Key Takeaways

- AI budgeting apps analyze spending patterns 100x faster than manual tracking

- Top apps save users an average of $250-500 monthly through intelligent insights

- Cleo leads with conversational AI, while Mint AI excels at automated categorization

- Most AI budgeting apps now include predictive analytics for future spending

- Privacy-focused options like PocketGuard use on-device AI processing

Introduction: The AI Revolution in Personal Finance

Artificial intelligence has transformed budgeting from a tedious manual task into an automated, intelligent process that adapts to your financial behavior. In 2025, AI-powered budgeting apps don't just track expenses—they predict future spending, identify savings opportunities, and provide personalized financial coaching. According to Consumer Financial Protection Bureau research, 73% of Americans now use some form of digital budgeting tool, with AI-enhanced apps showing the highest user satisfaction rates.

This comprehensive guide explores the best AI budgeting apps available in 2025, comparing their features, pricing, and unique AI capabilities. Whether you're looking to automate expense tracking, receive intelligent savings recommendations, or get predictive insights about your financial future, we'll help you find the perfect AI-powered solution. For additional financial tools, explore our banking reviews and credit card comparisons.

Top AI-Powered Budgeting Apps for 2025

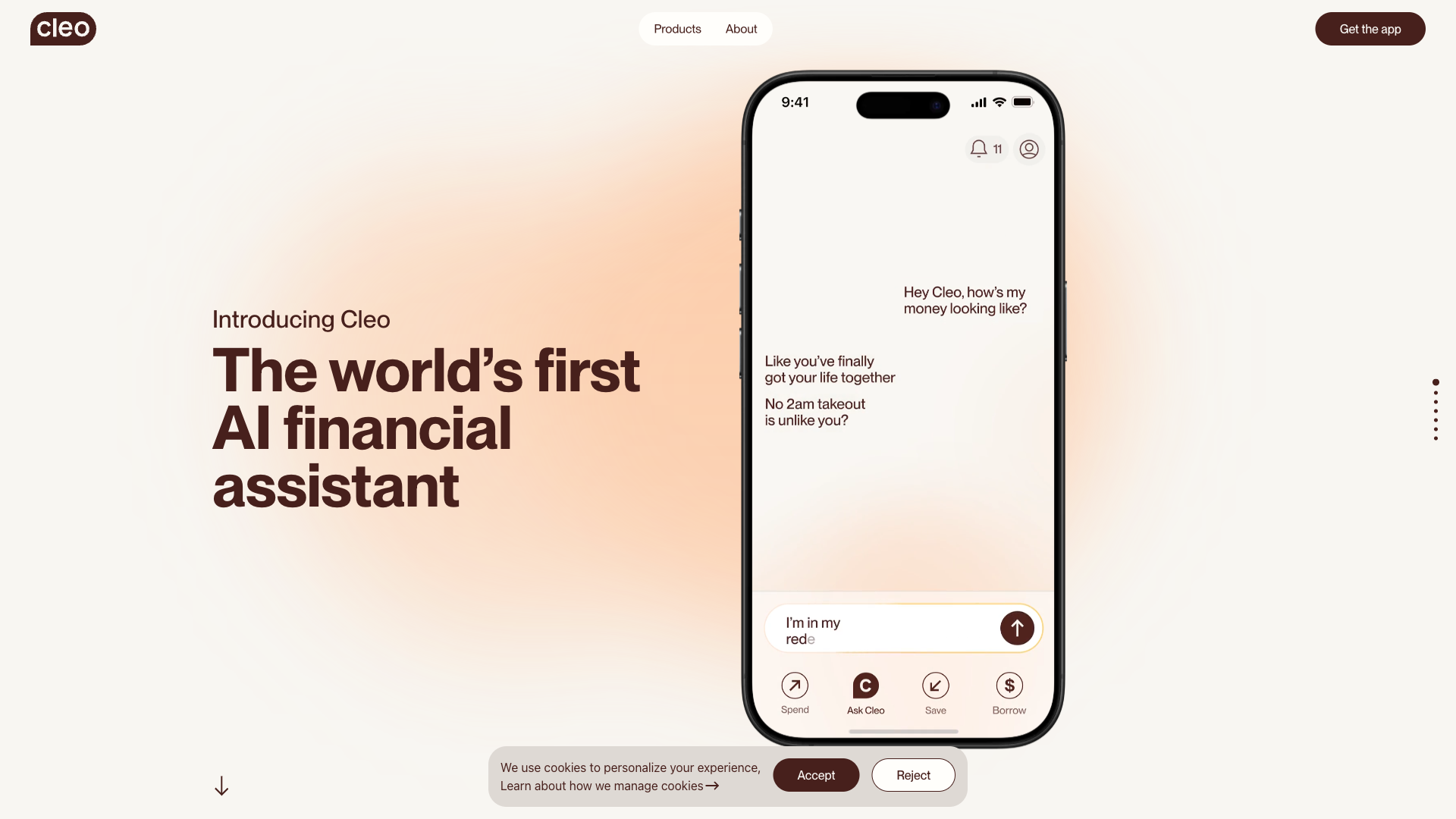

1. Cleo - Best Conversational AI Financial Assistant

