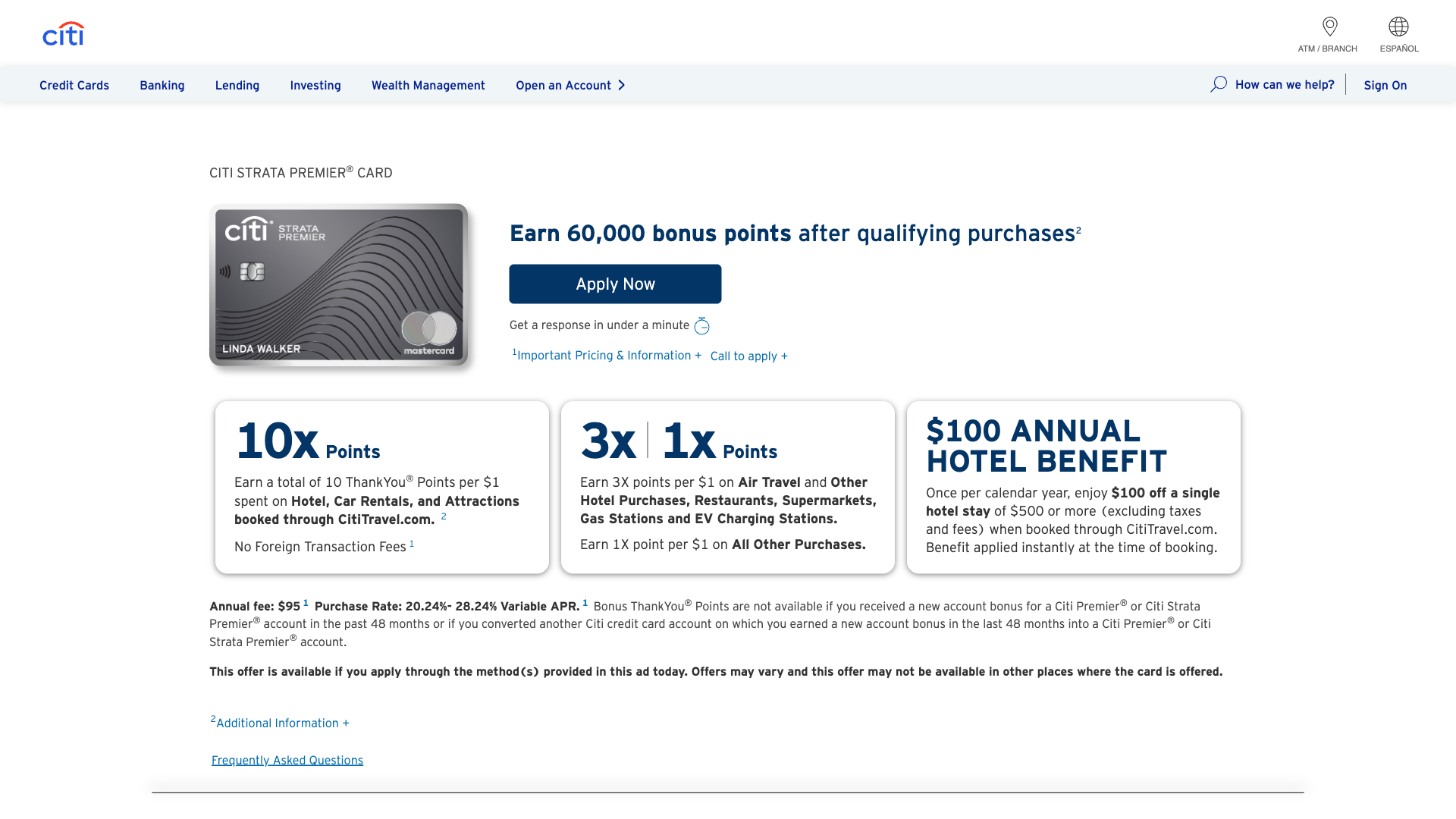

4. Citi Strata Premier - Best Earning Flexibility

Citi Strata Premier (formerly Premier) excels with diverse bonus categories perfect for international travelers who want flexibility. The card's ThankYou points transfer to 18 airline partners, offering exceptional redemption opportunities. Citi's research indicates Strata Premier cardholders achieve 2.1 cents per point value on average.

