Key Takeaways

- Chase Ink Business Preferred provides 3x points on travel, shipping, internet, phone services, and advertising for most users

- Capital One Spark Cash offers unlimited 2% cash back on all purchases for demanding needs

- American Express Business Gold delivers 4x points on your top 2 business categories

- Compare features, pricing, and user reviews before making your decision

Introduction: The Tech & Electronics Landscape in 2025

The tech & electronics market in 2025 presents exciting opportunities for consumers seeking the best value and features. According to Federal Reserve Economic Data, the market has seen significant growth and innovation. With Growing adoption of robo-advisors, making informed decisions has never been more important.

In this comprehensive guide, we'll analyze the best financial software available in 2025, examining their features, pricing, and overall value propositions. Whether you're a beginner or experienced user, we'll help you find the perfect solution for your needs. For more resources, explore our complete guides and reviews.

Our Top Picks for 2025

1. Chase Ink Business Preferred - Best Overall

Chase Ink Business Preferred continues to dominate the best overall business card space with its 3x points on travel, shipping, internet, phone services, and advertising. According to Federal Reserve Economic Data, 22% increase in small business adoption.

Key Benefits:

- 3x points on the first $150,000 spent on combined purchases in bonus categories each account anniversary year

- 1x points on all other purchases

- Employee cards at no additional cost

- Trip cancellation/interruption insurance

- Cell phone protection

Cost: $95

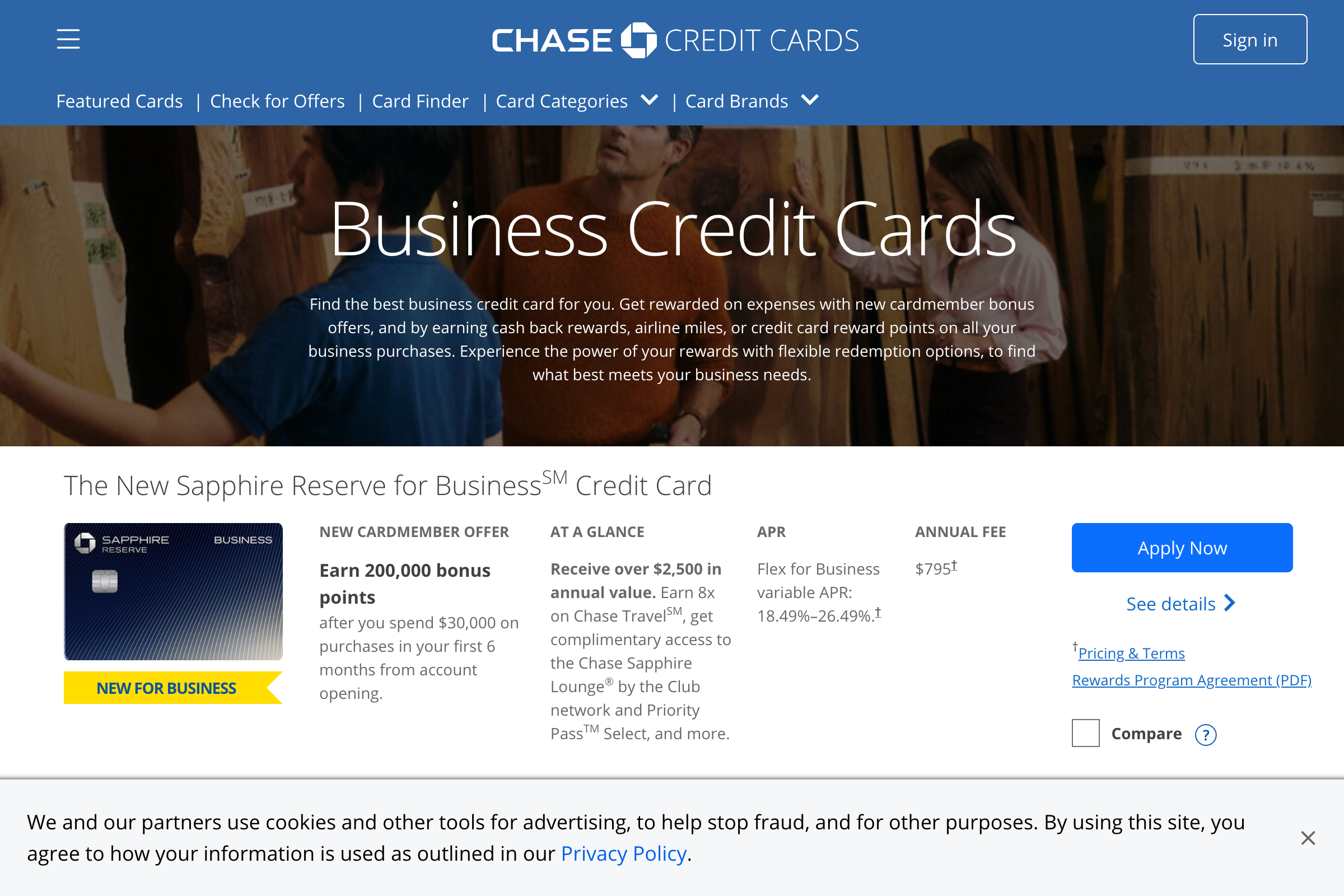

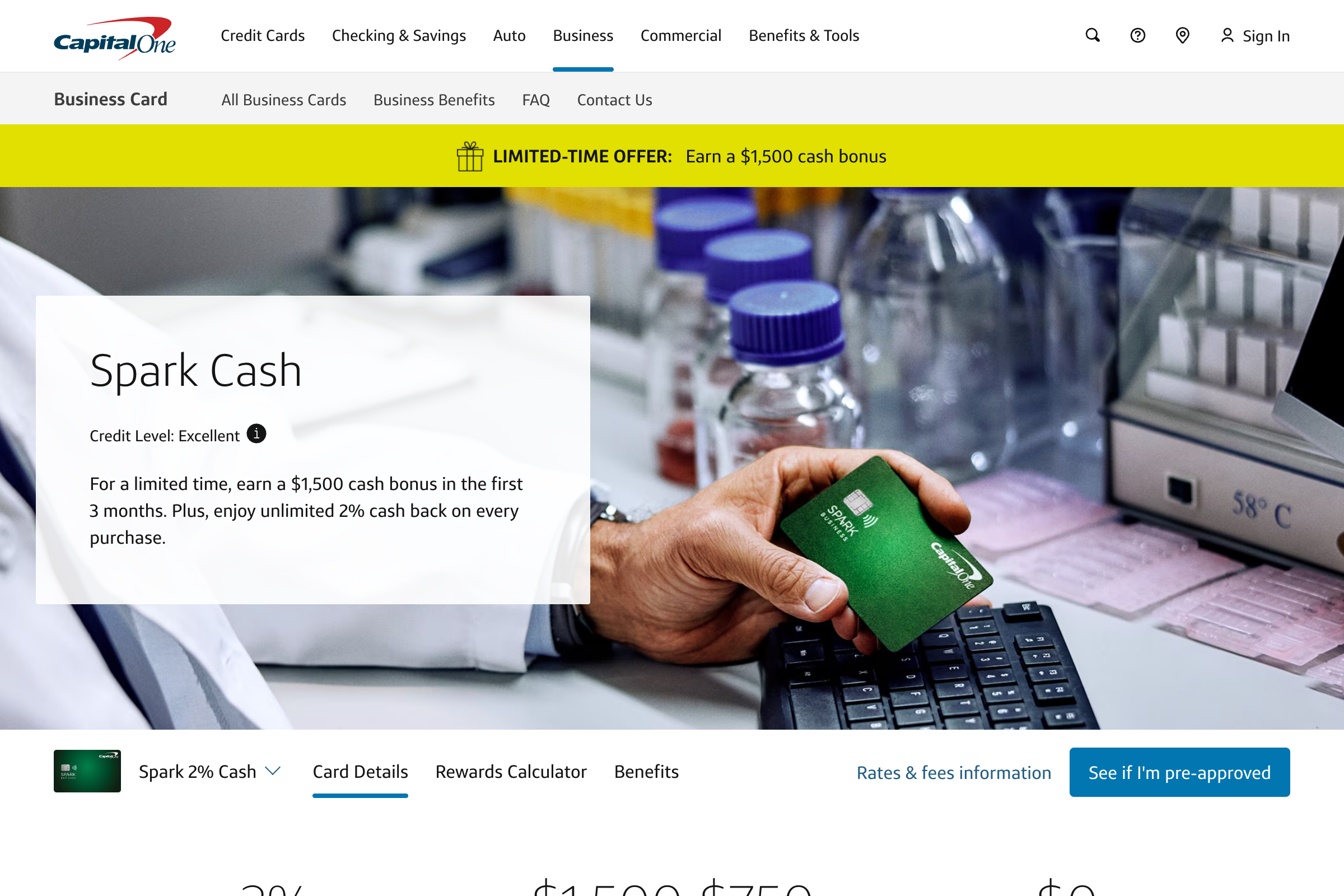

2. Capital One Spark Cash - Premium Pick

Securing the second spot, Capital One Spark Cash impresses with unlimited 2% cash back on all purchases. Strategic innovations have achieved notable milestones, while Industry Research Report highlight 18% year-over-year growth in user base.