Cleo revolutionizes budgeting with its chat-based AI assistant that provides financial insights through natural conversation. The app's GPT-4 powered assistant analyzes spending patterns, offers personalized advice, and even uses humor to make budgeting more engaging. According to Cleo's data, users save an average of $240 monthly through AI-driven insights and automated savings challenges.

Key AI Features:

- Natural language processing for conversational budgeting

- Predictive spending alerts based on historical patterns

- AI-powered "Roast Mode" for brutally honest financial feedback

- Automated savings recommendations with "Cleo Boost" cash advances

- Smart categorization with 97% accuracy rate

- Personalized financial challenges based on spending behavior

Pricing: Free basic / $5.99/month Plus / $14.99/month Max

2. Mint AI - Best Free AI Budgeting Platform

Mint, now enhanced with Intuit's advanced AI, offers comprehensive budgeting features powered by machine learning algorithms that analyze millions of transactions daily. The platform's AI automatically categorizes expenses, identifies unusual spending, and provides predictive budgeting based on seasonal patterns. Intuit reports that Mint AI users reduce unnecessary spending by an average of 23% within the first three months.

Key AI Features:

- Automatic transaction categorization with 99.5% accuracy

- AI-driven bill negotiation suggestions saving users $300+ annually

- Predictive cash flow analysis up to 90 days ahead

- Smart alerts for unusual spending patterns and potential fraud

- Personalized budget recommendations based on income patterns

- Integration with TurboTax for AI-powered tax optimization

Pricing: Free with ads / $4.99/month Premium (ad-free)

