Key Takeaways

- Choose cards based on your top spending categories to maximize rewards

- Premium dining cards like Amex Gold offer up to 4x points on restaurant purchases

- Cash back cards provide simplicity while travel cards offer higher redemption values

- Category-specific cards can earn 3-5% back in focused spending areas

- Consider annual fees only if rewards exceed the cost by at least $300+ annually

Introduction: Maximizing Credit Card Rewards by Spending Category

Choosing the right credit card in 2025 isn't just about finding any rewards card—it's about matching your spending habits to the cards that offer the highest returns in your specific categories. According to Federal Reserve data, the average American household spends over $60,000 annually, with dining, groceries, gas, and travel representing the largest discretionary categories.

This comprehensive guide analyzes the best credit cards for each major spending category in 2025, featuring detailed reviews of top performers and strategic advice for maximizing your rewards. Whether you're a frequent traveler, dining enthusiast, or everyday spender, we'll help you find the perfect card combination. For additional financial tools, explore our comprehensive credit card reviews and banking comparisons.

Best Credit Cards for Dining & Restaurants

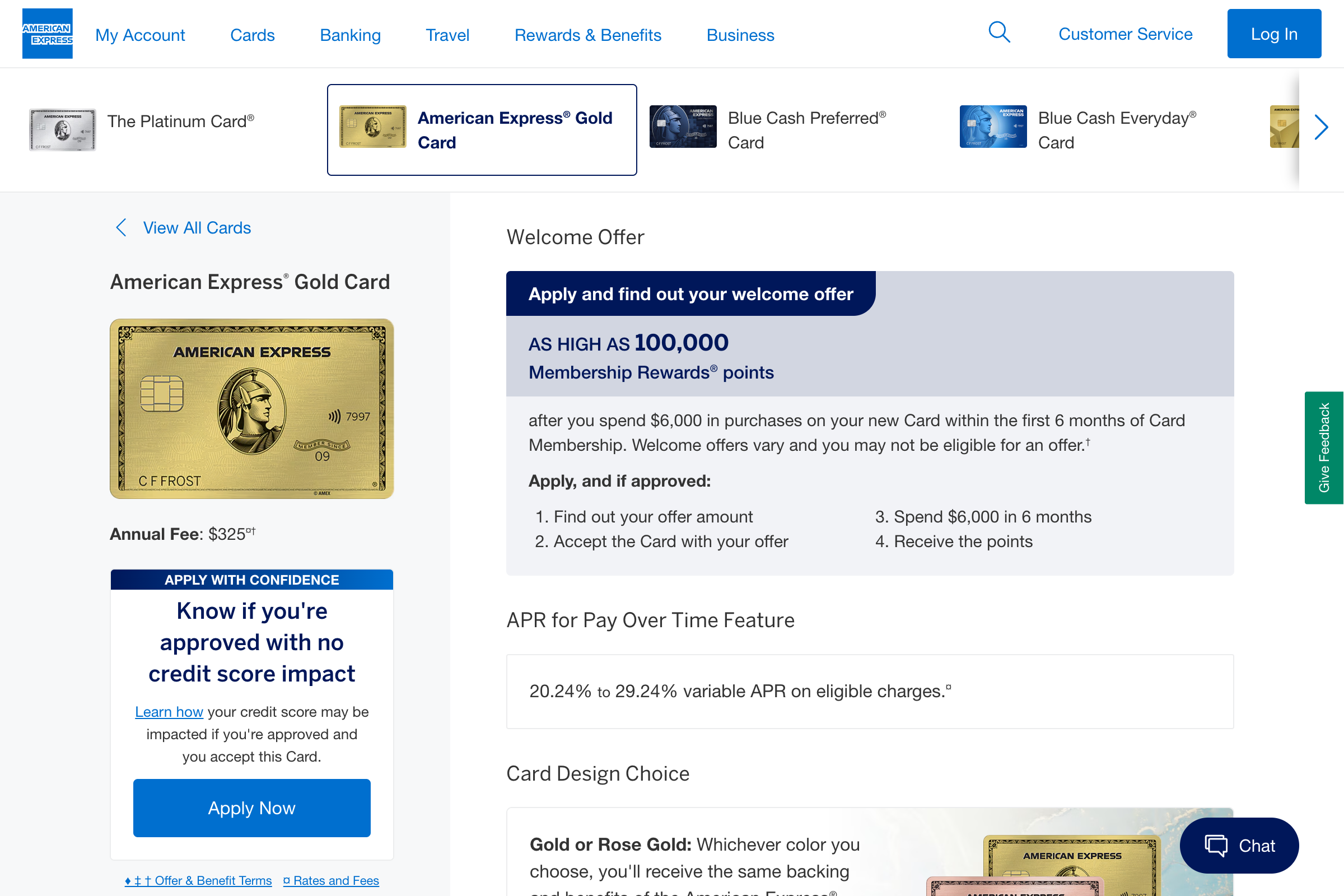

1. American Express Gold Card - Best Overall Dining Rewards

The American Express Gold Card dominates the dining category with an impressive 4x Membership Rewards points on dining at restaurants worldwide. This premium card also offers 4x points at U.S. supermarkets (up to $25,000 per year) and includes valuable dining credits that effectively reduce the annual fee. According to American Express data, cardholders earn an average of 60,000+ points annually on dining purchases alone.

Key Dining Benefits:

- 4x points on dining at restaurants worldwide

- 4x points at U.S. supermarkets (up to $25,000/year)

- $120 annual Uber Cash credit for food delivery

- $84 annual dining credit at participating restaurants

- No foreign transaction fees for international dining

- Membership Rewards points transfer to 20+ airline partners

Annual Fee: $250 (effectively $46 after credits)

