Key Takeaways

- Marcus by Goldman Sachs leads with 5.25% APY and no minimum balance requirements

- Ally Bank offers 5.00% APY plus budgeting tools perfect for emergency fund tracking

- Most high-yield accounts now offer same-day transfers for true emergency access

- FDIC insurance protects up to $250,000 per depositor at each bank

- Aim for 3-6 months of expenses; start with $1,000 as your initial goal

- Online banks consistently offer 10-25x higher rates than traditional banks

Introduction: Why Your Emergency Fund Deserves High-Yield Savings

Building an emergency fund is the cornerstone of financial security, but where you store that fund can make a significant difference in your financial growth. In 2025, with high-yield savings accounts offering rates above 5% APY, your emergency fund can grow substantially while remaining fully accessible. According to Federal Reserve data, the average savings account pays just 0.45% APY, while top high-yield accounts offer more than 10 times that rate.

This comprehensive guide examines the best high-yield savings accounts specifically optimized for emergency funds in 2025. We'll compare interest rates, accessibility features, FDIC coverage, and account requirements to help you maximize your emergency savings while maintaining the liquidity you need for unexpected expenses. For additional banking options, explore our complete banking reviews and online banking guide.

Understanding Emergency Fund Requirements

Before selecting a high-yield savings account, it's crucial to understand what makes an ideal emergency fund account:

Immediate Accessibility

Your emergency fund must be available when you need it most. Look for accounts offering multiple withdrawal methods including ACH transfers, wire transfers, ATM access, and check-writing capabilities. The best emergency fund accounts provide same-day or next-day access to your money.

Safety and Security

FDIC insurance is non-negotiable for emergency funds. Ensure your chosen bank is FDIC-insured, protecting deposits up to $250,000 per depositor. According to FDIC statistics, no depositor has lost insured funds since the agency's creation in 1933.

Consistent High Yields

While rates fluctuate with Federal Reserve decisions, choose banks with histories of competitive rates. The Bankrate savings survey shows online banks consistently outperform traditional banks by 10-25x on savings rates.