International Travel Benefits:

- 3x points on air travel, hotels, restaurants, supermarkets, gas

- 1x point on all other purchases

- No foreign transaction fees globally

- $100 annual hotel savings benefit

- Trip cancellation and interruption protection

- Transfer points to 18 airline partners

- No cap on bonus earning categories

- Points don't expire with activity

- Worldwide car rental insurance

Annual Fee: $95 | Sign-up Bonus: 60,000 points

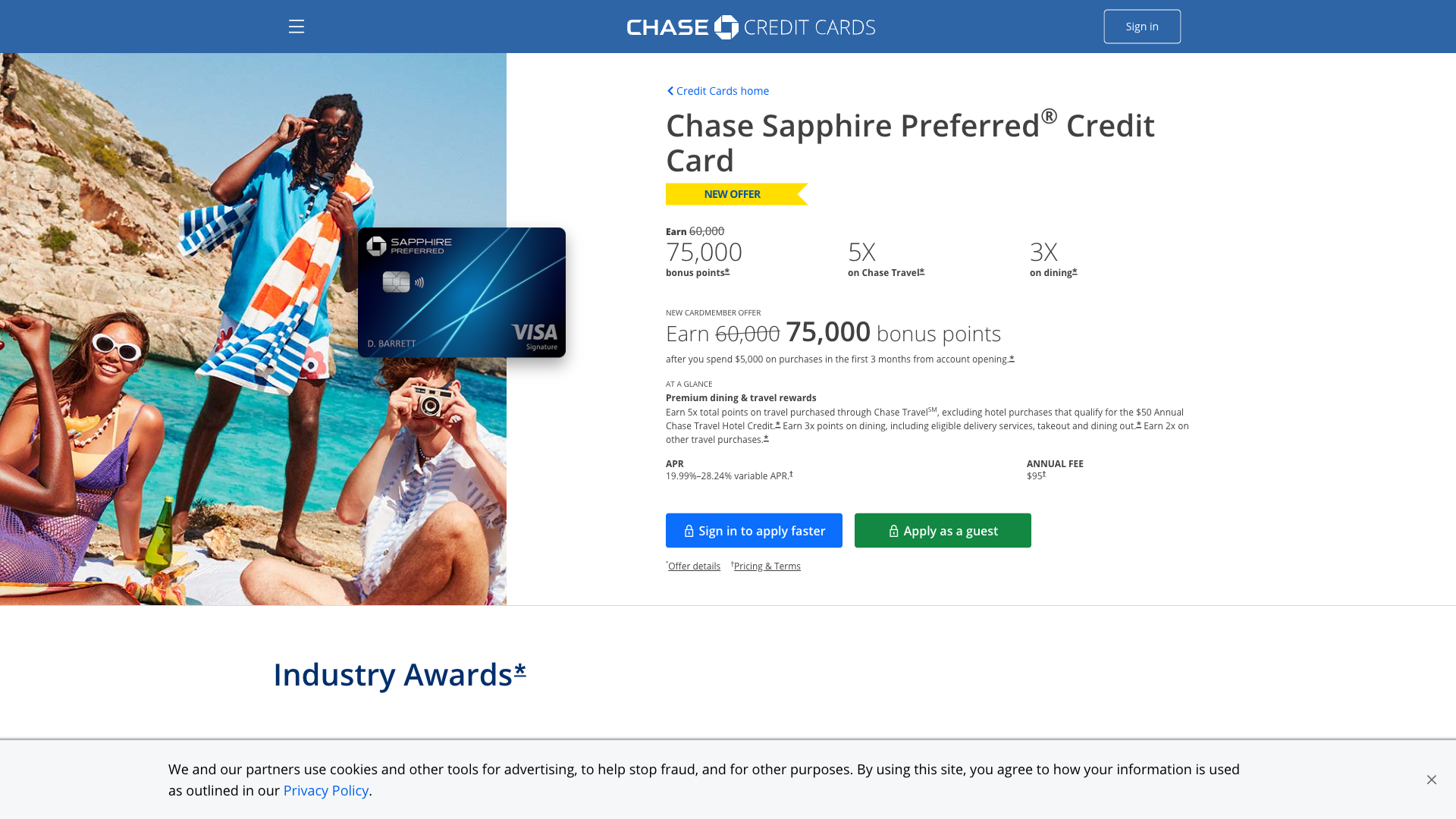

5. Chase Sapphire Preferred - Best Entry Premium Travel Card

Chase Sapphire Preferred provides premium travel benefits at an accessible price point, perfect for international travel beginners. The card offers the same valuable transfer partners as its Reserve sibling at a fraction of the cost. Chase reports that 73% of Preferred cardholders upgrade to Reserve within two years.

International Travel Benefits:

- 2x points on all travel and dining

- 5x points on travel through Chase Ultimate Rewards

- 10x points on hotels and car rentals through Chase

- No foreign transaction fees anywhere

- 25% point bonus when redeemed for travel

- Transfer to 14 airline and hotel partners

- Trip cancellation/interruption insurance

- Primary rental car coverage worldwide

- $50 annual Ultimate Rewards hotel credit

Annual Fee: $95 | Sign-up Bonus: 60,000 points

6. Capital One Venture Rewards - Best Simple Travel Rewards

Capital One Venture Rewards offers straightforward rewards without complexity—earn 2x miles on everything with flexible redemption options. Perfect for international travelers who value simplicity over maximization. Capital One data shows Venture cardholders redeem miles for travel 85% of the time.

International Travel Benefits:

- Unlimited 2x miles on all purchases globally

- 5x miles on hotels and rental cars through Capital One Travel

- No foreign transaction fees worldwide

- Miles never expire for any reason

- Redeem miles for any travel purchase

- Transfer to 15+ travel partners

- Global Entry/TSA PreCheck credit

- Travel accident insurance

- Extended warranty protection

Annual Fee: $95 | Sign-up Bonus: 75,000 miles

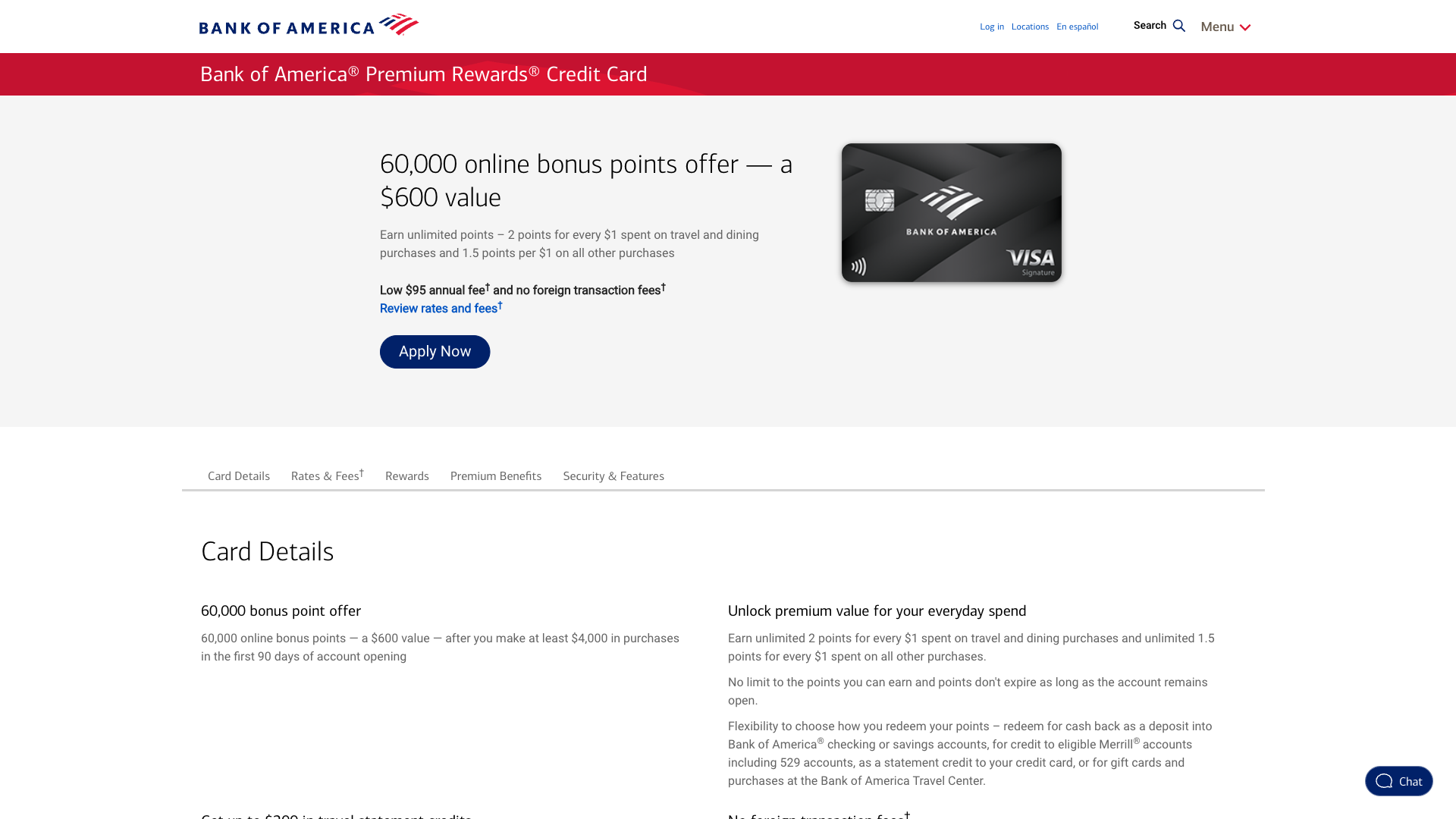

7. Bank of America Premium Rewards - Best with Preferred Rewards

Bank of America Premium Rewards shines for existing Bank of America customers who can earn up to 75% bonus rewards through Preferred Rewards status. The flexible points system works well for international travel redemptions. Bank of America reports that Preferred Rewards members earn 2.5x more points than standard customers.

International Travel Benefits:

- 2x points on travel and dining

- 1.5x points on all other purchases

- Up to 75% rewards bonus with Preferred Rewards

- No foreign transaction fees globally

- $100 annual airline incidental credit

- Global Entry/TSA PreCheck statement credit

- No expiration on points with activity

- Flexible redemption for travel purchases

- Premium travel and purchase protections

Annual Fee: $95 | Sign-up Bonus: 60,000 points

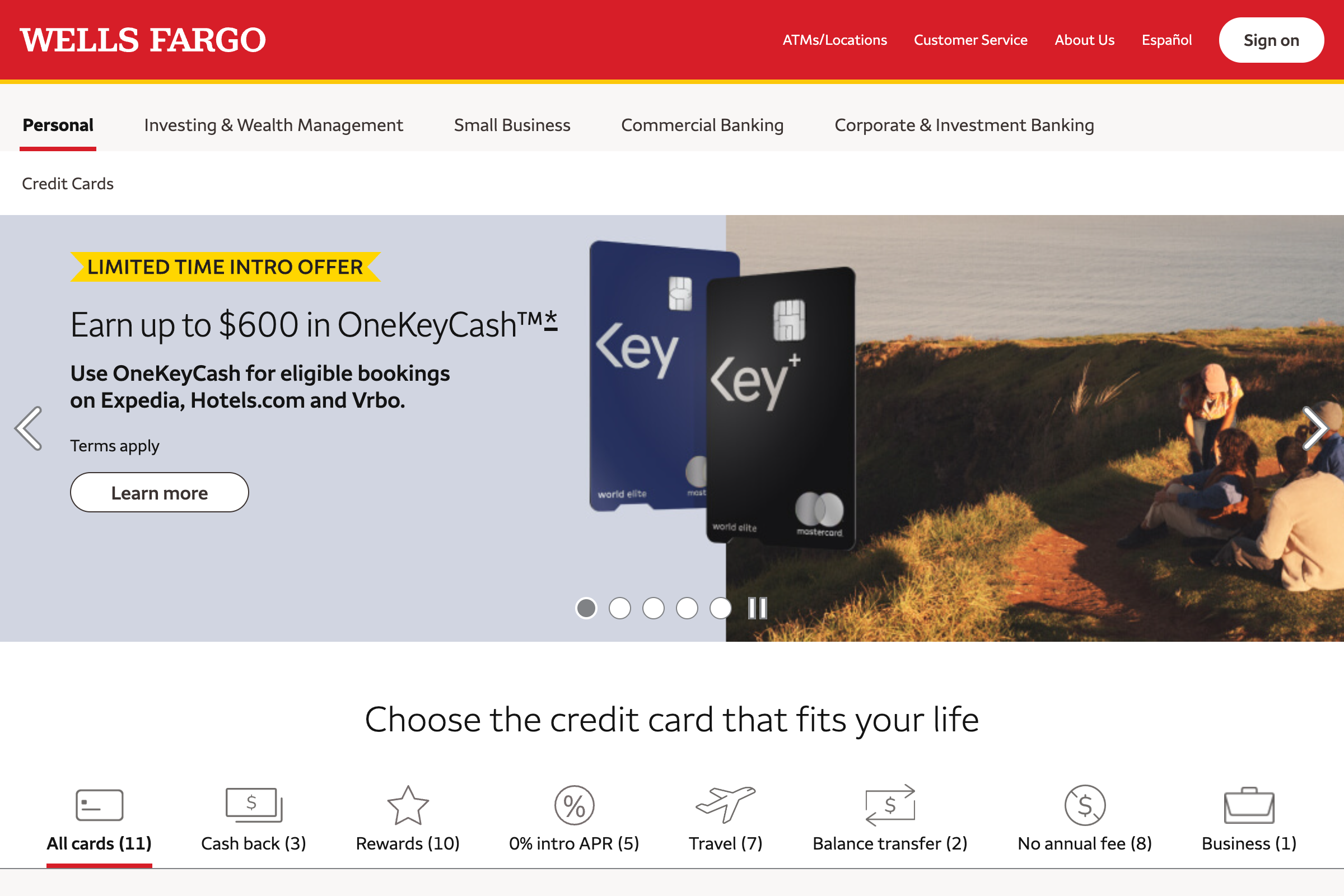

8. Wells Fargo Autograph Journey - Best No-Fee International Card

Wells Fargo Autograph Journey proves that no annual fee doesn't mean no benefits. With solid earning rates and surprising travel perks, it's perfect for occasional international travelers. Wells Fargo data shows Autograph Journey users save an average of $200 annually versus fee cards.

International Travel Benefits:

- 4x points on hotels

- 3x points on restaurants, travel, gas, transit, streaming

- 1x points on other purchases

- No foreign transaction fees anywhere

- $600 cell phone protection

- Trip cancellation and interruption coverage

- Auto rental collision damage waiver

- Visa Signature concierge service

- No annual fee ever

Annual Fee: $0 | Sign-up Bonus: 60,000 points

Maximizing Value from International Travel Cards

Understanding how to extract maximum value from your travel rewards cards transforms good deals into exceptional ones:

Strategic Point Transfers

Transfer partners multiply point values dramatically. While Chase Ultimate Rewards might be worth 1 cent each as cash back, transferring to Hyatt can yield 2-3 cents per point. The Points Guy valuations show transfer partners averaging 75% higher value than cash redemptions.