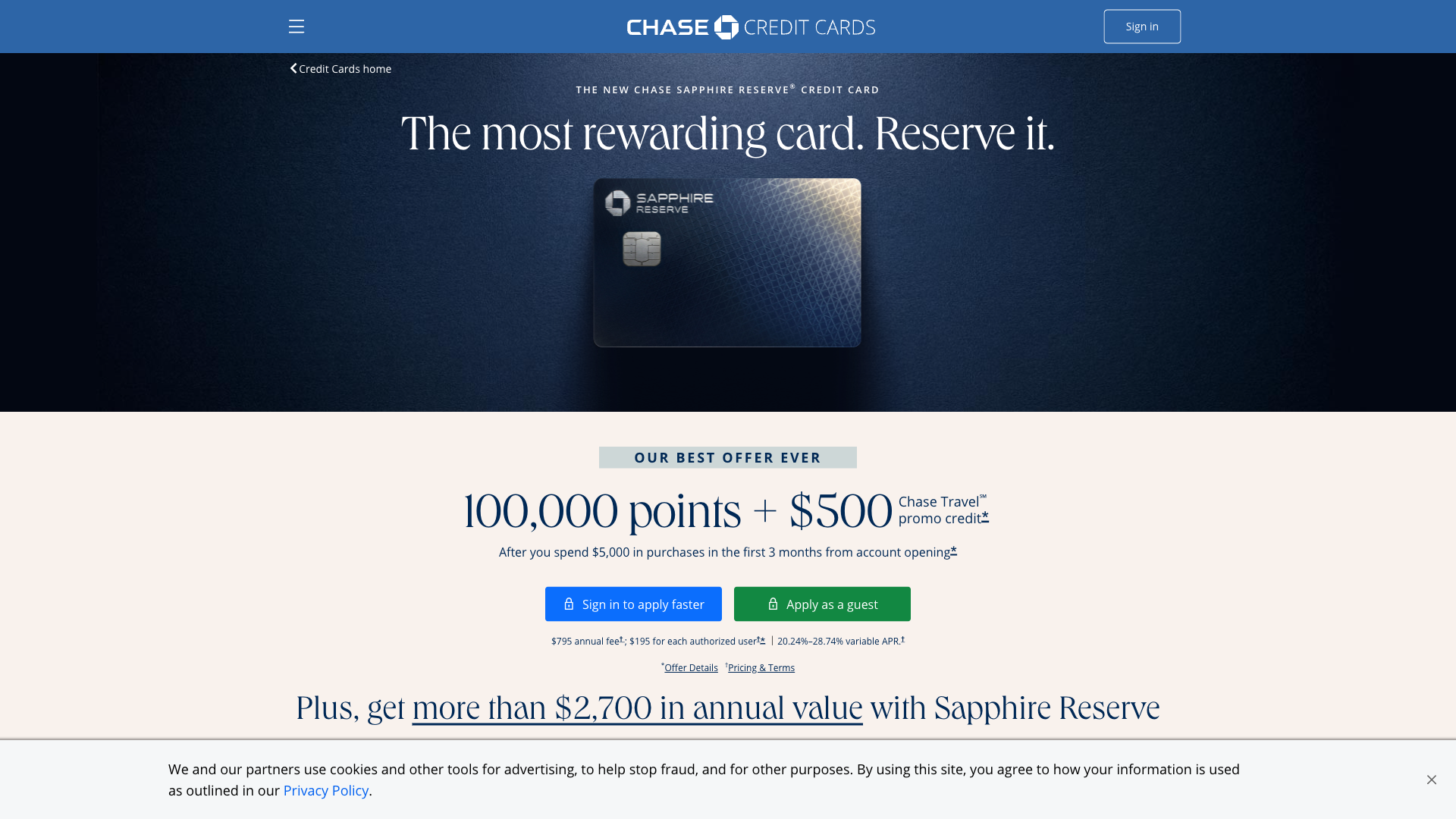

2. Chase Sapphire Reserve - Premium Dining with Travel Integration

The Chase Sapphire Reserve offers 3x Ultimate Rewards points on dining and travel, making it ideal for those who value both categories equally. The card's strength lies in its comprehensive travel benefits and the ability to redeem points at 1.5¢ each through Chase Travel℠. Chase reports that Reserve cardholders earn 25% more rewards than Preferred cardholders due to the higher earning rates.

Key Dining Benefits:

- 3x points on dining and travel purchases

- $300 annual travel credit (includes delivery services)

- Priority Pass Select membership with 1,300+ lounges

- 1.5¢ point value when redeemed through Chase Travel℠

- No foreign transaction fees

- DashPass complimentary membership through 2025

Annual Fee: $550 (effectively $250 after travel credit)