Best High-Yield Savings Accounts for Emergency Funds

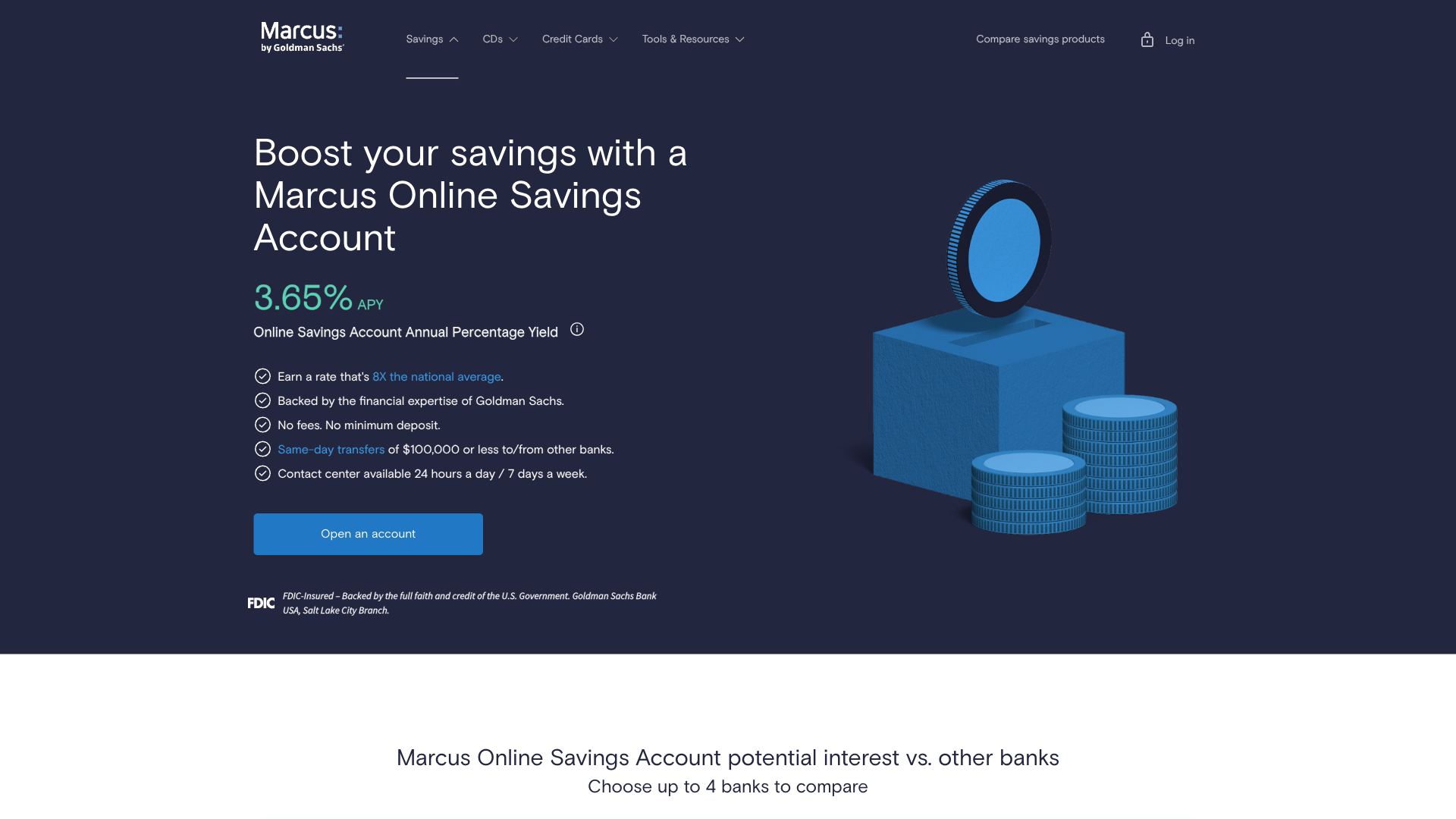

1. Marcus by Goldman Sachs - Best Overall for Emergency Funds

Marcus by Goldman Sachs offers an exceptional combination of high yields, no fees, and the backing of a major financial institution. With no minimum balance requirement and same-day transfers to external accounts, it's perfectly suited for emergency fund storage. Goldman Sachs reports that Marcus has over $100 billion in deposits, demonstrating strong consumer trust.

Emergency Fund Features:

- Current APY: 5.25% (10x national average)

