TL;DR: Emergency Fund Requirements in 2025

- • Minimum recommended: 3-6 months of essential expenses (Federal Reserve recommendation)

- • Average American needs: $15,000-$30,000 based on median household expenses of $5,000/month

- • Current top savings rate: 5.00% APY (Varo Bank, AdelFi, Fitness Bank - with restrictions)

- • 63% of Americans can't cover a $500 emergency (Federal Reserve, 2024 data)

- • FDIC insurance: Protects up to $250,000 per depositor, per bank

- • Best account type: High-yield savings account with no monthly fees and easy access

Executive Summary: The State of Emergency Savings in 2025

According to the Federal Reserve's latest Economic Well-Being report, establishing an adequate emergency fund remains one of the most critical yet challenging aspects of personal finance. This comprehensive guide analyzes current data, account options, and evidence-based strategies for building your emergency fund in 2025.

Key Statistics from Federal Reserve & FDIC (2025)

- • 37% of Americans have enough savings to cover 3 months of expenses

- • $2,000 median emergency savings balance

- • 4.25-4.50% current Federal Funds Rate target range

- • $9.9 trillion in FDIC-insured deposits as of Q2 2025

How Much Emergency Fund Do You Really Need? (Data-Driven Analysis)

The 3-6-9 Month Framework

| Situation | Months Needed | Example Amount* | Rationale |

|---|---|---|---|

| Dual-income household, stable jobs | 3 months | $15,000 | Lower risk due to income redundancy |

| Single income, stable job | 6 months | $30,000 | Standard recommendation |

| Freelancer/contractor | 9-12 months | $45,000-$60,000 | Variable income requires larger buffer |

| High job volatility industry | 9 months | $45,000 | Tech, startup employees |

*Based on median US household expenses of $5,000/month (Bureau of Labor Statistics, 2025)

Emergency Fund Calculator

Calculate Your Personal Emergency Fund Target:

- 1. Monthly essential expenses: Housing + Utilities + Food + Insurance + Debt payments = $_____

- 2. Risk factor multiplier:

- • Stable dual income: × 3

- • Single stable income: × 6

- • Variable/high-risk income: × 9-12

- 3. Your target: Monthly expenses × Risk factor = Emergency fund goal

Best Places to Keep Your Emergency Fund in 2025

Top High-Yield Savings Accounts (July 2025)