Best Credit Cards for Grocery Shopping

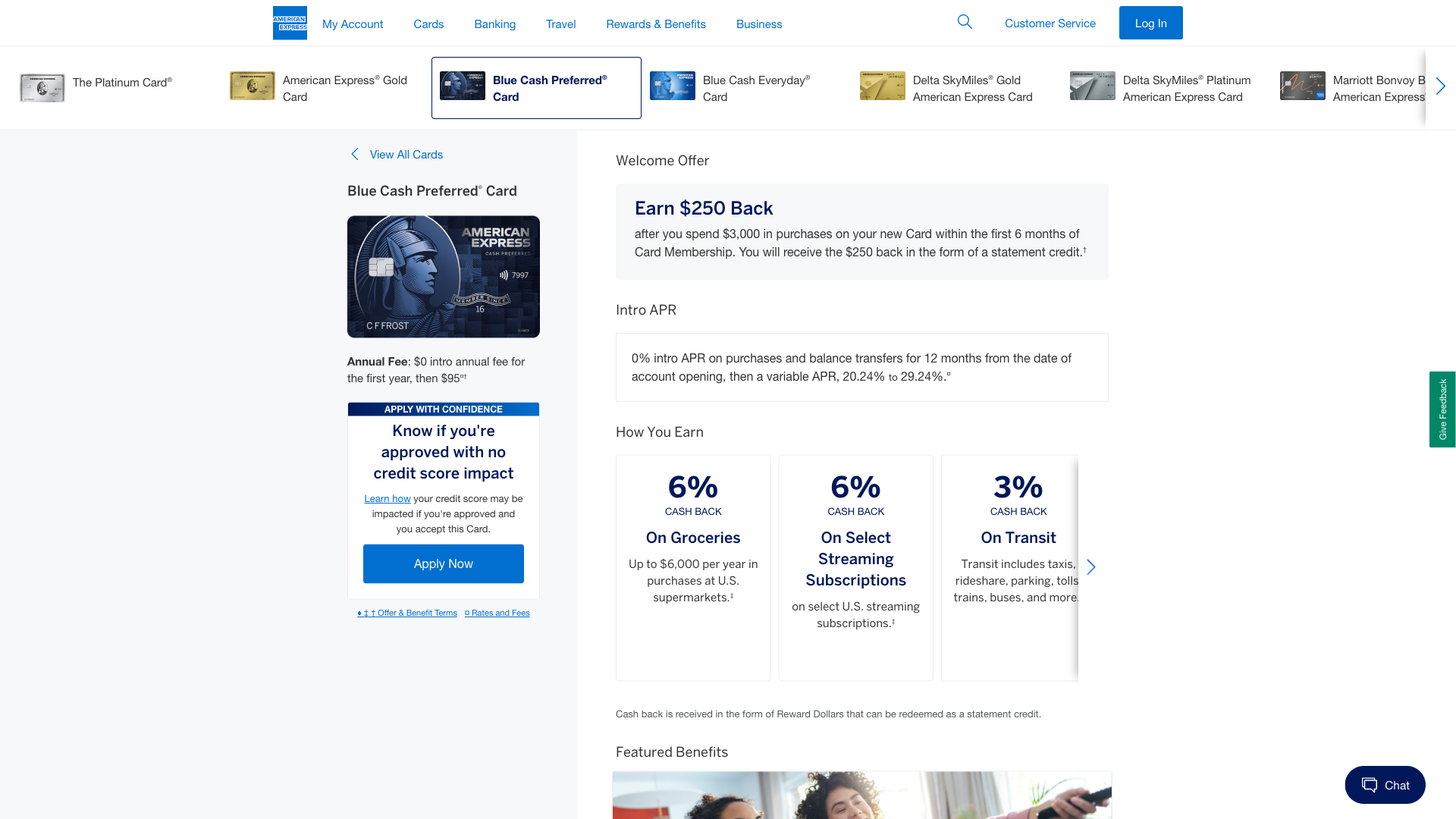

1. Blue Cash Preferred from American Express - Highest Grocery Rewards

The Blue Cash Preferred from American Express offers an industry-leading 6% cash back at U.S. supermarkets (up to $6,000 per year), making it the top choice for families who spend significantly on groceries. According to American Express data, the average cardholder earns $360 in grocery rewards annually, easily offsetting the modest annual fee.

Key Grocery Benefits:

- 6% cash back at U.S. supermarkets (up to $6,000/year)