- No minimum balance or monthly fees

- Same-day external transfers available

- FDIC insured up to $250,000

- No transaction limits beyond federal regulations

- 24/7 US-based customer service

- Mobile app for instant balance checks

- Rate history shows consistent competitiveness

Monthly Fee: $0 | Minimum Balance: $0

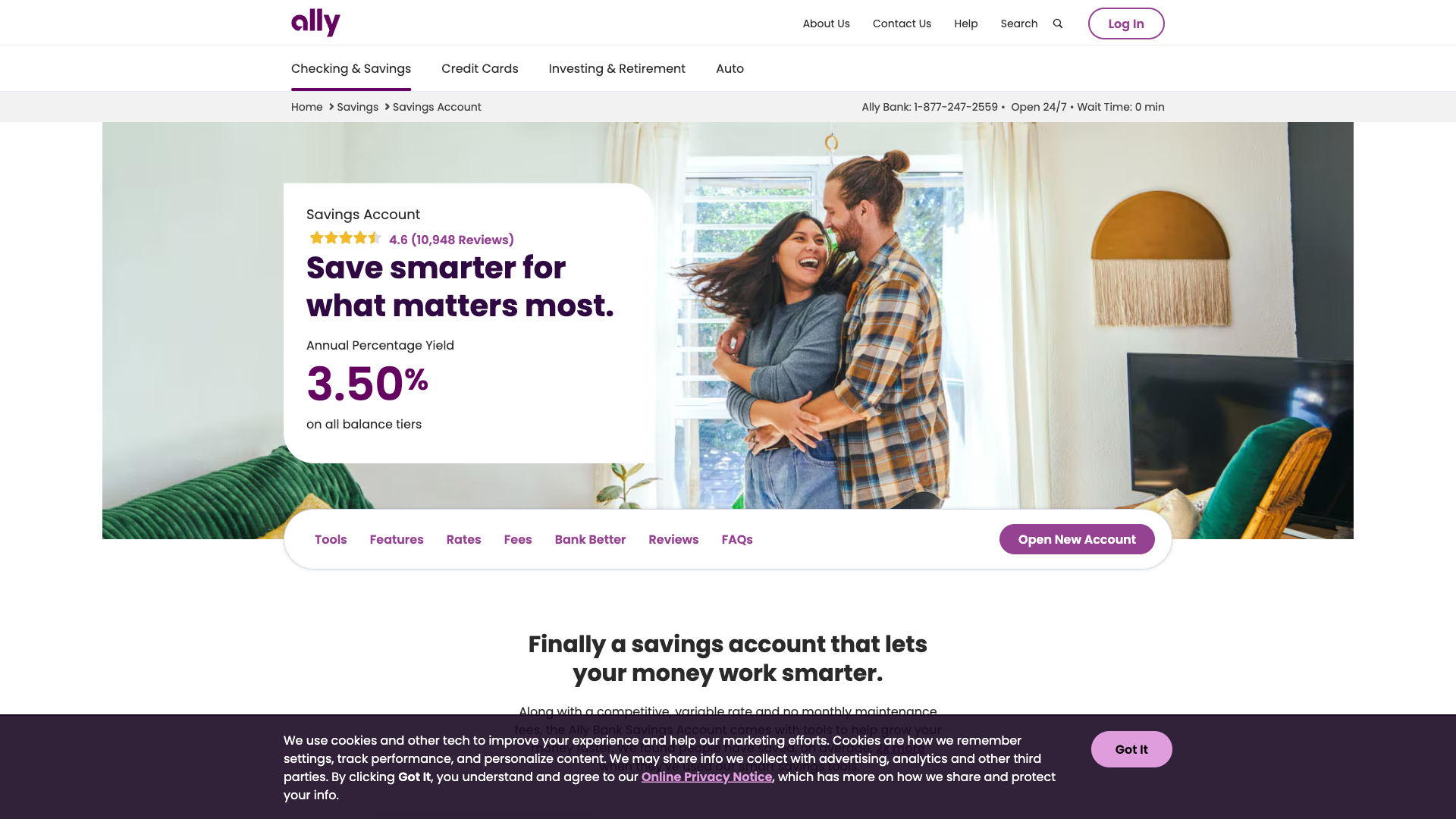

2. Ally Bank Online Savings - Best for Financial Tools

Ally Bank combines competitive rates with exceptional digital tools that make managing your emergency fund effortless. Their buckets feature allows you to organize savings goals within one account, perfect for separating different emergency scenarios. Ally's data shows customers who use savings buckets save 20% more than those who don't.

Emergency Fund Features:

- Current APY: 5.00% with no balance tiers

- Savings buckets for organizing emergency categories

- Free overdraft protection from savings

- Surprise Savings transfers for automatic building

- ATM card available for instant access

- Mobile check deposit up to $50,000

- Interest compounded daily

- No maintenance fees ever

Monthly Fee: $0 | Minimum Balance: $0

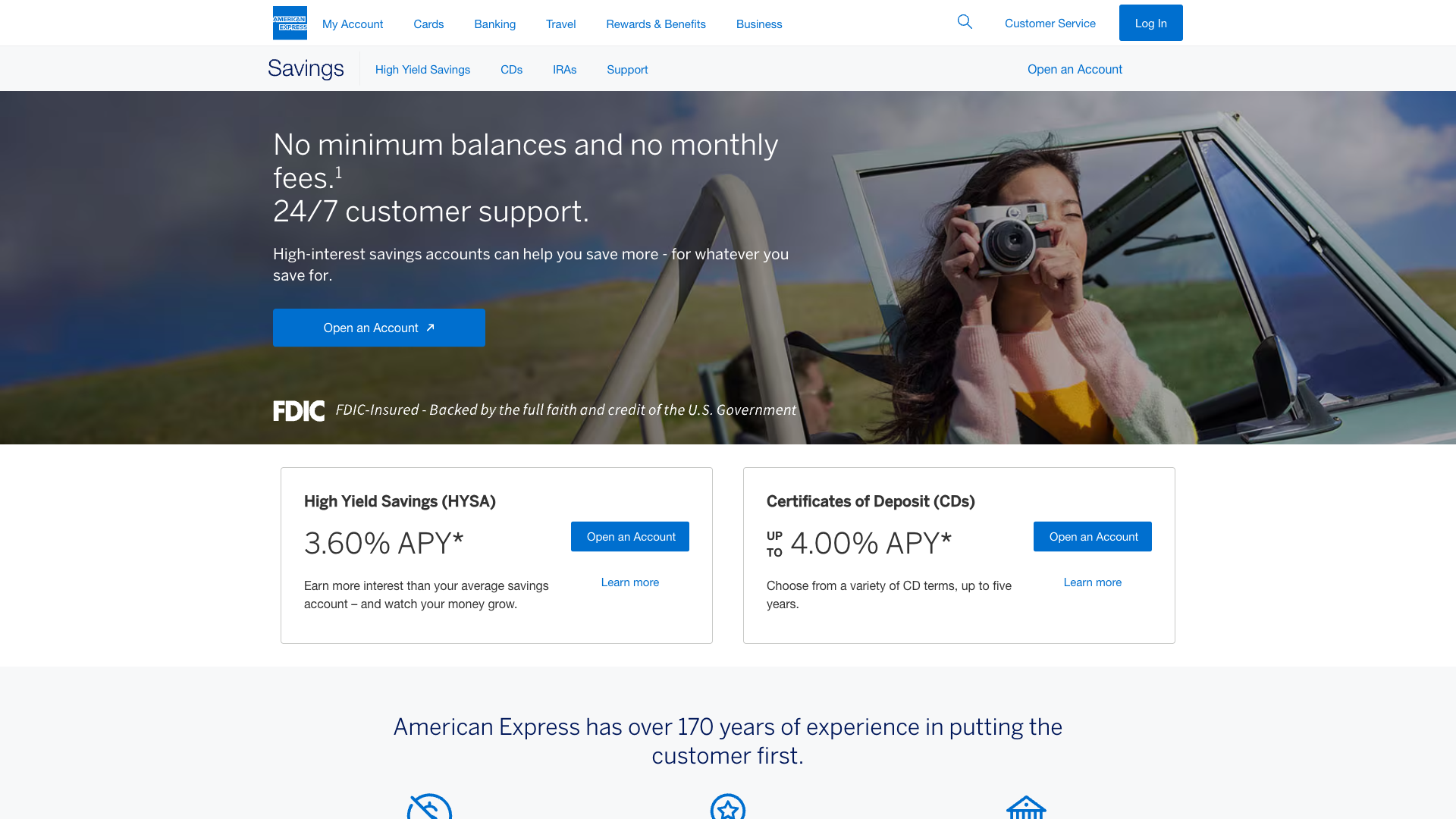

3. American Express Personal Savings - Best Brand Trust

American Express Personal Savings leverages the company's 170-year reputation to offer a secure, high-yield home for emergency funds. With no fees and competitive rates, it's ideal for those who value brand stability. American Express financial reports show consistent growth in their banking division with high customer satisfaction scores.

