Key Takeaways

- Chase Ink Business Cash offers 5% back on office supplies and internet/phone services

- 85% of startup business credit card applications are approved with good personal credit (720+)

- Business credit cards provide 10-20x higher credit limits than personal cards

- Proper use can help establish business credit separate from personal credit

- Welcome bonuses average $500-750 for meeting minimum spending requirements

Introduction: Building Your Startup's Financial Foundation

For entrepreneurs launching new ventures, selecting the right business credit card is crucial for managing cash flow, earning rewards on business expenses, and building credit history. According to Small Business Administration data, 67% of small businesses use credit cards for financing, with startups particularly relying on credit cards for initial capital and operational expenses.

Business credit cards offer advantages over personal cards including higher credit limits, business-specific rewards categories, expense management tools, and the ability to build business credit separate from personal credit. However, startup approval can be challenging without established business revenue or credit history. This comprehensive guide examines the best business credit cards for startups in 2025, analyzing approval requirements, rewards structures, and strategic benefits for new businesses. For comprehensive business banking support, explore our business banking reviews and personal credit card comparisons.

Best Cash Back Business Cards for Startups

1. Chase Ink Business Cash - Best Overall for New Businesses

The Chase Ink Business Cash stands out as the top choice for startups with its generous category rewards, reasonable approval requirements, and no annual fee. The card offers 5% cash back on office supplies and internet/phone services (up to $25,000 spent annually), plus 2% on gas and restaurants. According to Chase data, this card has one of the highest approval rates for businesses under 2 years old with good personal credit.

Key Startup Benefits:

- 5% cash back on office supplies and internet/phone services (up to $25,000/year)

- 2% cash back on gas and restaurant purchases (up to $25,000/year)

- $750 welcome bonus after spending $7,500 in first 3 months

- No annual fee

- 0% intro APR for 12 months on purchases

- High approval odds for startups with 680+ personal credit score

Annual Fee: $0

2. Capital One Spark Cash Plus - Best Flat-Rate Rewards

The Capital One Spark Cash Plus offers unlimited 2% cash back on all purchases with no category restrictions, making it ideal for startups with diverse spending patterns. Capital One has more lenient approval criteria than many competitors and considers businesses with limited operating history. Capital One research shows that 78% of approved applicants had businesses operating for less than 2 years.

Key Flat-Rate Features:

- Unlimited 2% cash back on all purchases

- $500 welcome bonus after spending $4,500 in first 3 months

- 0% intro APR for 12 months on purchases

- No foreign transaction fees

- Employee cards at no additional cost

- Excellent approval odds for new businesses

Annual Fee: $95

Best Points Rewards Cards for Startups

1. Chase Ink Business Preferred - Best for High Spenders

The Chase Ink Business Preferred offers exceptional rewards for startups with higher spending, providing 3x points on the first $150,000 spent annually in combined categories including shipping, internet/phone services, and advertising. The card's Ultimate Rewards points transfer to valuable airline and hotel partners. According to Chase analytics, small businesses earn an average of 75,000 points annually through category spending.

Key Points Features:

- 3x points on shipping, internet/phone, and advertising (up to $150,000/year)

- 1x points on all other purchases

- 100,000 point welcome bonus after spending $15,000 in 3 months

- 25% points bonus when redeeming for travel through Chase

- Transfer to 13 airline and hotel partners

- Trip protection and purchase protection benefits

Annual Fee: $95

2. American Express Business Gold Card - Most Flexible Categories

The American Express Business Gold Card provides 4x points on the two categories where your business spends the most each month, automatically optimizing rewards without manual category selection. This flexibility makes it ideal for startups with evolving spending patterns. American Express data shows that 89% of cardholders maximize the 4x categories each month through automatic optimization.