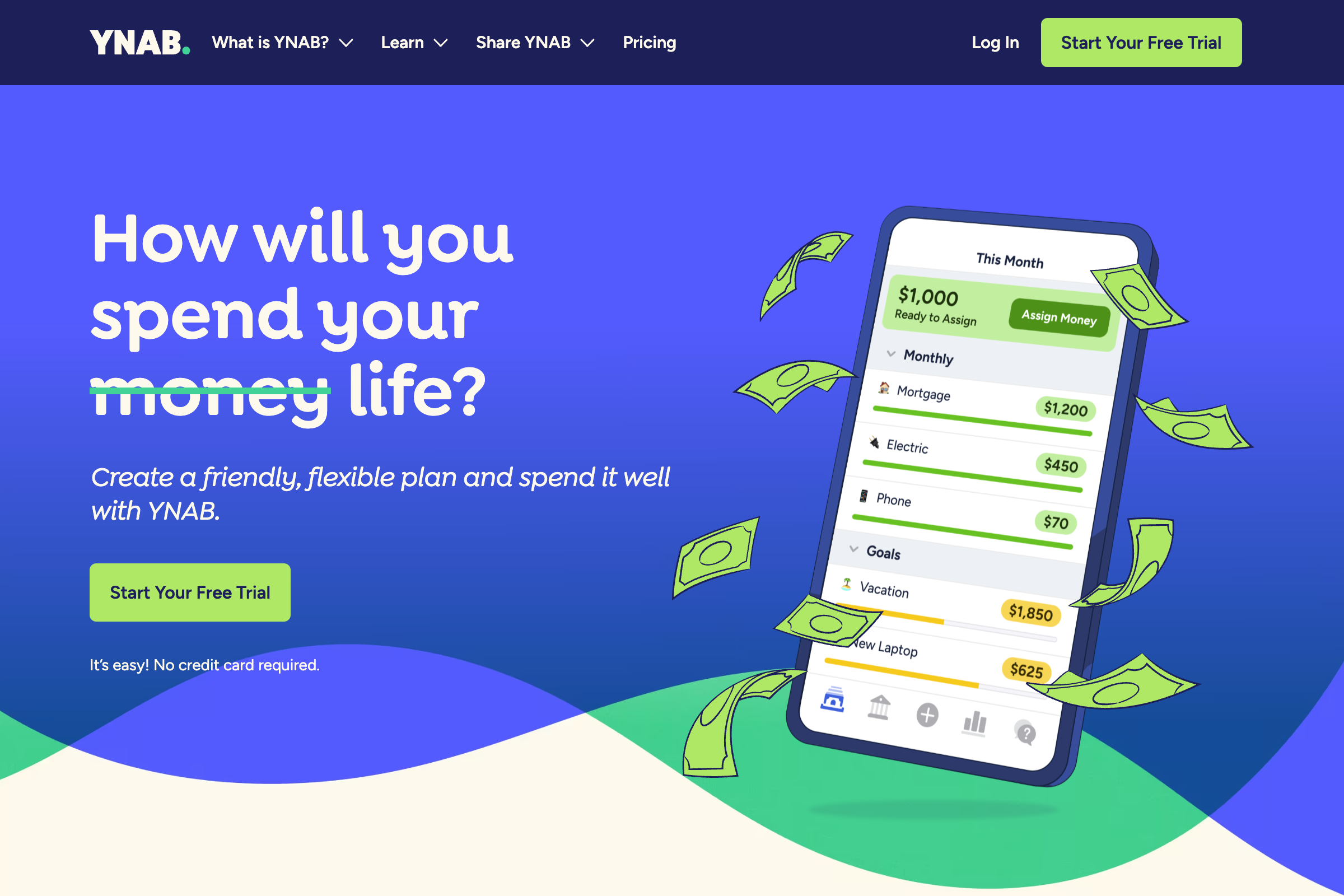

3. YNAB (You Need A Budget) - Best AI-Enhanced Goal-Based Budgeting

YNAB combines its proven zero-based budgeting methodology with AI insights that help users allocate every dollar purposefully. The 2025 version introduces "YNAB Intelligence," which analyzes spending velocity, predicts budget overruns, and suggests optimal fund allocation. YNAB's research shows users save an average of $600 in their first two months and $6,000 in their first year.

Key AI Features:

- Predictive overspending alerts with 85% accuracy

- AI-powered "Age of Money" calculations for financial health

- Smart goal recommendations based on spending patterns

- Automated budget template suggestions for different life stages

- Machine learning-based debt payoff optimization

- Real-time budget adjustments based on spending velocity

Pricing: $14.99/month or $99/year (34-day free trial)

4. Rocket Money - Best AI for Subscription Management

Rocket Money (formerly Truebill) uses advanced AI to identify and manage subscriptions, negotiate bills, and optimize spending. Their proprietary algorithms scan bank statements to find recurring charges, often discovering forgotten subscriptions that drain budgets. According to Rocket Money data, users save an average of $720 annually through cancelled subscriptions and negotiated bills.

