Key Takeaways

- Capital One SavorOne offers 3% cash back on entertainment and streaming with no annual fee

- Chase Freedom Flex provides 5% rotating quarterly bonuses that often include streaming and entertainment

- American Express Blue Cash Preferred earns 6% on streaming services for the first year, then 3%

- Consider bundling entertainment purchases with cards that offer bonus categories or statement credits

Introduction: The Entertainment Spending Revolution in 2025

As we navigate through 2025, entertainment and streaming spending has reached unprecedented levels. The average American household now spends over $2,400 annually on entertainment services, including streaming platforms, movie theaters, concerts, and digital content. According to Federal Reserve Economic Data, entertainment spending has grown by 28% since 2020, making it a significant category for credit card rewards optimization.

In this comprehensive guide, we'll analyze the best credit cards for streaming services and entertainment purchases in 2025, examining their rewards structures, annual fees, and entertainment-specific perks. Whether you're a streaming enthusiast, movie buff, or concert-goer, we'll help you find the perfect card to maximize your entertainment rewards. For more credit card options, check out our complete credit card reviews.

Our Top Picks for 2025

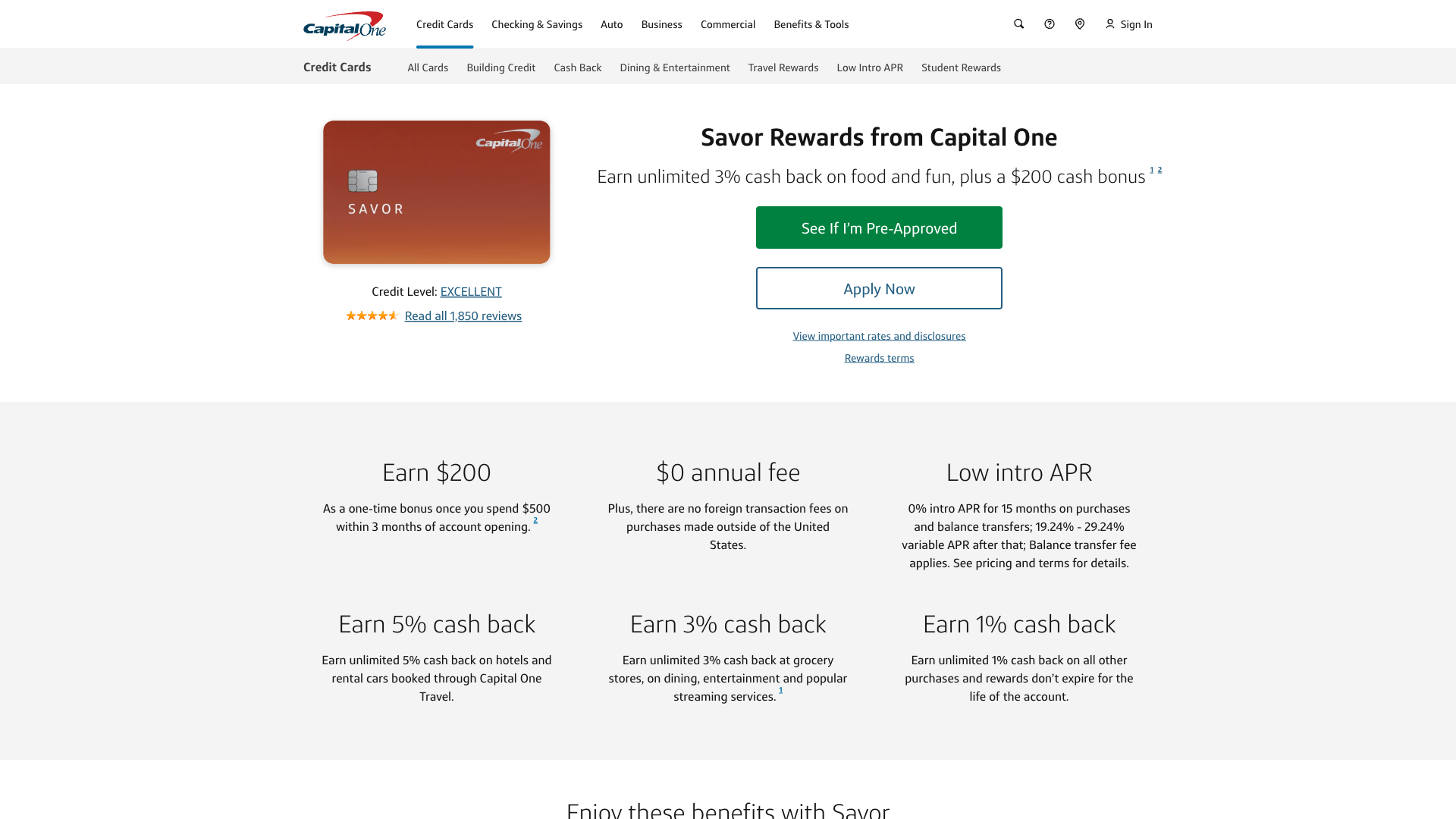

1. Capital One SavorOne - Best Overall for Entertainment

Capital One SavorOne stands out as the top choice for entertainment and streaming purchases with its straightforward 3% cash back on entertainment, dining, and popular streaming services. According to Capital One data, cardholders save an average of $300 annually on entertainment expenses.

Key Benefits:

- 3% cash back on entertainment, dining, and popular streaming services

- 1% cash back on all other purchases

- No annual fee

- No foreign transaction fees

- Covers Netflix, Spotify, Disney+, Hulu, and more

Annual Fee: $0

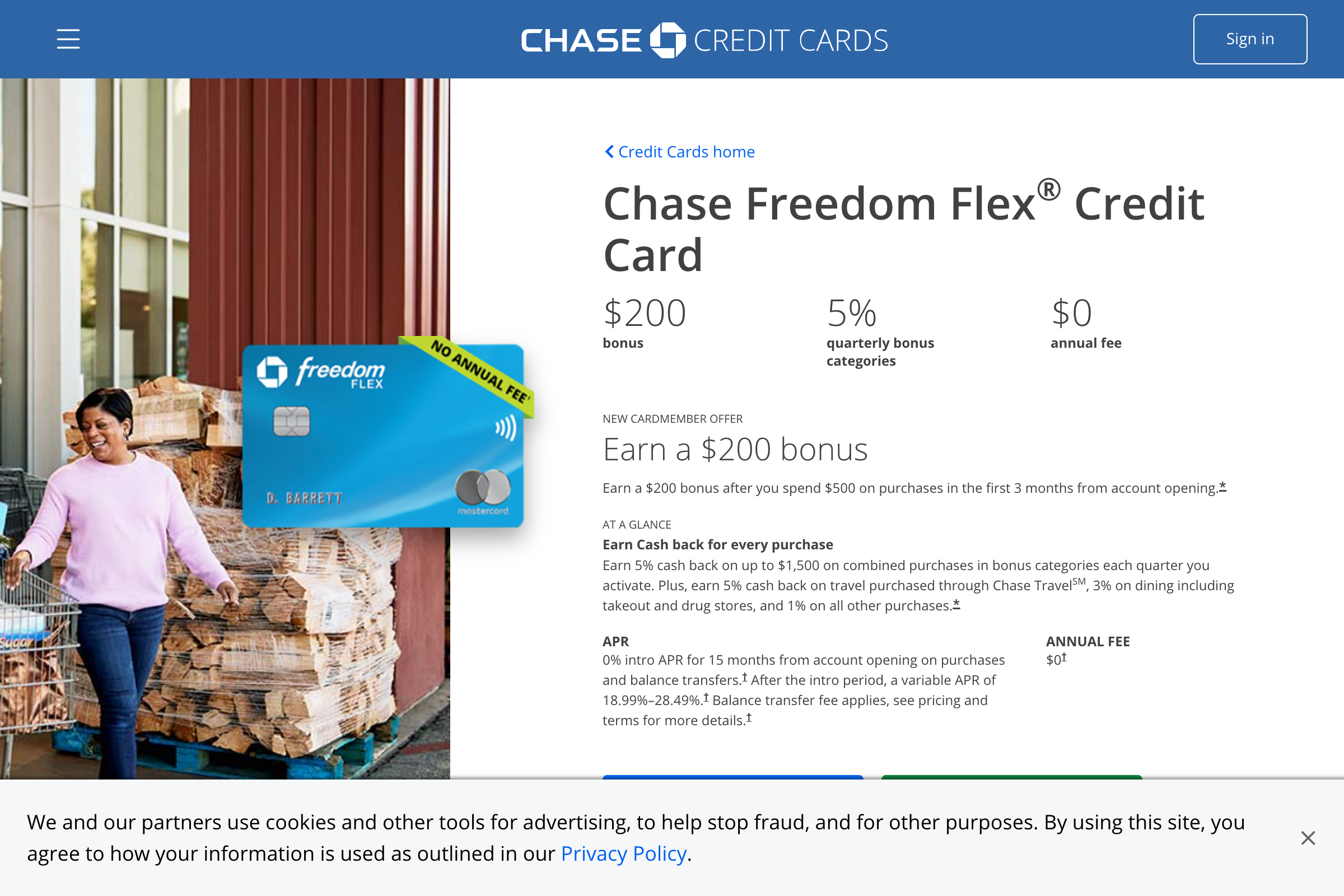

2. Chase Freedom Flex - Best for Rotating Categories

Chase Freedom Flex offers the highest potential rewards for entertainment spending with 5% cash back on rotating quarterly categories that frequently include streaming services, movie theaters, and entertainment purchases. Chase research shows entertainment categories appear 2-3 times per year.

Key Benefits:

- 5% cash back on rotating quarterly categories (up to $1,500 per quarter)