Emergency Fund Features:

- Current APY: 5.00% on all balances

- No minimum balance requirement

- No monthly maintenance fees

- 24/7 customer service availability

- Link up to 3 external bank accounts

- Same-day transfers between Amex accounts

- Member FDIC with strong financial backing

- Simple, user-friendly interface

Monthly Fee: $0 | Minimum Balance: $0

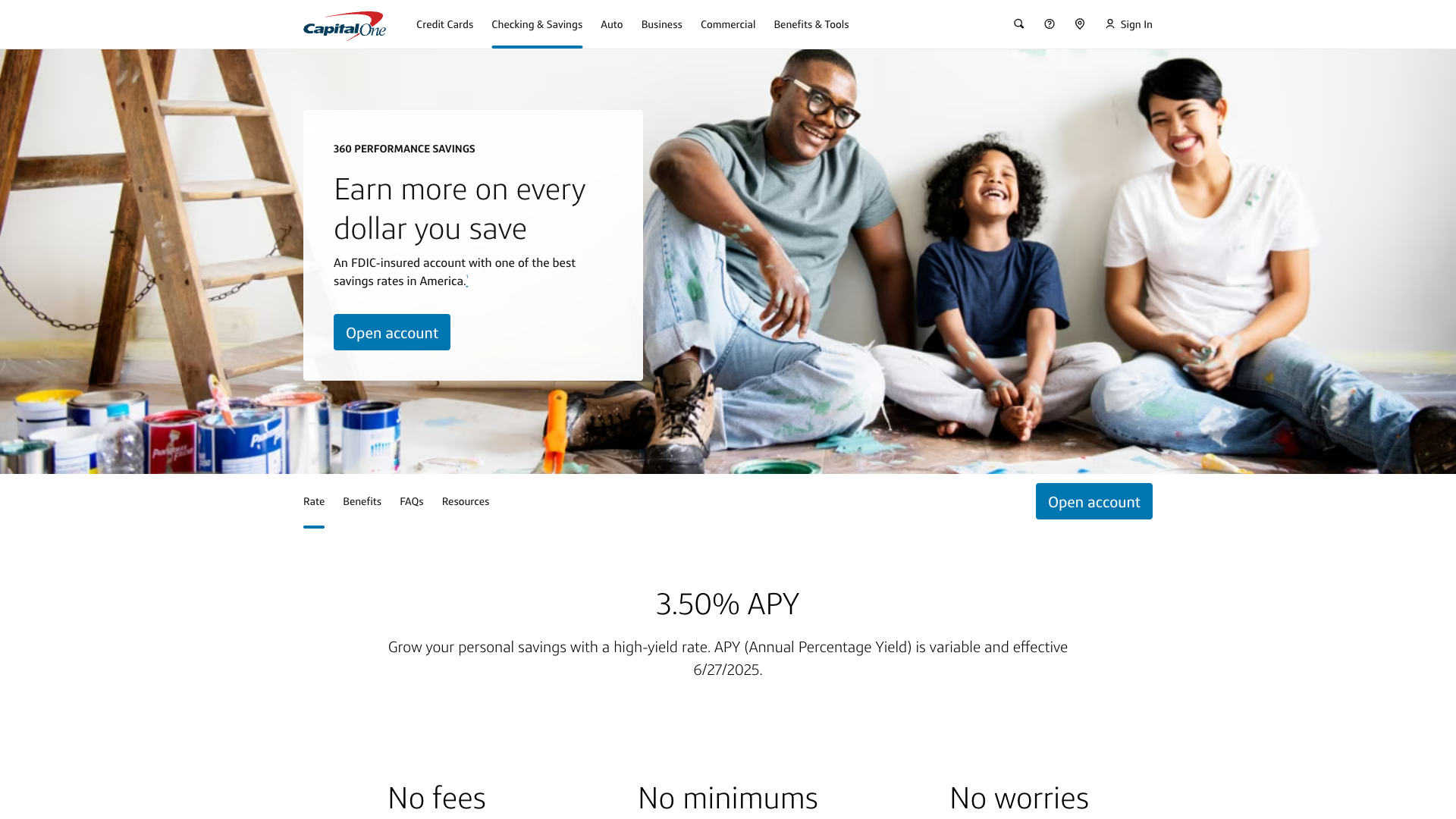

4. Capital One 360 Performance Savings - Best Mobile Experience

Capital One 360 Performance Savings offers an award-winning mobile app that makes managing your emergency fund intuitive and convenient. With no fees or minimums plus automatic savings plans, building your safety net becomes effortless. Capital One's investor data shows their digital banking customers are 3x more engaged than traditional banking customers.