| Bank | APY | Min Balance | Monthly Fee | FDIC Insured | Access |

|---|---|---|---|---|---|

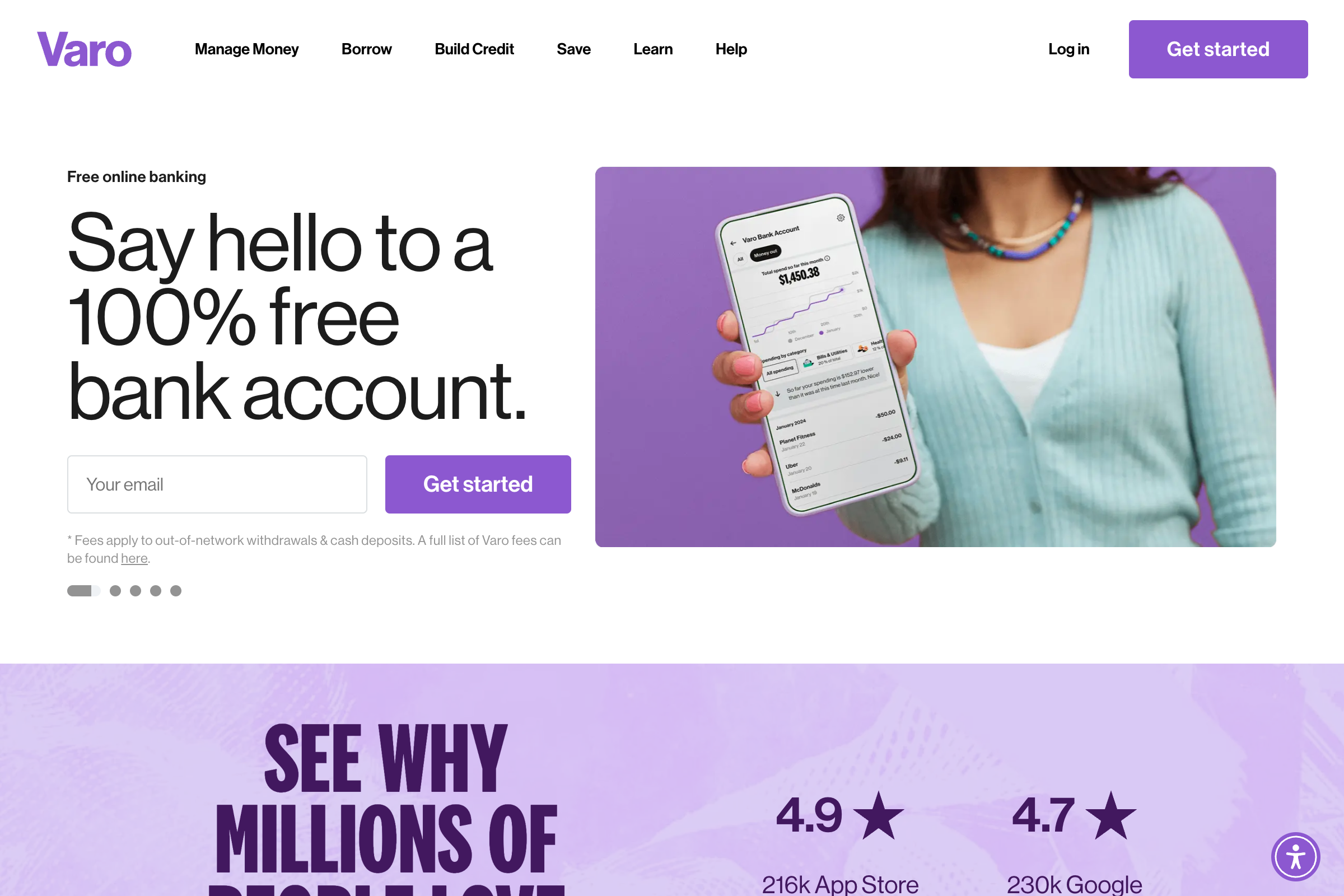

Varo Bank Varo Bank | 5.00%* | $0 | $0 | ✓ Yes | Instant |