- 5% cash back on travel through Chase Ultimate Rewards

- 3% cash back on dining and drugstores

- 1% cash back on all other purchases

- No annual fee

Annual Fee: $0

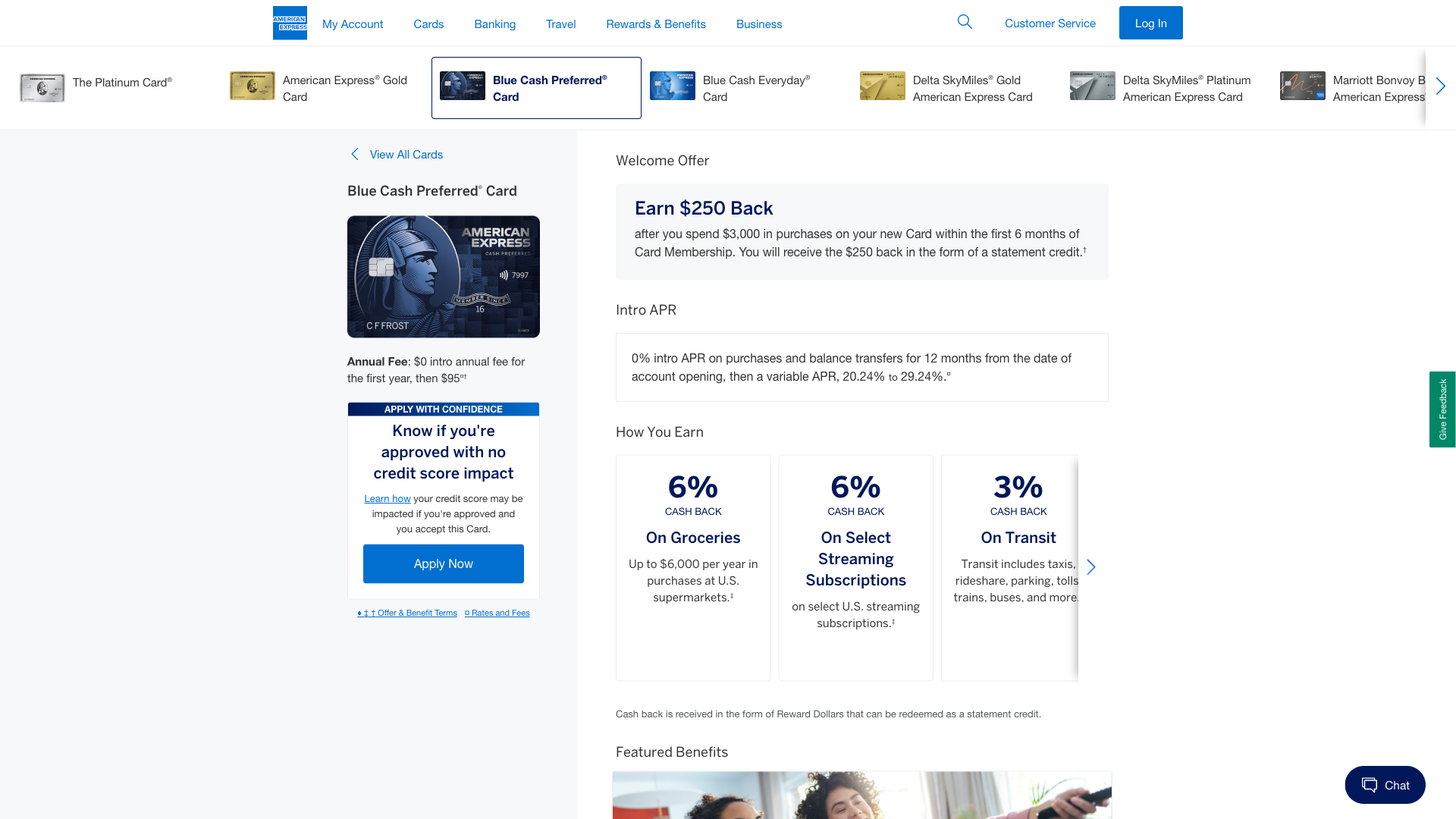

3. Blue Cash Preferred - Best for Streaming Services

American Express Blue Cash Preferred offers the highest streaming rewards available with 6% cash back on streaming services for the first year, then 3% cash back ongoing. American Express data shows cardholders earn an average of $240 annually on streaming purchases alone.

Key Benefits:

- 6% cash back on streaming services (first 12 months), then 3%