Category Optimization

Use different cards for their bonus categories: Chase Sapphire Reserve for dining (3x), Citi Strata Premier for hotels (3x), and Capital One Venture X for everything else (2x). This strategy can earn 20-50% more points annually than using a single card.

Portal Stacking

Book through credit card travel portals when they offer bonuses, but compare prices with direct bookings. Some portals offer 5-10x points on hotels, dramatically accelerating earnings. Always check if portal bookings earn hotel loyalty points.

Annual Fee Justification

Calculate whether annual fees provide positive value: Add up travel credits, lounge access value, point earning differentials, and insurance benefits. Premium cards often provide $1,000+ in quantifiable value beyond their fees.

Quick Comparison of International Travel Cards

| Card | Annual Fee | Key Earning | Best Feature | Sign-up Bonus |

|---|---|---|---|---|

| Chase Sapphire Reserve | $550 | 3x travel/dining | Comprehensive coverage | 60,000 points |

| Capital One Venture X | $395 | 2x everything | Value proposition | 75,000 miles |

| Amex Platinum | $695 | 5x flights/hotels | Luxury perks | 80,000 points |

| Citi Strata Premier | $95 | 3x multiple | Category variety | 60,000 points |

| Chase Sapphire Preferred | $95 | 2x travel/dining | Entry premium | 60,000 points |

| Capital One Venture | $95 | 2x everything | Simplicity | 75,000 miles |

| BofA Premium Rewards | $95 | 2x travel/dining | Preferred bonus | 60,000 points |

| Wells Fargo Autograph | $0 | 4x hotels | No annual fee | 60,000 points |

International Travel Card Strategies by Traveler Type

Different travel patterns call for different card strategies. Here's how to optimize based on your travel style:

Digital Nomads and Remote Workers

Long-term international travelers benefit most from cards with broad acceptance and comprehensive benefits. Pair Chase Sapphire Reserve for dining and travel bookings with Capital One Venture X for everything else. The lounge access becomes invaluable when airports become temporary offices.

Business Travelers

Frequent international business travelers should prioritize cards with strong airline transfer partners and premium perks. American Express Platinum's airline benefits and Centurion Lounges paired with Citi Strata Premier for non-airfare travel expenses creates a powerful combination.

Vacation Travelers (2-3 trips annually)

Occasional international travelers can maximize value with mid-tier cards. Chase Sapphire Preferred provides excellent benefits without breaking the bank, while adding Wells Fargo Autograph Journey gives bonus earning without additional fees.

Budget Backpackers

Cost-conscious travelers should focus on no-fee cards with no foreign transaction fees. Wells Fargo Autograph Journey as a primary card with Capital One SavorOne (no fee, 3% dining) creates solid earning without annual costs.

Advanced International Travel Card Tactics

Elevate your rewards game with these advanced strategies:

Manufactured Spending Abroad

Some international locations offer unique manufactured spending opportunities through gift card purchases or bill payment services. Research local options while staying within card terms and legal boundaries.

Currency Arbitrage

When local currency is weak against the dollar, your rewards effectively increase. A 3% reward in a country where your dollar goes 20% further provides outsized value. Time large purchases accordingly.

Status Matching

Use elite status from one card to match with international hotel and airline programs. Hilton Gold from Amex Platinum often matches to competing chains' mid-tier status, multiplying benefits.

Split Payments

For large international purchases, split payments across multiple cards to maximize sign-up bonus progress and category bonuses. Many merchants accommodate this, especially for high-value items.

Travel Insurance and Protection Deep Dive

Premium travel cards' insurance benefits can save thousands during international trips:

Trip Cancellation/Interruption

Coverage typically ranges from $5,000-10,000 per trip when you pay with the card. This includes non-refundable expenses due to covered reasons like illness, severe weather, or family emergencies. Squaremouth data shows average trip cancellation claims exceed $4,500.