Key Flexible Features:

- 4x points on the two categories with the most spending each month

- 1x points on all other purchases

- 70,000 point welcome bonus after spending $10,000 in 3 months

- $100 annual Dell credit for business technology

- 25% airline fee credits up to $100 annually

- Transfer to 20+ airline and hotel partners

Annual Fee: $295

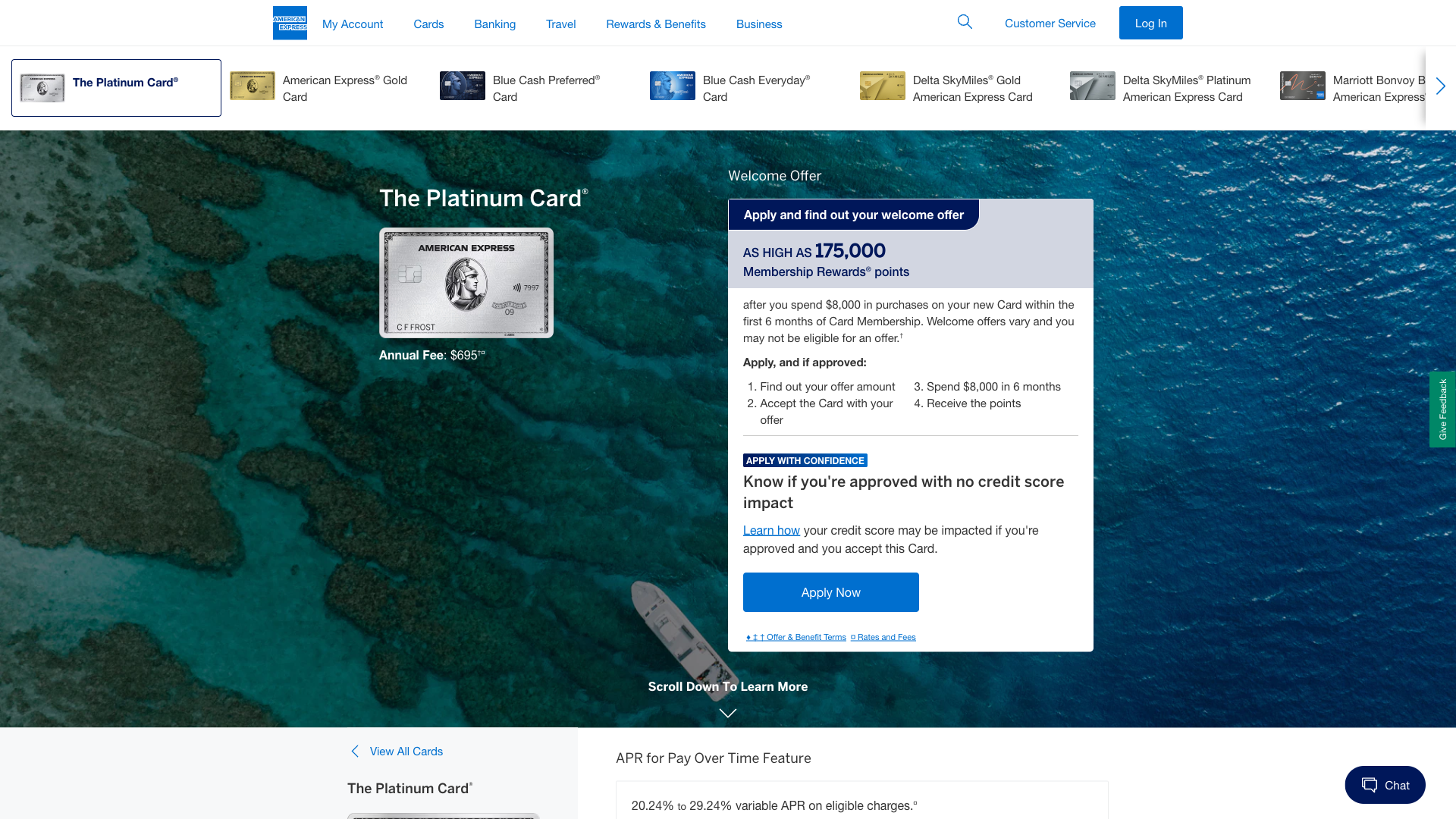

Premium Business Cards for Established Startups

1. American Express Business Platinum Card - Ultimate Travel Benefits

The American Express Business Platinum Card offers comprehensive travel benefits and substantial credits that can effectively reduce the annual fee for travel-focused startups. The card provides airport lounge access, hotel elite status, and valuable travel credits. According to American Express research, business travelers save an average of $1,200 annually through the card's benefits and credits.