- 6% cash back at U.S. supermarkets (up to $6,000 per year)

- 3% cash back on transit and gas stations

- 1% cash back on all other purchases

- Covers all major streaming platforms

Annual Fee: $95

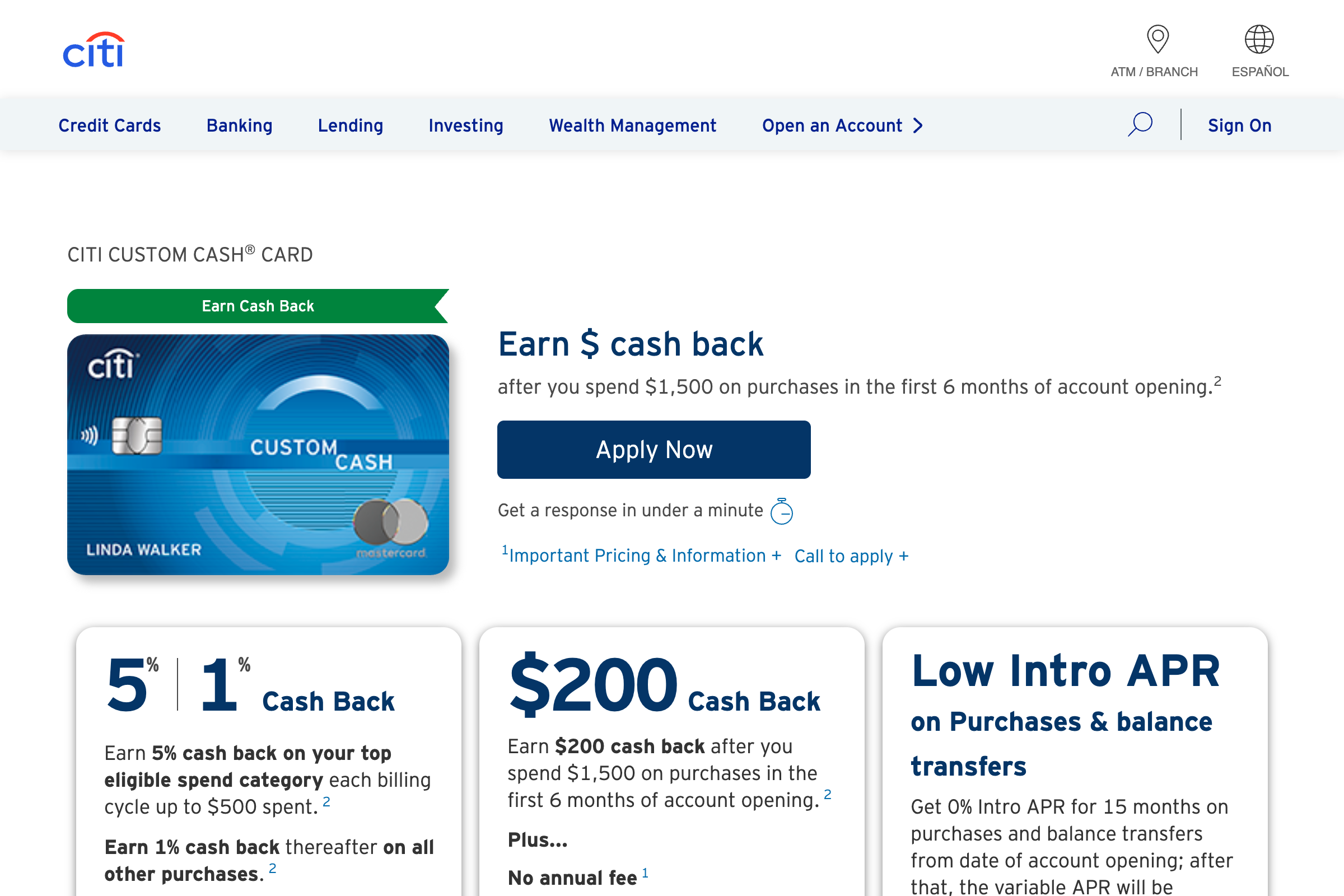

4. Citi Custom Cash - Best Customizable Entertainment Rewards

Citi Custom Cash automatically earns 5% cash back on your top eligible spending category each billing cycle, making it perfect for heavy entertainment spenders. Citi analysis shows entertainment often becomes users' top spending category, maximizing rewards.