Emergency Fund Features:

- Current APY: 4.90% on all balance amounts

- Automatic savings plans with customizable rules

- No fees or minimum balance requirements

- Free ATM access at 70,000+ locations

- Mobile check deposit with instant confirmation

- Create up to 25 savings accounts for different goals

- Real-time alerts and notifications

- Integration with Capital One credit cards

Monthly Fee: $0 | Minimum Balance: $0

5. Discover Online Savings - Best Rewards Integration

Discover Online Savings uniquely combines high-yield savings with a cashback debit card, allowing you to earn rewards even on emergency fund withdrawals. This dual benefit makes it exceptional for maximizing every dollar. Discover's financial data shows their banking customers have 40% higher satisfaction scores than industry average.

Emergency Fund Features:

- Current APY: 4.85% with no balance tiers

- 1% cashback debit card on up to $3,000/month

- No fees, no minimum balance

- Free official bank checks

- 24/7 US-based customer service

- 60,000+ fee-free ATMs nationwide

- Online and mobile banking rated #1 by J.D. Power

- Free identity theft protection

Monthly Fee: $0 | Minimum Balance: $0

6. SoFi Checking and Savings - Best Hybrid Account

SoFi Checking and Savings revolutionizes emergency fund storage by combining checking and savings features in one account with an exceptional APY. This eliminates transfer delays during emergencies while maximizing growth. SoFi's investor reports show 90% of members use multiple products, demonstrating strong ecosystem value.

Emergency Fund Features:

- Current APY: 4.60% with direct deposit

- Up to 2-day early paycheck access

- No account fees whatsoever

- Savings vaults for goal organization

- Roundup feature for automatic saving

- FDIC insured up to $2 million through partner banks

- Free overdraft coverage up to $50

- Global ATM fee reimbursement

Monthly Fee: $0 | Minimum Balance: $0

7. Wealthfront Cash Account - Best Automated Features

Wealthfront Cash Account uses sophisticated automation to optimize your emergency fund growth while maintaining accessibility. Their self-driving money feature automatically routes funds for maximum efficiency. Wealthfront data shows automated savings users accumulate emergency funds 3x faster than manual savers.

Emergency Fund Features:

- Current APY: 5.00% on all balances

- Self-driving money automation

- FDIC insured up to $8 million through partner banks

- Free debit card with mobile wallet support

- Automatic rebalancing between accounts

- Real-time spending notifications

- Direct deposit switching service

- Integration with Wealthfront investing

Monthly Fee: $0 | Minimum Balance: $1

Building Your Emergency Fund Strategy

Creating an effective emergency fund requires more than just choosing the right account. Here's a comprehensive strategy for success:

Calculate Your Target Amount

Financial experts recommend 3-6 months of essential expenses for most people. Calculate your monthly costs including housing, utilities, food, insurance, minimum debt payments, and transportation. According to Bureau of Labor Statistics data, the average American household spends $5,111 monthly on essentials, suggesting a $15,000-$30,000 emergency fund target.

Start Small and Build Consistently

Begin with an achievable goal like $1,000, which covers most common emergencies. Set up automatic transfers aligned with your paycheck to build the habit. Even $25 per week adds up to $1,300 annually, plus interest earned.

Optimize Your Savings Rate

With rates changing frequently, review your account quarterly. Don't hesitate to switch banks if your current rate falls significantly below market leaders. The Federal Reserve Economic Data shows high-yield rates closely follow federal funds rate changes.

Separate But Accessible

Keep your emergency fund at a different bank than your checking account to reduce temptation while maintaining accessibility. Online banks are perfect for this separation while offering superior rates.