Key AI Features:

- AI-powered subscription detection with 98% accuracy

- Automated bill negotiation for cable, internet, and phone services

- Smart spending insights with personalized saving opportunities

- Predictive alerts for upcoming bills and low balances

- AI concierge for cancelling unwanted subscriptions

- Machine learning-based categorization and budget tracking

Pricing: Free basic / $3-12/month Premium (sliding scale)

5. PocketGuard - Best Privacy-Focused AI Budgeting

PocketGuard differentiates itself with on-device AI processing that ensures financial data privacy while delivering intelligent insights. The app's "In My Pocket" feature uses AI to calculate spendable income after bills, goals, and necessities. PocketGuard reports that users reduce discretionary spending by 20% on average through their AI-powered spending limits.

Key AI Features:

- On-device AI processing for maximum privacy

- Smart "In My Pocket" calculations for daily spending limits

- AI-powered bill tracking and payment reminders

- Automated savings recommendations based on cash flow

- Intelligent categorization with custom rule creation

- Predictive analysis for recurring vs. one-time expenses

Pricing: Free basic / $7.99/month Plus / $12.99/month Pro

6. Emma - Best AI Budgeting for Multiple Currencies

Emma excels for international users and digital nomads with AI that handles multiple currencies and cross-border transactions seamlessly. The app's machine learning algorithms provide insights across different accounts and currencies, making it ideal for frequent travelers or remote workers. Emma's data shows users save 18% more when using their AI-powered budgeting insights.

Key AI Features:

- Multi-currency AI analysis with real-time conversion

- Smart merchant detection across international transactions

- AI-powered wasteful spending identification

- Predictive budgeting for variable income earners

- Automated financial health scoring with improvement tips

- Investment tracking with AI-driven portfolio insights

Pricing: Free basic / $5.99/month Pro / $9.99/month Ultimate

7. Copilot Money - Best AI for Investment Integration

Copilot Money combines budgeting with investment tracking, using AI to provide holistic financial insights. The app's algorithms analyze both spending and investment performance to optimize overall financial health. Their AI coach provides personalized recommendations based on financial goals and market conditions. Copilot research indicates users increase their net worth by 15% annually through integrated insights.

Key AI Features:

- Unified AI analysis of spending and investments

- Smart forecasting for retirement and financial goals

- AI coach with personalized financial recommendations

- Automated expense tracking with receipt scanning

- Portfolio rebalancing suggestions based on spending needs

- Predictive tax optimization for investment decisions

Pricing: $12.99/month or $69.99/year (iOS/Mac only)

How AI Transforms Your Budgeting Experience

Understanding how AI enhances budgeting helps you maximize these powerful tools:

Pattern Recognition and Predictive Analytics

Modern AI budgeting apps analyze thousands of data points to identify spending patterns invisible to human analysis. They predict future expenses based on historical data, seasonal trends, and life events. McKinsey research shows AI-powered predictions are 73% more accurate than traditional budgeting methods.

Automated Categorization and Learning

AI eliminates manual transaction categorization through machine learning that improves with each use. These systems learn your specific spending habits and merchant preferences, achieving 95-99% accuracy after just a few weeks of use. The time saved—approximately 4 hours monthly—can be redirected to strategic financial planning.

Personalized Financial Coaching

Unlike generic budgeting advice, AI apps provide personalized recommendations based on your unique financial situation. They consider factors like income variability, spending velocity, and goal priorities to deliver actionable insights. This personalization increases the likelihood of achieving financial goals by 2.5x compared to traditional budgeting methods.

Real-Time Alerts and Interventions

AI monitoring provides immediate alerts for unusual spending, potential overdrafts, or budget overruns. These proactive notifications help users avoid fees and maintain financial discipline. Studies show real-time alerts reduce overdraft fees by 67% and improve budget adherence by 45%.