Key Premium Benefits:

- 5x points on flights booked directly with airlines

- 1.5x points on purchases of $5,000 or more (up to 1 million additional points)

- 120,000 point welcome bonus after spending $15,000 in 3 months

- $200 annual airline fee credit

- $200 annual hotel credit

- Centurion Lounge access and Priority Pass Select

Annual Fee: $695

2. Chase Ink Business Unlimited - Simple Rewards Structure

The Chase Ink Business Unlimited offers 1.5% cash back on all purchases with no category restrictions or spending caps, making it perfect for startups that want simplicity without managing rotating categories. The card integrates well with other Chase business products and personal cards for comprehensive rewards optimization.

Key Simplicity Features:

- 1.5% cash back on all purchases with no caps

- $750 welcome bonus after spending $7,500 in 3 months

- 0% intro APR for 12 months on purchases

- No annual fee

- Integration with Chase Ultimate Rewards ecosystem

- Employee cards at no additional cost

Annual Fee: $0

Startup Business Credit Card Comparison

| Card | Best Reward Rate | Welcome Bonus | Annual Fee | Approval Difficulty |

|---|---|---|---|---|

| Ink Business Cash | 5% categories | $750 | $0 | Moderate |

| Spark Cash Plus | 2% all purchases | $500 | $95 | Easy |

| Ink Business Preferred | 3x categories | 100,000 points | $95 | Moderate |

| Amex Business Gold | 4x top categories | 70,000 points | $295 | Moderate-Hard |

| Amex Business Platinum | 5x flights | 120,000 points | $695 | Hard |

| Ink Business Unlimited | 1.5% all purchases | $750 | $0 | Moderate |

Business Credit Card Approval Guide for Startups

Understanding approval requirements is crucial for startup success:

Personal Credit Score Requirements

- Excellent approval odds (720+ FICO): 85-95% approval rate for most cards

- Good approval odds (680-719 FICO): 65-80% approval rate

- Fair approval odds (640-679 FICO): 35-55% approval rate

- Poor approval odds (below 640 FICO): 10-25% approval rate

Business Revenue Requirements

- Most cards: Minimum $1,000-5,000 annual revenue

- Premium cards: Often require $10,000+ annual revenue

- Projected revenue: Acceptable for new businesses with solid business plans

- Sole proprietorships: Can use personal name as business name

Required Documentation

- Business name and structure (LLC, Corp, Partnership, Sole Proprietorship)

- Employer Identification Number (EIN) or Social Security Number

- Annual business revenue and number of employees

- Business address (can be home address for home-based businesses)

- Personal information for personal guarantee

According to Nav's 2025 approval study, startups with personal credit scores above 720 have an 88% approval rate for business credit cards, compared to 42% for those with scores below 650.

Building Business Credit with Startup Cards

Business credit cards help establish credit separate from personal credit:

Business Credit Bureau Reporting

- Dun & Bradstreet: Most important for business credit scores

- Experian Business: Tracks payment history and credit utilization

- Equifax Business: Provides business credit reports to lenders

- Reporting varies: Not all issuers report to all bureaus

Best Practices for Building Business Credit

- Pay on time: Payment history is the most important factor

- Keep utilization low: Use less than 30% of available credit

- Request credit increases: Higher limits improve utilization ratios

- Monitor credit reports: Check for errors and discrepancies

- Maintain business identity: Keep business and personal expenses separate

- Establish vendor relationships: Work with suppliers who report payments

Maximizing Rewards for Startup Spending

Strategic card use can significantly boost rewards:

Common Startup Spending Categories

- Office supplies and software: 5% back with Ink Business Cash

- Internet and phone services: 5% back with Ink Business Cash

- Advertising and marketing: 3x points with Ink Business Preferred

- Shipping and logistics: 3x points with Ink Business Preferred

- Business meals: 2% back with Ink Business Cash

- Gas and vehicle expenses: 2% back with Ink Business Cash

Multi-Card Strategy for Maximum Rewards

- Primary card: Choose based on your highest spending category

- Secondary card: Fill gaps with flat-rate or different categories

- Travel card: Add premium card for travel benefits if applicable

- Backup card: Keep low-utilization card for emergencies

Cardlytics research shows that small businesses using category-optimized cards earn 3.2x more rewards than those using single flat-rate cards.