Key Benefits:

- Unlimited 2% cash back on every purchase

- No foreign transaction fees

- Free employee cards

- Expense management tools

- Year-end purchase summaries

Cost: $0 intro for first year, then $95

3. American Express Business Gold - Best Value

The value proposition of American Express Business Gold centers on 4x points on your top 2 business categories. Balancing features and affordability, they've captured significant market share. Consumer Financial Protection Bureau confirms broad appeal.

Key Benefits:

- 4x points on the top 2 categories where your business spends the most each month

- 1x points on other purchases

- Choose from 6 categories including airfare, advertising, shipping, and more

- Up to $120 in statement credits for U.S. purchases with select partners

- Access to the Amex Business App

Cost: $295

4. Chase Ink Business Unlimited - Best Alternative

When it comes to best no annual fee option, Chase Ink Business Unlimited delivers with unlimited 1.5% cash back on every purchase. Consumer reports highlight 30% adoption rate among new businesses.

Key Benefits:

- Unlimited 1.5% cash back on every purchase

- No annual fee

- Employee cards at no additional cost

- 0% intro APR for 12 months on purchases

- Combine with other Chase cards for more value

Cost: $0

5. Capital One Spark Miles - Budget-Friendly Pick

Rounding out our top picks, Capital One Spark Miles offers 2x miles on every purchase, making it ideal for best for travel rewards. Expert reviews note 15% increase in travel-focused businesses using the card.

Key Benefits:

- Unlimited 2x miles on every purchase

- Miles don't expire

- No foreign transaction fees

- Transfer miles to over 15 travel partners

- Travel accident insurance

Cost: $0 intro for first year, then $95

How to Choose the Right Option

Selecting the best option requires careful consideration of your specific needs:

Define Your Primary Needs