Key Benefits:

- 5% cash back on top spending category each month (up to $500)

- 1% cash back on all other purchases

- No annual fee

- Automatically selects your highest category

- Entertainment often qualifies as top category

Annual Fee: $0

5. Discover it Cash Back - Best First-Year Value

Discover it Cash Back offers exceptional value for entertainment purchases with its Cashback Match feature that doubles all rewards earned in the first year. Discover research shows new cardholders earn an average of $600 in doubled rewards during their first year.

Key Benefits:

- 5% cash back on rotating quarterly categories (up to $1,500)

- 1% cash back on all other purchases

- Cashback Match: Double all cash back earned in first year

- No annual fee

- Entertainment categories appear multiple times yearly

Annual Fee: $0

How to Choose the Right Entertainment Credit Card

Selecting the best entertainment credit card depends on your streaming and entertainment spending patterns:

Analyze Your Entertainment Spending

Track your monthly spending on streaming services, movie theaters, concerts, and digital entertainment. If you spend over $200 monthly on entertainment, cards with bonus categories become more valuable than flat-rate cards. The Federal Reserve Economic Data shows the average household spends $2,400 annually on entertainment services.

Consider Streaming Service Coverage

Ensure your preferred streaming platforms qualify for bonus rewards. Most cards cover Netflix, Spotify, Disney+, Hulu, and Amazon Prime, but coverage can vary. Check the specific terms before applying. Bureau of Labor Statistics data shows households average 4.2 streaming subscriptions.

Evaluate Category Rotation vs. Fixed Rewards

Rotating category cards like Chase Freedom Flex offer higher rates but require quarterly activation. Fixed category cards like Capital One SavorOne provide consistent rewards without management. Choose based on your preference for hands-on optimization versus simplicity.

Quick Comparison

| Entertainment Credit Card | Annual Fee | Entertainment Rewards | Best For |

|---|---|---|---|

| Capital One SavorOne | $0 | 3% cash back | Consistent rewards |

| Chase Freedom Flex | $0 | 5% quarterly categories | Maximum rewards |

| Blue Cash Preferred | $95 | 6% streaming (1st year) | Heavy streamers |

| Citi Custom Cash | $0 | 5% top category | Flexible spending |

| Discover it Cash Back | $0 | 5% + first-year match | New cardholders |

Maximizing Your Entertainment Rewards

To get the most value from your entertainment credit card:

- Bundle subscriptions strategically: Use the same card for all entertainment purchases to maximize category spending

- Activate quarterly categories: Don't forget to activate rotating categories for Chase and Discover cards

- Consider gift card purchases: Buy entertainment gift cards during bonus categories to earn rewards year-round

- Track streaming service coverage: Ensure your services qualify before relying on bonus categories

- Time annual fee cards: Apply for cards like Blue Cash Preferred when you can maximize the first-year bonus

Entertainment Services That Qualify for Bonus Rewards

Most entertainment credit cards cover these popular services:

- Streaming Services: Netflix, Disney+, Hulu, HBO Max, Amazon Prime Video, Apple TV+, Spotify, Apple Music

- Gaming: PlayStation Network, Xbox Live, Nintendo eShop, Steam, Epic Games

- Movie Theaters: AMC, Regal, Cinemark, local theaters

- Concert & Event Tickets: Ticketmaster, StubHub, venue purchases

- Digital Content: iTunes, Google Play, Amazon digital purchases

Conclusion

The best entertainment credit card for 2025 depends on your streaming habits, entertainment spending, and reward preferences. Capital One SavorOne provides the most consistent entertainment rewards with no annual fee, while Chase Freedom Flex offers the highest potential returns for active card users.

With entertainment spending continuing to grow, having the right credit card can save hundreds of dollars annually on your streaming services, movie tickets, and digital purchases. Choose the card that best matches your entertainment lifestyle and spending patterns. For more credit card options, explore our comprehensive credit card reviews and banking guides.