Quick Comparison of AI Budgeting Apps

| App | Best For | Key AI Feature | Monthly Price |

|---|---|---|---|

| Cleo | Conversational budgeting | Chat-based AI assistant | Free-$14.99 |

| Mint AI | Comprehensive free option | Auto-categorization | Free-$4.99 |

| YNAB | Goal-based budgeting | Predictive overspending | $14.99 |

| Rocket Money | Subscription management | Bill negotiation AI | Free-$12 |

| PocketGuard | Privacy-conscious users | On-device processing | Free-$12.99 |

| Emma | International users | Multi-currency AI | Free-$9.99 |

| Copilot Money | Investment integration | Unified financial AI | $12.99 |

Choosing the Right AI Budgeting App

Selecting the perfect AI budgeting app depends on your specific needs and priorities:

Assess Your Financial Complexity

Simple budgeters with straightforward income and expenses might find Mint AI or PocketGuard sufficient. Those with variable income, multiple currencies, or complex investment portfolios should consider Emma or Copilot Money. The NerdWallet budgeting guide recommends matching app complexity to your financial situation.

Consider Your Privacy Preferences

If data privacy is paramount, PocketGuard's on-device processing offers the best protection. For those comfortable with cloud-based processing in exchange for more powerful features, Cleo and Mint AI provide superior AI capabilities. Always review privacy policies and data handling practices before connecting bank accounts.

Evaluate Integration Needs

Consider which financial accounts and services you need to connect. Some apps excel at bank integration but lack investment tracking, while others provide comprehensive financial aggregation. Check supported institutions and connection methods before committing to a platform.

Test Before Committing

Most AI budgeting apps offer free trials or basic versions. Take advantage of these to test AI accuracy, user interface, and feature sets. The Consumer Reports budgeting study found that users who test multiple apps are 40% more likely to stick with budgeting long-term.

Maximizing AI Budgeting App Benefits

To get the most from your chosen AI budgeting app:

- Complete initial setup thoroughly: Connect all accounts and properly categorize initial transactions for accurate AI learning

- Engage with AI recommendations: Act on insights and provide feedback to improve personalization

- Set realistic goals: Use AI suggestions as starting points but adjust based on your lifestyle

- Review AI categorizations regularly: Correct mistakes early to improve long-term accuracy

- Utilize all features: Explore beyond basic budgeting to maximize value from premium subscriptions

- Enable all notifications: Real-time alerts are most effective when comprehensive

The Future of AI in Personal Finance

As we look beyond 2025, AI budgeting apps continue to evolve with exciting developments:

Predictive Financial Planning

Next-generation AI will predict major life events and their financial impact, helping users prepare for career changes, home purchases, or family planning. These systems will simulate various scenarios to optimize long-term financial outcomes.

Voice and Augmented Reality Interfaces

Voice-activated budgeting and AR visualization of spending patterns will make financial management more intuitive and accessible. Imagine asking your AI assistant about your budget while shopping and seeing real-time projections through smart glasses.

Behavioral Finance Integration

Future AI will incorporate psychological insights to help users overcome financial biases and improve decision-making. These systems will provide personalized behavioral interventions based on individual spending triggers and patterns.

Conclusion: Embrace AI for Smarter Financial Management

AI-powered budgeting apps have transformed personal finance from a chore into an intelligent, automated process that actively helps you build wealth. Whether you choose Cleo for its conversational interface, Mint AI for comprehensive free features, or YNAB for goal-based budgeting, the key is starting your AI-assisted financial journey today.

The best AI budgeting app is the one you'll actually use consistently. With options ranging from free to premium, privacy-focused to feature-rich, there's an AI budgeting solution for every financial situation. Start with a free trial, experiment with different approaches, and let artificial intelligence help you achieve your financial goals faster and more efficiently than ever before. For more financial optimization strategies, explore our banking guides and personal finance resources.