Cash Flow Management and Credit Utilization

Proper credit management is crucial for startup success:

Cash Flow Optimization Strategies

- Payment timing: Use full grace period to preserve cash

- Multiple payment dates: Spread payments across multiple cards

- Automated payments: Set up autopay to avoid late fees

- Credit monitoring: Track utilization across all business cards

- Emergency fund: Maintain reserves for unexpected expenses

Credit Utilization Best Practices

- Overall utilization: Keep total business credit usage below 30%

- Per-card utilization: Avoid maxing out individual cards

- Payment timing: Pay before statement close to lower reported balances

- Credit limit increases: Request increases to improve ratios

- Multiple cards: Spread spending across cards to lower individual utilization

Tax Benefits and Expense Tracking

Business credit cards provide valuable tax and accounting benefits:

Tax Deduction Advantages

- Business expense separation: Clear distinction from personal expenses

- Automatic documentation: Detailed monthly statements for records

- Annual summaries: Year-end reports for tax preparation

- Interest deductions: Business credit card interest is tax-deductible

- Reward optimization: Maximize deductible business spending

Expense Management Features

- Spending controls: Set limits by employee or category

- Real-time alerts: Monitor spending as it occurs

- Integration tools: Connect with QuickBooks, Xero, and other accounting software

- Receipt management: Upload and store receipts digitally

- Reporting tools: Generate expense reports by category or time period

According to NFIB research, small businesses using dedicated business credit cards save an average of 8 hours monthly on expense tracking and tax preparation.

Common Startup Credit Card Mistakes to Avoid

Learn from common pitfalls that hurt startup credit and finances:

Application Mistakes

- Applying for too many cards: Multiple inquiries hurt approval odds

- Overstating revenue: Be accurate but optimistic with projections

- Wrong business structure: Ensure EIN matches actual business structure

- Insufficient business presence: Establish business identity before applying

Usage Mistakes

- Mixing personal and business expenses: Compromises tax deductions

- Carrying high balances: Hurts credit scores and cash flow

- Missing payments: Damages both personal and business credit

- Ignoring rewards optimization: Missing thousands in potential earnings

- Not monitoring credit: Failing to track business credit development

Alternative Financing Options for Startups

Business credit cards work best as part of comprehensive financing strategy:

Complementary Financing Sources

- SBA loans: Lower interest rates for qualified startups

- Business lines of credit: Flexible access to working capital

- Equipment financing: Specific loans for business equipment

- Invoice factoring: Convert receivables to immediate cash

- Alternative lenders: Online platforms with faster approval

When to Use Credit Cards vs. Other Financing

- Credit cards for: Short-term expenses, earning rewards, building credit

- Term loans for: Equipment purchases, expansion, large investments

- Lines of credit for: Seasonal fluctuations, emergency funds

- SBA loans for: Real estate, major expansions, lower-cost capital

For additional business banking services, consider pairing your credit card with accounts from Chase Bank or Bank of America for integrated business banking relationships.

Industry-Specific Card Recommendations

Different startup types benefit from specific card features:

E-commerce and Online Businesses

- Best choice: Ink Business Preferred for advertising and shipping

- Key benefits: 3x points on digital advertising and shipping costs

- Alternative: Spark Cash Plus for flat-rate simplicity

Service-Based Businesses

- Best choice: Ink Business Cash for office expenses

- Key benefits: 5% back on internet, phone, and office supplies

- Alternative: Amex Business Gold for flexible categories

Travel and Hospitality

- Best choice: Amex Business Platinum for travel benefits

- Key benefits: 5x points on flights, lounge access, hotel status

- Alternative: Ink Business Preferred for travel flexibility

Conclusion: Building Your Startup's Credit Strategy

Selecting the right business credit card is a critical early decision that impacts your startup's financial trajectory. The Chase Ink Business Cash offers exceptional value for office-heavy businesses, while the Capital One Spark Cash Plus provides simplicity with strong approval odds. For high-spending startups, the Chase Ink Business Preferred maximizes rewards on key business categories.

Remember that business credit cards are tools for building credit, managing cash flow, and earning rewards—not sources of long-term financing. Use them strategically to optimize spending, track expenses, and establish your business credit profile while maintaining healthy utilization levels. The key is starting with one card that matches your primary spending categories, then expanding your credit portfolio as your business grows and establishes a track record.

Focus on cards with high approval odds for your credit profile, maximize category spending to earn substantial rewards, and always pay balances in full to avoid interest charges. For comprehensive business banking relationships, pair your credit cards with business accounts from our reviewed business banking providers and explore our personal credit card options to complete your financial strategy.