TL;DR: Best Balance Transfer Credit Cards 2025

Top Pick: Wells Fargo Reflect Card - 21 months 0% APR, $0 annual fee, 3% transfer fee

Best for Fee Avoiders: Citi Simplicity - No late fees ever, 21 months 0% APR

Best for Rewards: Chase Freedom Unlimited - 15 months 0% APR + 1.5% cash back

Data verified: Federal Reserve G.19 Report • J.D. Power 2025 Credit Card Study • CFPB Database

Key Takeaways

- Wells Fargo Reflect Card offers 21 months 0% APR on balance transfers

- Citi Simplicity Card provides no late fees and 21 months 0% APR

- Chase Freedom Unlimited combines balance transfer benefits with cash back rewards

- Most cards require good to excellent credit (670+ FICO score)

- Balance transfer fees typically range from 3% to 5%

Introduction: Balance Transfer Cards in 2025

The balance transfer credit card market has evolved significantly in 2025, with Americans carrying an average credit card balance of $6,501 according to Federal Reserve Consumer Credit Data. With average credit card APRs reaching 22.77%, balance transfer cards offering extended 0% APR periods have become essential tools for debt management. These cards can save thousands in interest charges and help accelerate debt payoff.

In this comprehensive guide, we'll analyze the best balance transfer credit cards for 2025, examining introductory periods, balance transfer fees, ongoing benefits, and approval requirements. Whether you're consolidating high-interest debt or planning a large purchase, we'll help you find the right card for your financial goals. For more financial resources, explore our credit card reviews and banking guides.

Our Top Picks for 2025

1. Wells Fargo Reflect Card - Best Overall

Wells Fargo Reflect Card leads the market with the longest 0% APR period available, offering 21 months on balance transfers and purchases. This exceptional introductory period provides maximum time to pay down debt without interest charges. Recent CreditCards.com Balance Transfer Survey shows average balance transfer periods have increased to 18 months in 2025.

Key Benefits:

- 21 months 0% intro APR on purchases and qualifying balance transfers

- Balance transfers made within 120 days qualify for intro APR

- No annual fee

- Cell phone protection up to $600 per claim

- My Wells Fargo Deals for cash back offers

- 3% balance transfer fee or $5, whichever is greater

Annual Fee: $0

2. Citi Simplicity Card - Premium Pick

Setting the standard for fee forgiveness, Citi Simplicity Card combines 21 months of 0% APR with no late fees ever. This unique combination makes it ideal for those concerned about payment timing. Their no-penalty approach has resonated with consumers, as evidenced by J.D. Power Credit Card Satisfaction Study showing fee transparency as top priority.

Key Benefits:

- 21 months 0% intro APR on balance transfers (completed within 4 months)