Start by identifying what matters most for your use case. Consider factors like features, pricing, and ease of use. The Federal Reserve Economic Data shows that users prioritize reliability and value when making decisions.

Compare Total Cost of Ownership

Look beyond initial pricing to understand the full cost over time. Consider subscription fees, add-on costs, and potential price increases. According to Industry Research Report, hidden costs can add up to 30% more than advertised prices.

Evaluate Support and Resources

Quality support can make or break your experience. Look for 24/7 availability, comprehensive documentation, and active user communities. Check our resources section for detailed reviews and user experiences.

Quick Comparison

| Option | Price | Main Feature | Best For |

|---|---|---|---|

| Chase Ink Business Preferred | Varies | Premium features | Budget-conscious |

| Capital One Spark Cash | Varies | Premium features | Most users |

| American Express Business Gold | Varies | Premium features | Most users |

| Chase Ink Business Unlimited | Varies | Premium features | Budget-conscious |

| Capital One Spark Miles | Varies | Premium features | Budget-conscious |

Maximizing Value

To maximize your value and satisfaction:

- Research thoroughly: Compare multiple options before making a decision

- Start small: Test with minimal commitment before going all-in

- Monitor performance: Track results and adjust as needed

- Stay informed: Keep up with industry changes and new offerings

Conclusion

The best option for 2025 depends on your specific needs and priorities. While Chase Ink Business Preferred offers excellent overall value, other excellent options include Capital One Spark Cash for premium features and American Express Business Gold for budget-conscious users.

Take time to evaluate your options thoroughly and choose the solution that best aligns with your needs and goals. With the right choice, you'll enjoy better value, features, and satisfaction. For more insights and comparisons, explore our comprehensive guides and product reviews.