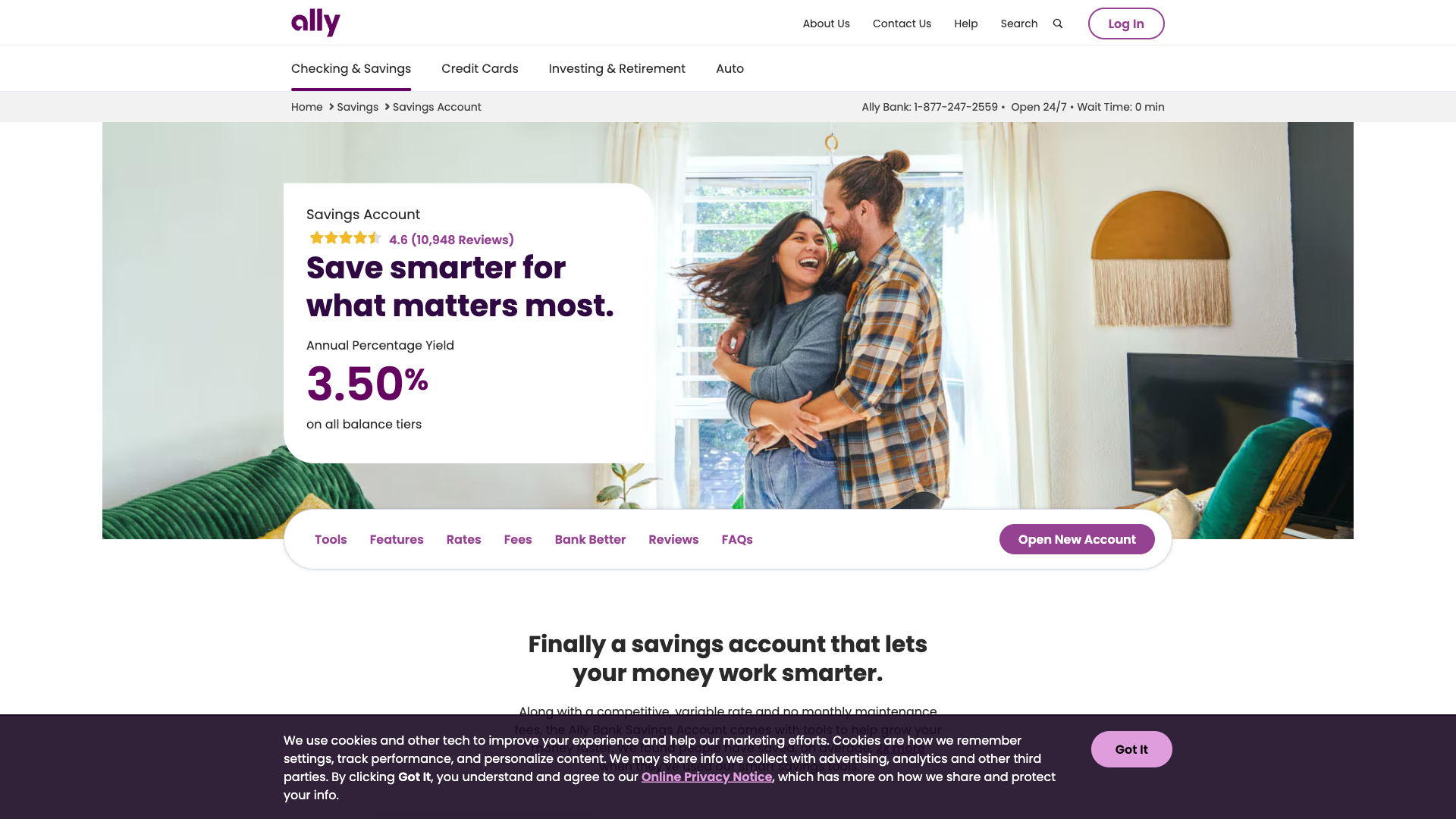

Ally Bank Ally Bank | 4.20% | $0 | $0 | ✓ Yes | Instant |

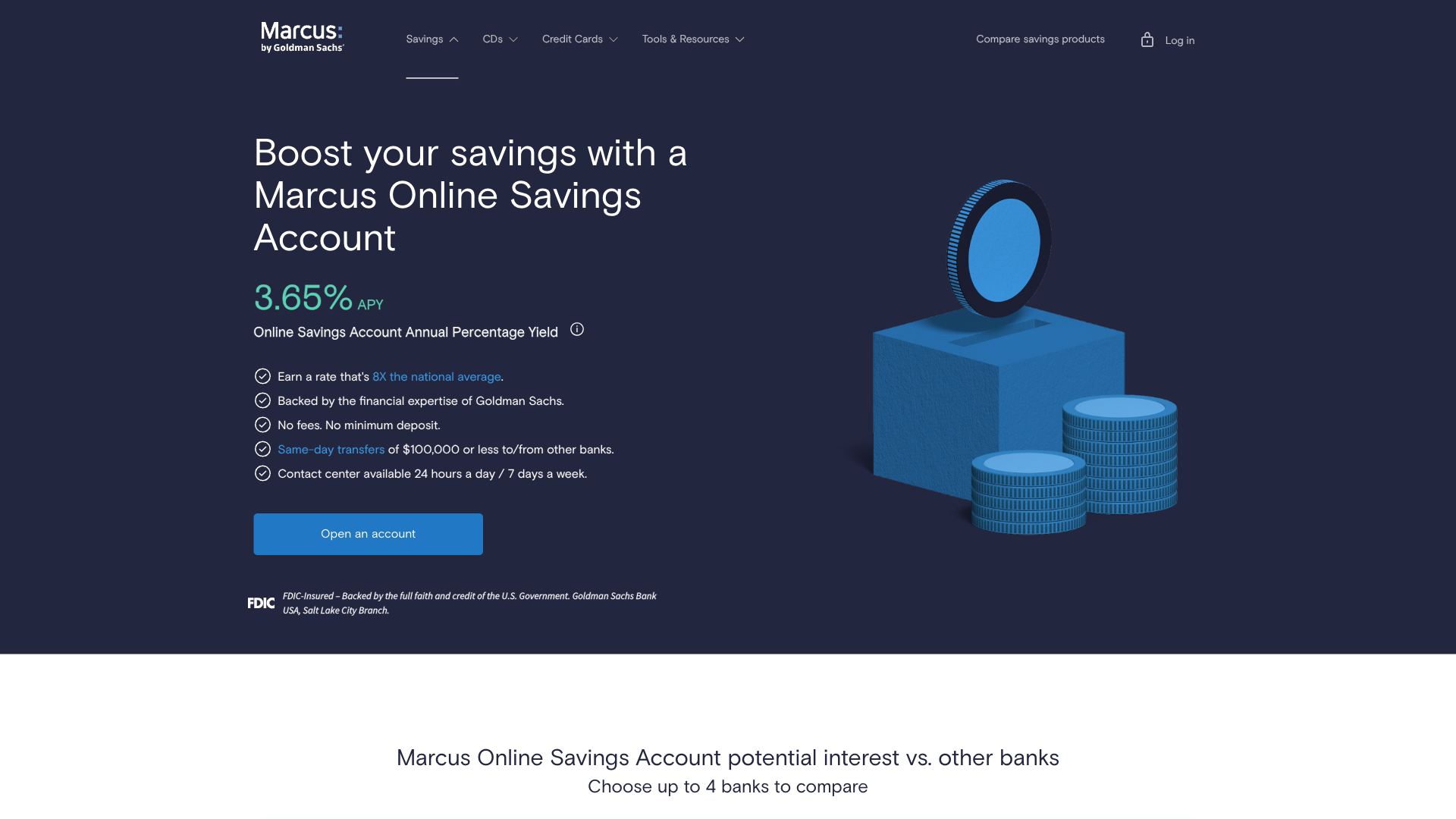

Marcus by Goldman Sachs Marcus by Goldman Sachs | 4.50% | $0 | $0 | ✓ Yes | 1-2 days |