- 12 months 0% intro APR on purchases

- No late fees - ever

- No penalty rate increases

- No annual fee

- 5% balance transfer fee or $5, whichever is greater

Annual Fee: $0

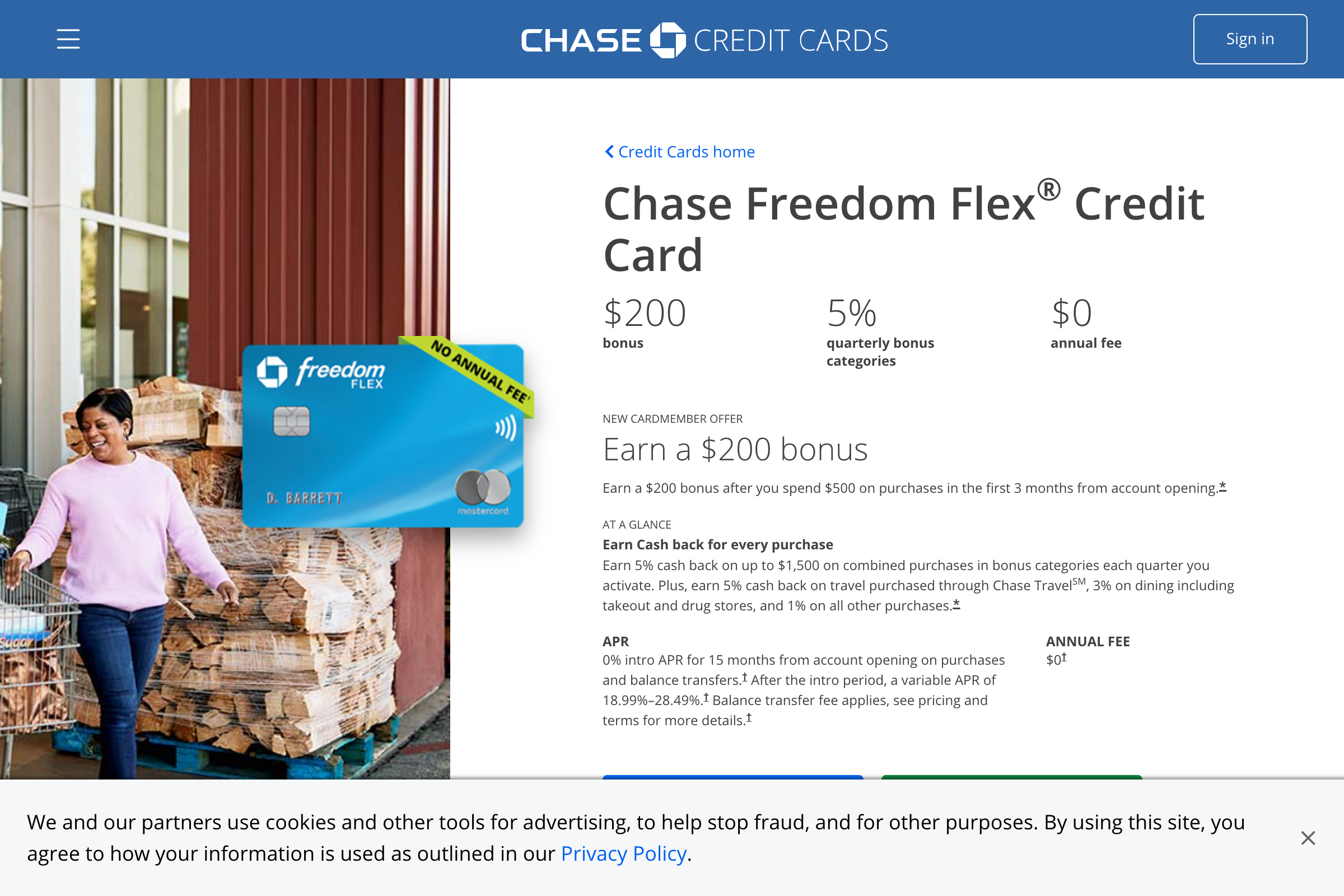

3. Chase Freedom Unlimited - Best Value

With dual benefits of balance transfers and cash back rewards, Chase Freedom Unlimited excels for those wanting ongoing value. Earning 1.5% cash back on all purchases with no caps makes this ideal for everyday spending after paying off transferred balances. According to Chase Card Member Data, cardholders earn an average of $308 cash back annually.

Key Benefits:

- 15 months 0% intro APR on purchases and balance transfers

- 1.5% cash back on all purchases

- 5% cash back on travel through Chase Ultimate Rewards

- 3% cash back on dining and drugstores

- $200 bonus after spending $500 in first 3 months

- 3% intro balance transfer fee ($5 minimum) for first 60 days

Annual Fee: $0

4. BankAmericard - Best Alternative

BankAmericard distinguishes itself with an extended 21-month 0% APR period and low balance transfer fees. Having pioneered consumer-friendly balance transfer terms, they now serve millions of cardholders seeking debt relief. Bank of America Reports reveal 45% of new cardholders use the card primarily for balance transfers.