- 6% cash back on select U.S. streaming subscriptions

- 3% cash back at U.S. gas stations

- 1% cash back on all other purchases

- $200 welcome bonus after spending $2,000 in 6 months

- 0% intro APR for 12 months on purchases

Annual Fee: $95

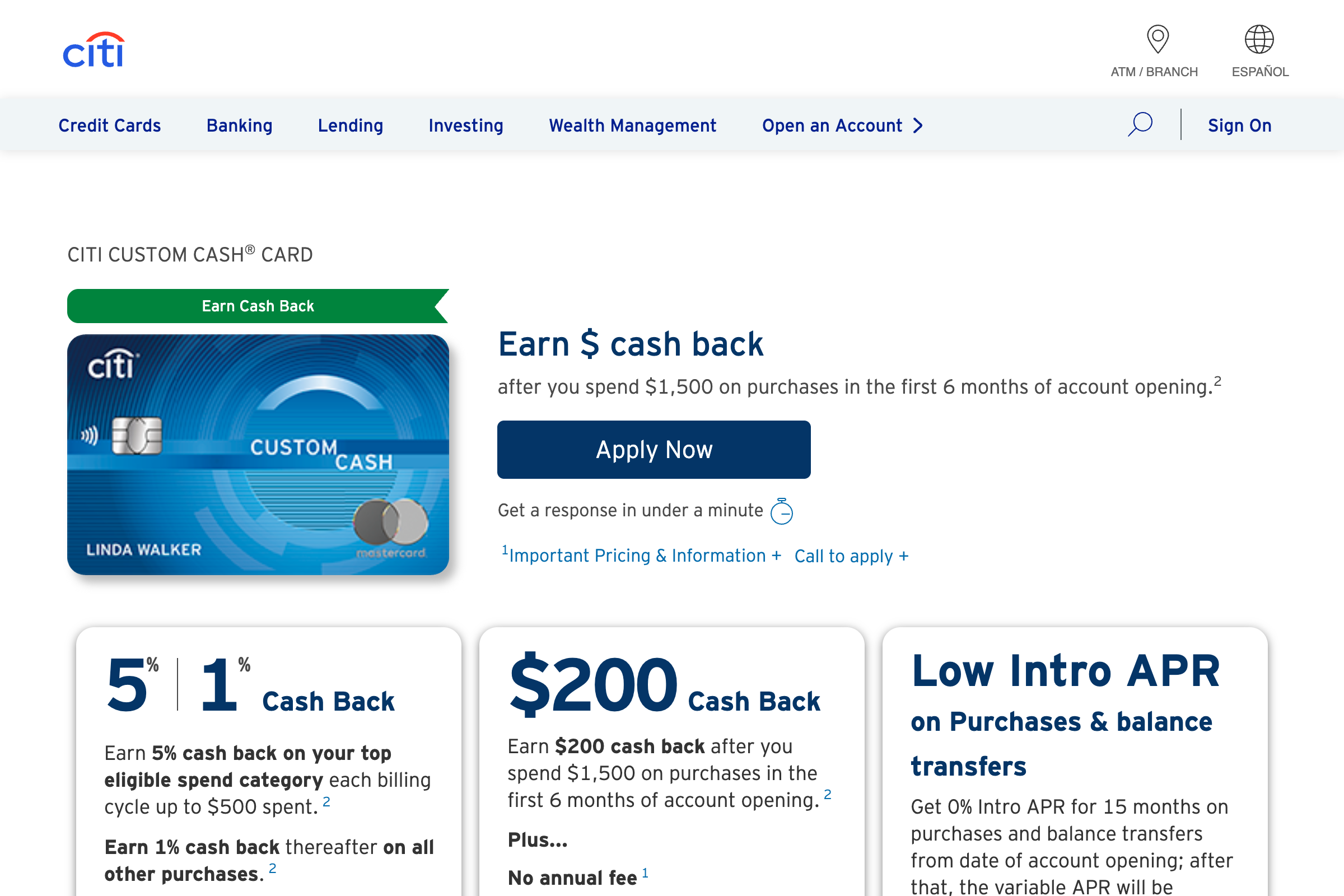

2. Citi Custom Cash Card - Flexible Category Selection

The Citi Custom Cash Card automatically awards 5% cash back on your top spending category each billing cycle (up to $500 spent), including groceries. This flexibility makes it perfect for households with varying monthly spending patterns. Citi research shows that 68% of cardholders maximize the 5% category each month through automated category selection.

Key Grocery Benefits:

- 5% cash back on your top spending category (up to $500/month)

- Automatic category detection and optimization

- 1% cash back on all other purchases

- $200 welcome bonus after spending $1,500 in 15 months

- No annual fee

- 21-month 0% intro APR on balance transfers

Annual Fee: $0

Best Credit Cards for Gas Purchases

1. Citi Custom Cash Card - Highest Gas Rewards

When gas is your top spending category, the Citi Custom Cash Card delivers an exceptional 5% cash back at gas stations (up to $500 spent per month). With no annual fee and automatic category optimization, it's the clear winner for gas rewards. According to Energy Information Administration data, the average American household spends $2,100+ annually on gasoline, making this card's rewards substantial.