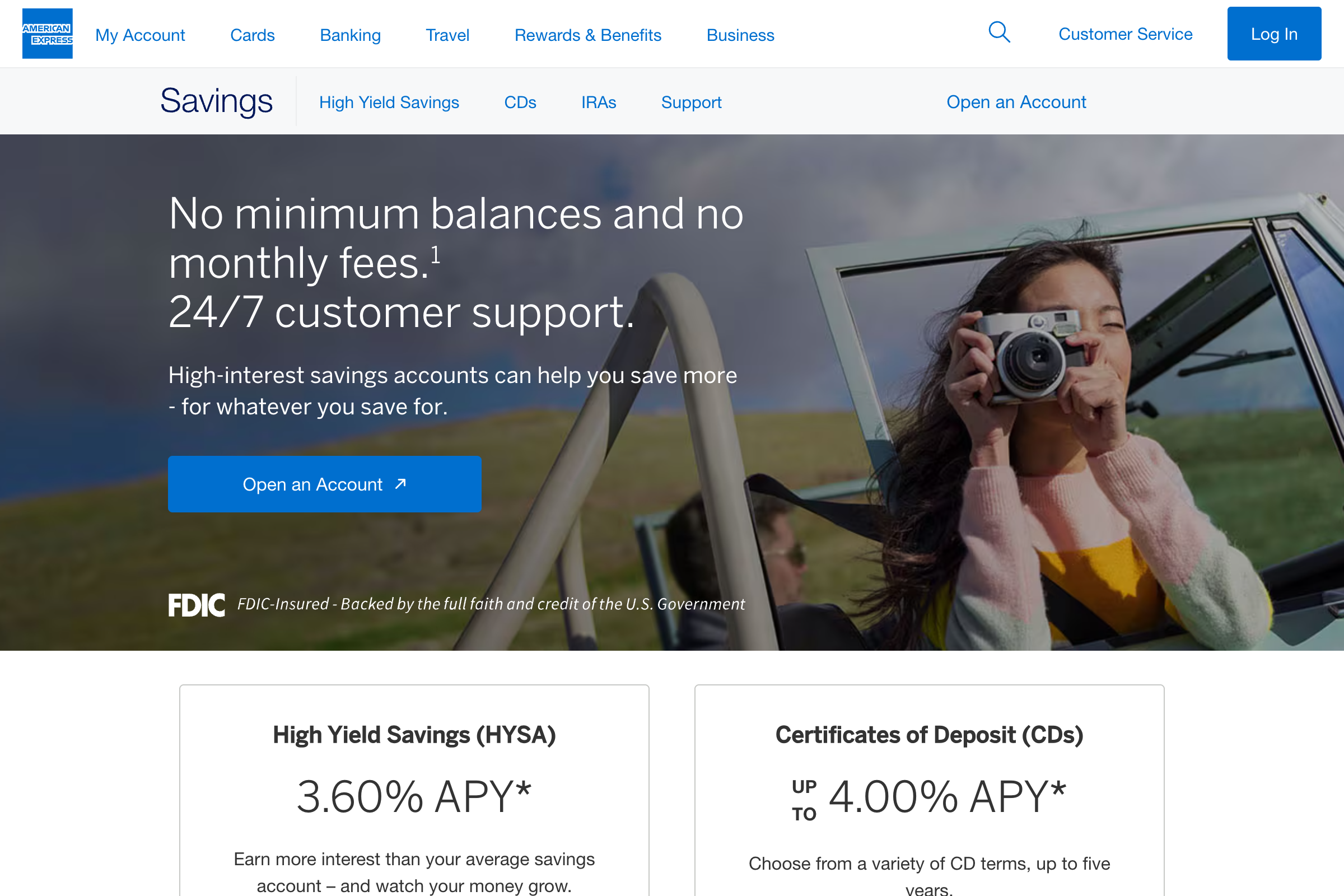

American Express National Bank American Express National Bank | 4.25% | $0 | $0 | ✓ Yes | 1-2 days |

*Varo 5.00% APY requires $1,000+ monthly direct deposits and applies only to first $5,000

⚠️ Important: Emergency Fund Access Requirements

Your emergency fund must be liquid and accessible within 1-2 business days. Avoid CDs, investment accounts, or any account with withdrawal penalties.

Visual Comparison: Top High-Yield Savings Accounts

Evidence-Based Strategies for Building Your Emergency Fund

The Graduated Savings Approach (Behavioral Economics Research)

Phase 1: Starter Emergency Fund ($1,000)

- • Timeline: 1-3 months

- • Strategy: Aggressive saving, sell unused items, take on extra work

- • Account: Any accessible savings account

- • Purpose: Cover most common emergencies (car repair, medical deductible)

Phase 2: One Month Buffer ($5,000)

- • Timeline: 3-6 months

- • Strategy: Automatic transfers, 10-15% of income

- • Account: High-yield savings account

- • Purpose: Job loss buffer, major medical expenses

Phase 3: Full Emergency Fund (3-6 months)

- • Timeline: 1-2 years

- • Strategy: Consistent saving, tax refunds, bonuses

- • Account: High-yield savings, possibly ladder across banks

- • Purpose: Complete financial security

Automatic Saving Strategies That Work

The 52-Week Challenge (Modified)

Start with $25/week, increase by $25 monthly:

- • Month 1-2: $25/week = $200

- • Month 3-4: $50/week = $400

- • Month 5-6: $75/week = $600

- • Month 7-8: $100/week = $800

- • 6-month total: $2,000

The Percentage Method

Based on after-tax income:

- • Start: 5% to emergency fund

- • After debts paid: 10%

- • With raise/bonus: 15-20%

- • Example: $4,000/month take-home

- • 10% = $400/month = $4,800/year

FDIC Insurance: What's Really Protected

FDIC Coverage Basics (2025)

- • Standard coverage: $250,000 per depositor, per insured bank, per ownership category