Medical and Evacuation Coverage

Some premium cards include emergency medical and dental coverage abroad, plus medical evacuation benefits up to $100,000. This becomes critical in countries with expensive healthcare or remote locations requiring air ambulance services.

Baggage and Personal Effects

Lost, damaged, or delayed baggage coverage provides reimbursement for essentials and replacements. Premium cards typically cover $3,000 per passenger for delays over 6 hours—enough for clothing and toiletries during wait times.

Rental Car Coverage

Primary rental car coverage means you don't need to involve your personal auto insurance for international rentals. This protection can save hundreds on collision damage waivers while providing better coverage than rental companies offer.

International Lounge Access Comparison

Airport lounges transform international travel, especially during long layovers:

Priority Pass Networks

Chase Sapphire Reserve and Capital One Venture X include Priority Pass Select memberships worth $469 annually. With 1,300+ lounges globally, you'll find refuge in most international airports. Guest policies vary, so understand your card's specific benefits.

Airline-Specific Lounges

American Express Platinum provides access to Delta Sky Clubs when flying Delta, plus their exclusive Centurion Lounges. These premium spaces offer superior food, drinks, and amenities compared to standard Priority Pass options.

Credit Card Branded Lounges

Capital One and Chase are building proprietary lounge networks in major airports. These exclusive spaces often provide better experiences than overcrowded Priority Pass locations, with premium food and beverage offerings.

International Lounge Benefits

Lounge access becomes even more valuable internationally: free WiFi for work, showers during long connections, local cuisine, and quiet spaces away from chaotic terminals. Many international lounges exceed US domestic options in quality and amenities.

Common International Travel Card Mistakes

Avoid these costly errors when using travel rewards cards abroad:

- Not notifying banks of travel: Fraud prevention can freeze your cards at the worst times

- Relying on one card: Always carry backup options in case of issues

- Ignoring acceptance limitations: American Express isn't universal; carry Visa or Mastercard

- Dynamic currency conversion: Always pay in local currency to avoid terrible exchange rates

- Missing bonus categories: Know what earns extra points in each country

- Forgetting travel protections: Pay for entire trips with cards offering insurance

- Overlooking ATM options: Some cards reimburse foreign ATM fees—use them

Future of International Travel Rewards

The travel rewards landscape continues evolving with exciting developments for international travelers:

Dynamic Rewards Categories

Cards are introducing rotating international bonus categories, offering 5-10x points in specific countries or regions quarterly. This gamification encourages exploration while maximizing rewards.

Cryptocurrency Integration

Several issuers are testing crypto rewards and payment options, potentially revolutionizing international transactions by eliminating currency conversion entirely. Early adopters could see significant advantages.

Sustainable Travel Bonuses

Eco-conscious travel categories are emerging, with bonus points for carbon-neutral flights, sustainable hotels, and public transportation. This trend aligns rewards with environmental responsibility.

AI-Powered Optimization

Machine learning will soon recommend optimal card usage based on location, merchant, and spending patterns. Real-time notifications will ensure you never miss bonus earning opportunities.

Conclusion: Your Passport to Premium Travel Rewards

Selecting the right travel rewards credit cards transforms international adventures from expensive endeavors into rewarding investments. Chase Sapphire Reserve remains our top choice for comprehensive benefits and valuable points, while Capital One Venture X offers exceptional value at a lower price point. For luxury travelers, American Express Platinum provides unmatched premium perks globally.

The key to maximizing international travel rewards lies in understanding your travel patterns and selecting cards that align with your spending. Whether you're exploring European capitals, island-hopping in Southeast Asia, or conducting business across continents, the right combination of travel cards ensures every purchase contributes to your next adventure. Start with one premium travel card, understand its benefits thoroughly, then expand your wallet strategically. With no foreign transaction fees, valuable travel protections, and rewarding earning rates, these cards pay for themselves while elevating every aspect of international travel. For more strategies to optimize your finances while traveling, explore our comprehensive guides and credit card reviews.