2. Discover it Cash Back - Rotating Gas Quarters

The Discover it Cash Back offers 5% cash back on gas stations during rotating quarters (up to $1,500 per quarter), plus Discover matches all cash back earned in your first year. While not as consistent as the Citi Custom Cash, the first-year match makes it incredibly valuable for new cardholders.

Key Gas Benefits:

- 5% cash back on rotating categories (includes gas quarters)

- Discover matches all cash back earned in first year

- 1% cash back on all other purchases

- No annual fee

- $50 late fee forgiveness on first late payment

- Free FICO Score tracking

Annual Fee: $0

Best Credit Cards for Travel Rewards

1. Capital One Venture X Rewards - Best Overall Travel Value

The Capital One Venture X Rewards offers exceptional value with 2x miles on all purchases, a $300 annual travel credit, and 10x miles on hotels and rental cars booked through Capital One Travel. Capital One data shows cardholders save an average of $750 annually compared to other premium travel cards when considering all benefits and credits.

Key Travel Benefits:

- 2x miles on all purchases (no category restrictions)

- 10x miles on hotels and rental cars through Capital One Travel

- $300 annual travel credit

- Priority Pass Select membership with unlimited guests

- $100 annual credit for Global Entry/TSA PreCheck

- Transfer partners include 16 airlines and 3 hotel programs

Annual Fee: $395 (effectively $95 after credits)

2. Chase Sapphire Reserve - Premium Travel Experience

The Chase Sapphire Reserve remains the gold standard for premium travel cards, offering 3x points on travel and dining, comprehensive travel insurance, and access to Chase's extensive Ultimate Rewards transfer partner network. The card's $300 travel credit and Priority Pass membership provide significant value for frequent travelers.

Best Credit Cards for General Spending

1. Chase Freedom Unlimited - Best Flat-Rate Cash Back

The Chase Freedom Unlimited offers a simple 1.5% cash back on all purchases with no annual fee, making it perfect for everyday spending. The card also provides 5% on travel purchased through Chase Ultimate Rewards℠ and 3% on drugstore purchases. Chase data shows this card has one of the highest customer satisfaction rates due to its simplicity and reliability.

Key General Spending Benefits:

- 1.5% cash back on all purchases

- 5% on travel through Chase Ultimate Rewards℠

- 3% cash back on drugstore purchases

- $200 welcome bonus after spending $500 in 3 months

- No annual fee

- 15-month 0% intro APR on purchases

Annual Fee: $0

2. Capital One Venture Rewards - Simple Travel Earning

The Capital One Venture Rewards offers 2x miles on all purchases with no category restrictions, making it ideal for those who want travel rewards without managing spending categories. The card's transfer partners and straightforward earning structure appeal to travelers who prefer simplicity.

Credit Card Category Comparison Chart

| Category | Best Card | Reward Rate | Annual Fee | Best For |

|---|---|---|---|---|

| Dining | Amex Gold Card | 4x points | $250 | Restaurant enthusiasts |

| Groceries | Blue Cash Preferred | 6% cash back | $95 | Large families |

| Gas | Citi Custom Cash | 5% cash back | $0 | Daily commuters |

| Travel | Capital One Venture X | 2x miles + credits | $395 | Frequent travelers |

| General | Chase Freedom Unlimited | 1.5% cash back | $0 | Simple rewards |

Cash Back vs. Travel Rewards: Which Strategy Works Best?

The choice between cash back and travel rewards depends on your spending patterns, travel frequency, and preference for simplicity versus potential value maximization:

Choose Cash Back If:

- You prefer immediate, flexible rewards

- You travel less than 3-4 times per year

- You want simple redemption options

- You're debt averse and prefer guaranteed value

- You spend heavily in bonus categories like groceries or gas

Choose Travel Rewards If:

- You travel frequently for business or leisure

- You can take advantage of transfer partners

- You value premium travel experiences

- You're willing to learn redemption strategies

- You spend significantly on dining and travel

According to Bankrate research, travel rewards cards can provide 15-25% higher value than cash back cards for frequent travelers who optimize their redemptions, while cash back cards offer more consistent value for average spenders.