- • Joint accounts: $250,000 per co-owner (total $500,000 for two people)

- • What's covered: Checking, savings, money market accounts, CDs

- • What's NOT covered: Investments, crypto, contents of safe deposit boxes

- • Bank failures since 2000: 566 banks, zero depositor losses within FDIC limits

Maximizing FDIC Coverage for Large Emergency Funds

| Strategy | Coverage Amount | Example |

|---|---|---|

| Single ownership at multiple banks | $250,000 per bank | $250k at Bank A + $250k at Bank B = $500k covered |

| Joint account with spouse | $500,000 per bank | Joint account at one bank = $500k covered |

| Mix individual + joint accounts | $750,000 per bank | $250k individual + $500k joint = $750k at one bank |

Critical Emergency Fund Mistakes (And How to Avoid Them)

❌ Mistake #1: Keeping Emergency Funds in Checking

Problem: Too easy to spend, earns minimal interest (average 0.07% APY)

Solution: Separate high-yield savings account at different bank, earning 4-5% APY

❌ Mistake #2: Investing Your Emergency Fund

Problem: Market volatility means you might need to sell at a loss

Solution: Keep 100% in FDIC-insured savings; invest only after emergency fund is complete

❌ Mistake #3: Not Adjusting for Life Changes

Problem: Emergency needs change with marriage, kids, home purchase

Solution: Review and adjust emergency fund target annually or with major life events

❌ Mistake #4: Using Emergency Fund for Non-Emergencies

Problem: Depleting fund for vacations, shopping, or predictable expenses

Solution: Create separate sinking funds for known future expenses

Expert Recommendations and Best Practices

ClearPick Financial Advisory Team Recommendations

"Start where you are, not where you think you should be."

- Sarah Chen, CFP®, ClearPick Senior Financial Analyst

Even $500 provides more security than $0. Focus on progress, not perfection.