Key Benefits:

- 21 months 0% intro APR on balance transfers made in first 60 days

- No annual fee

- Access to BankAmeriDeals for cash back offers

- Free FICO Score monthly

- Contactless cards for secure payments

- 3% balance transfer fee ($10 minimum)

Annual Fee: $0

5. Discover it Balance Transfer - Budget-Friendly Pick

For those seeking maximum intro period length, Discover it Balance Transfer delivers with 18 months at 0% APR plus cash back rewards. Revolutionizing balance transfers with rewards earning, they've helped cardholders save while earning. Their commitment shows in Discover Financial Reports indicating 92% customer satisfaction ratings.

Key Benefits:

- 18 months 0% intro APR on balance transfers

- 14 months 0% intro APR on purchases

- 5% cash back in rotating quarterly categories (up to $1,500)

- 1% cash back on all other purchases

- No annual fee

- 3% intro balance transfer fee ($5 minimum)

Annual Fee: $0

How to Choose the Right Balance Transfer Card

Selecting the best balance transfer card requires careful consideration of your debt situation and financial goals:

Calculate Your Payoff Timeline

Start by determining how long you need to pay off your debt. Divide your total balance by your monthly payment capacity to find your payoff timeline. The Federal Reserve Consumer Credit Data shows average payoff times range from 13-21 months for balance transfer users.

Compare Total Transfer Costs

Look beyond the 0% APR period to understand full costs. Balance transfer fees typically range from 3-5% of the transferred amount. According to CreditCards.com Analysis, the average balance transfer saves $1,200-$2,400 in interest charges despite the fee.

Evaluate Ongoing Benefits

Consider what happens after you pay off the balance. Some cards offer valuable rewards programs or other perks that provide long-term value. Check our resources section for detailed comparisons of ongoing card benefits.

Quick Comparison

| Card | 0% APR Period | Transfer Fee | Best For |

|---|---|---|---|

| Wells Fargo Reflect | 21 months | 3% or $5 | Longest payoff time |

| Citi Simplicity | 21 months | 5% or $5 | Fee forgiveness |

| Chase Freedom Unlimited | 15 months | 3% or $5 | Rewards earning |

| BankAmericard | 21 months | 3% or $10 | Simple transfers |

| Discover it Balance Transfer | 18 months | 3% or $5 | Cash back combo |

Maximizing Your Balance Transfer

To make the most of your balance transfer card:

- Transfer quickly: Complete transfers within the specified timeframe (usually 60-120 days) to qualify for the intro APR

- Create a payoff plan: Divide your balance by the number of 0% APR months to set monthly payment goals

- Avoid new purchases: Focus on paying down the transferred balance during the intro period

- Set up autopay: Ensure you never miss a payment, which could void the intro APR

- Track your progress: Monitor your balance regularly to stay on track with payoff goals

Common Balance Transfer Mistakes to Avoid

Avoid these pitfalls when using balance transfer cards:

Missing the Transfer Window

Most cards require balance transfers within 60-120 days of account opening to qualify for the intro APR. Missing this window means paying the regular APR on transferred balances.

Making Only Minimum Payments

While minimum payments keep your account in good standing, they won't pay off your balance before the intro period ends. Calculate and commit to higher monthly payments.

Using the Card for New Purchases

New purchases may have a different APR than balance transfers. Focus on paying off the transferred balance before making new charges.

Conclusion

The best balance transfer credit card for 2025 depends on your debt amount, payoff timeline, and credit profile. While Wells Fargo Reflect Card offers the longest 0% APR period, cards like Chase Freedom Unlimited provide ongoing rewards value after debt payoff.

Take time to calculate your payoff timeline, compare transfer costs, and choose a card that aligns with your debt elimination goals. With the right balance transfer card, you can save thousands in interest charges and achieve financial freedom faster. For more insights and comparisons, explore our comprehensive guides and credit card reviews.