Quick Comparison of Emergency Fund Savings Accounts

| Bank | Current APY | Minimum | ATM Access | Best Feature |

|---|---|---|---|---|

| Marcus | 5.25% | $0 | No | Highest rate |

| Ally | 5.00% | $0 | Yes | Savings buckets |

| American Express | 5.00% | $0 | No | Brand trust |

| Capital One 360 | 4.90% | $0 | Yes | Mobile app |

| Discover | 4.85% | $0 | Yes | Cashback debit |

| SoFi | 4.60% | $0 | Yes | Hybrid account |

| Wealthfront | 5.00% | $1 | Yes | Automation |

Emergency Fund Best Practices

Maximize your emergency fund's effectiveness with these proven strategies:

Define True Emergencies

Establish clear criteria for emergency fund use: job loss, medical expenses, major home repairs, or car repairs needed for work. Vacation, holiday shopping, and lifestyle upgrades don't qualify. Creating these boundaries protects your fund's integrity.

Regular Review and Adjustment

Reassess your emergency fund target annually or after major life changes like marriage, children, home purchase, or job changes. Inflation also impacts your needed amount—the Consumer Price Index shows costs rising 3-4% annually in recent years.

Consider Laddering for Larger Funds

Once your emergency fund exceeds $50,000, consider spreading across multiple banks to maximize FDIC coverage or using a bank that offers extended coverage through sweep programs. This strategy ensures full protection while maintaining high yields.

Tax Optimization

Interest from high-yield savings is taxable income. If your emergency fund generates significant interest, consider quarterly estimated tax payments to avoid surprises. Banks provide 1099-INT forms for interest over $10 annually.

When to Use Alternative Options

While high-yield savings accounts are ideal for most emergency funds, certain situations merit alternatives:

Money Market Accounts

If you need check-writing privileges or prefer a debit card with higher transaction limits, money market accounts offer similar yields with more flexibility. However, they often require higher minimum balances.

Short-Term CDs

For the portion of your emergency fund you're least likely to need immediately, 3-month CDs might offer slightly higher rates. Create a CD ladder to maintain some liquidity while maximizing returns.

I Bonds

Treasury I Bonds protect against inflation but require a one-year holding period. Consider these for the outer layer of a large emergency fund, beyond your immediate 3-month needs.

Common Emergency Fund Mistakes to Avoid

Learn from these frequent errors to build a stronger financial safety net:

- Keeping funds in checking: You're losing hundreds in potential interest annually

- Investing your emergency fund: Market volatility could force you to sell at losses during emergencies

- Using it for non-emergencies: Depleting your fund for wants rather than needs leaves you vulnerable

- Not adjusting for inflation: Your fund's purchasing power decreases without regular increases

- Choosing convenience over yield: Staying with big banks costs you thousands in lost interest

- Forgetting to automate: Manual saving is inconsistent and often forgotten

The Psychology of Emergency Savings

Building an emergency fund is as much mental as financial. Understanding the psychological aspects helps ensure success:

Peace of Mind Value

Research from American Psychological Association shows financial stress is the top stressor for Americans. A funded emergency account provides immeasurable peace of mind, improving overall well-being and decision-making.

Avoiding Debt Cycles

Without emergency savings, unexpected expenses often lead to credit card debt. With average credit card rates above 20%, using savings earning 5% instead saves thousands in interest charges.

Building Financial Confidence

Successfully building an emergency fund creates momentum for other financial goals. It proves you can save systematically, encouraging investment and long-term wealth building.

Conclusion: Secure Your Financial Foundation Today

A well-funded emergency account in a high-yield savings account provides the ultimate financial safety net while growing your money. Marcus by Goldman Sachs leads our recommendations with its 5.25% APY and no fees, while Ally Bank offers the best tools for managing and growing your fund with its innovative buckets feature.

Don't let your emergency fund languish in a low-yield account. With today's high-yield savings accounts offering 10-25x traditional bank rates, your safety net can grow significantly while remaining fully accessible. Start with $1,000 as your initial goal, automate your savings, and choose an account that aligns with your needs. Your future self will thank you when life's inevitable surprises arrive and you're financially prepared. For more strategies to optimize your finances, explore our banking guides and comprehensive financial resources.