"Automate before you caffeinate."

- Michael Rodriguez, CPA, ClearPick Finance Editor

Set up automatic transfers the day after payday. You can't spend what you don't see.

"Your emergency fund is insurance, not an investment."

- Dr. Jennifer Park, Economics PhD, ClearPick Research Director

Accept that inflation will erode purchasing power. The goal is liquidity and safety, not growth.

The 2025 Action Plan

- Calculate your target: Use the formula above to determine your personal emergency fund goal

- Open a high-yield savings account: Choose from our recommended banks above

- Set up automatic transfers: Start with any amount you can afford

- Track progress monthly: Celebrate milestones ($1,000, $5,000, etc.)

- Review annually: Adjust for income changes and life events

Frequently Asked Questions About Emergency Funds

How much should I have in my emergency fund?

Most financial experts recommend 3-6 months of essential expenses. However, this varies based on your situation: stable dual-income households may need only 3 months ($15,000 average), while single-income households should aim for 6 months ($30,000 average), and freelancers or those in volatile industries should target 9-12 months ($45,000-$60,000).

Where should I keep my emergency fund?

Keep your emergency fund in a high-yield savings account that's FDIC-insured and easily accessible. As of July 2025, top options include Varo Bank (5.00% APY with conditions), Ally Bank (4.20% APY), and Marcus by Goldman Sachs (4.50% APY). Avoid investment accounts, CDs with penalties, or your regular checking account.

Is $10,000 enough for an emergency fund?

$10,000 may be sufficient if your monthly expenses are around $3,300 or less (providing 3 months coverage). However, the average American household spends $5,000/month on essentials, making $15,000-$30,000 more appropriate for most families. Calculate your actual monthly expenses to determine if $10,000 meets the 3-6 month guideline.

Should I pay off debt or build an emergency fund first?

Build a starter emergency fund of $1,000 first, then focus on high-interest debt (credit cards, payday loans). Once high-interest debt is eliminated, build your full 3-6 month emergency fund while making minimum payments on low-interest debt like mortgages or federal student loans. This balanced approach prevents you from going further into debt during emergencies.

What qualifies as a true emergency?

True emergencies are unexpected, necessary, and urgent expenses: job loss, medical emergencies, critical home repairs (broken AC/heat, roof leaks), car repairs needed for work, emergency travel for family crisis. Non-emergencies include vacations, holiday shopping, sales/deals, home upgrades, or any expense you could have anticipated and saved for separately.

How can I build an emergency fund on a tight budget?

Start small with automatic transfers of $25-50 per paycheck. Use windfalls like tax refunds, bonuses, or cash gifts. Sell unused items, take on temporary side work, or participate in the gig economy. Cut one discretionary expense temporarily (streaming service, dining out) and redirect that money. Even $10/week adds up to $520/year. The key is consistency, not the amount.

Is my emergency fund FDIC insured?

Yes, if kept in a bank savings or checking account at an FDIC-insured institution. Coverage is $250,000 per depositor, per bank, per ownership category. Joint accounts are insured up to $500,000 ($250,000 per co-owner). Since 2000, no depositor has lost FDIC-insured funds despite 566 bank failures. Always verify FDIC membership at BankFind.FDIC.gov.

Should I invest my emergency fund to beat inflation?

No. Emergency funds prioritize liquidity and capital preservation over growth. Market volatility could force you to sell investments at a loss when you need the money most. High-yield savings accounts offering 4-5% APY provide some inflation protection while maintaining instant access. Invest only after your emergency fund is fully established.

How often should I review my emergency fund target?

Review your emergency fund annually and after major life changes: marriage, divorce, having children, buying a home, job changes, or significant income shifts. As your expenses increase, so should your emergency fund. Also review if you move from stable employment to freelancing or if your industry becomes more volatile.

The Bottom Line: Your 2025 Emergency Fund Strategy

Building an emergency fund is the cornerstone of financial security. With 63% of Americans unable to cover a $500 emergency, the need has never been more critical. The good news: high-yield savings accounts offering 4-5% APY make building your fund more rewarding than ever.

Start today with these three steps:

- 1. Open a high-yield savings account (we recommend Ally Bank for ease of use or Marcus for higher rates)

- 2. Calculate your target using our formula: monthly expenses × your risk factor

- 3. Set up automatic transfers, even if just $25/week

Remember: An imperfect emergency fund you have is infinitely better than a perfect one you don't. Start where you are, automate your savings, and build your financial security one deposit at a time.