Strategic Credit Card Combinations for Maximum Rewards

Many savvy cardholders use multiple cards to maximize rewards across different categories:

The "Trifecta" Strategy

Combine three complementary cards to cover all major spending categories:

- Premium Dining/Travel Card: Amex Gold or Chase Sapphire Reserve

- Category-Specific Card: Citi Custom Cash for rotating high rewards

- Flat-Rate Card: Chase Freedom Unlimited for everything else

The "Simplified" Strategy

Use two cards that cover most spending without complexity:

- Primary Card: Capital One Venture X for all spending

- Category Card: Blue Cash Preferred for groceries

Annual Fee Analysis: When Premium Cards Make Sense

Premium cards with annual fees can provide exceptional value when the rewards and benefits exceed the fee by a significant margin:

Break-Even Analysis for Premium Cards:

- Amex Gold ($250 fee): Need $3,125 annual dining spend to break even vs. free cards

- Chase Sapphire Reserve ($550 fee): Break even with $300 travel credit + $8,750 in travel/dining

- Capital One Venture X ($395 fee): Break even with $300 travel credit + $1,900 in purchases

- Blue Cash Preferred ($95 fee): Need $1,583 in grocery spending to beat free alternatives

Credit Card Application Strategy for 2025

When applying for multiple cards to build a rewards portfolio, timing and strategy matter:

Application Best Practices

- Space applications 3-6 months apart to minimize credit score impact

- Apply for the most valuable card first (highest welcome bonus)

- Ensure you can meet minimum spending requirements naturally

- Consider Chase cards first due to their 5/24 rule restrictions

- Monitor credit score regularly and apply when scores are highest

According to Consumer Financial Protection Bureau guidance, multiple credit inquiries within a 14-45 day window are typically counted as a single inquiry for scoring purposes, though this applies more to mortgage/auto loans than credit cards.

Managing Multiple Credit Cards Effectively

Successfully managing multiple rewards cards requires organization and discipline:

Organization Tips

- Use a spreadsheet or app to track spending categories and limits

- Set up automatic payments to avoid late fees

- Review statements monthly for unauthorized charges

- Take advantage of mobile apps for real-time spending tracking

- Set calendar reminders for annual fee dates and benefit expirations

Common Pitfalls to Avoid

- Carrying balances to "earn more rewards" (interest negates rewards)

- Overspending to hit welcome bonus thresholds

- Ignoring annual fee renewal dates

- Not maximizing category spending limits

- Letting rewards expire unused

Future Trends in Credit Card Rewards for 2025

The credit card industry continues evolving with new trends shaping reward structures:

Emerging Trends

- Increased focus on sustainability and eco-friendly spending rewards

- Integration with digital wallets and contactless payments

- Personalized spending insights and automated optimization

- Expansion of "Pay with Points" options for everyday purchases

- Enhanced fraud protection and real-time spending alerts

Financial industry research indicates that 73% of credit card users now prioritize mobile app functionality and digital features when choosing cards, influencing how issuers design reward programs.

Conclusion: Building Your Perfect Credit Card Strategy

The best credit card strategy for 2025 depends on your unique spending patterns, travel habits, and reward preferences. Whether you choose the American Express Gold Card for dining excellence, the Citi Custom Cash for category flexibility, or the Capital One Venture X for comprehensive travel benefits, the key is matching cards to your lifestyle.

Start by analyzing your spending patterns over the past 12 months, identify your top categories, and select cards that maximize rewards in those areas. Remember that the best rewards card is worthless if you carry a balance—always pay in full and use rewards as a bonus, not a reason to overspend. For more detailed individual card reviews, explore our comprehensive credit card comparison tool and banking guides.