Key Takeaways

- YNAB leads with zero-based budgeting and powerful goal tracking for $14.99/month

- PocketGuard uses AI to prevent overspending and offers free basic features

- Mint provides comprehensive free budgeting with credit score monitoring and bill tracking

- Personal Capital excels in investment tracking and retirement planning for high-net-worth users

Introduction: The AI-Powered Finance Revolution in 2025

The personal finance management landscape has been transformed by AI technology in 2025, with smart algorithms now capable of analyzing spending patterns, predicting financial outcomes, and providing personalized recommendations. According to Federal Reserve Economic Data, AI-powered finance apps have grown by 340% since 2020, with over 200 million Americans now using intelligent budgeting and investment tools.

In this comprehensive guide, we'll analyze the best AI-powered personal finance tools available in 2025, examining their smart features, pricing, and how they can revolutionize your money management. Whether you're looking to automate budgeting, optimize investments, or gain insights into spending habits, we'll help you find the perfect AI assistant for your financial goals. For more fintech resources, explore our banking guides and credit card reviews.

Our Top Picks for 2025

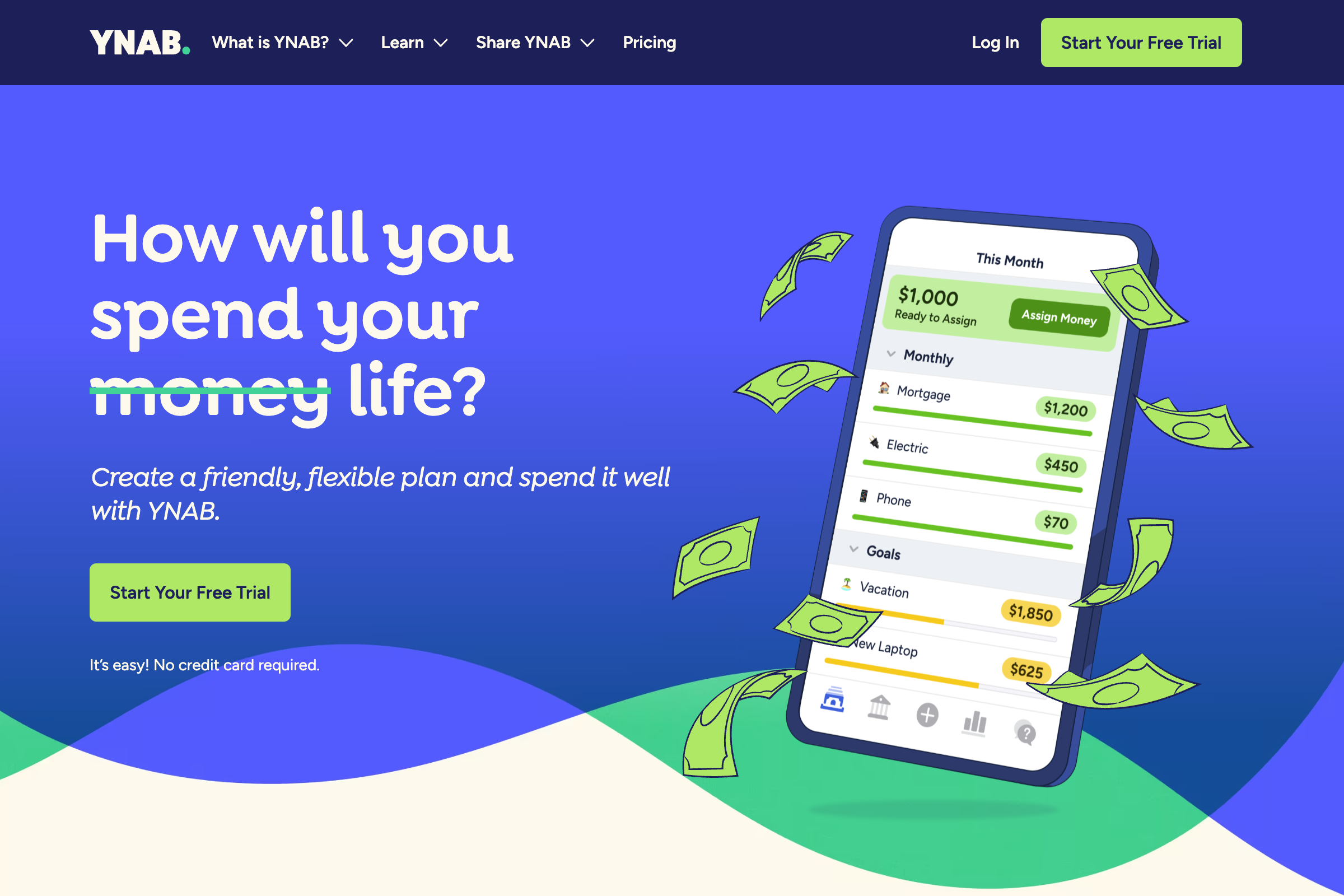

1. YNAB (You Need A Budget) - Best for Zero-Based Budgeting

YNAB revolutionizes budgeting with its proven zero-based methodology and AI-powered insights. Every dollar gets assigned a job before you spend it, helping users break the paycheck-to-paycheck cycle. According to YNAB's user survey, new users save an average of $600 in their first two months and $6,000 in their first year.

Key Benefits:

- Zero-based budgeting methodology

- Real-time sync across all devices

- AI-powered spending insights and trends

- Goal tracking with timeline predictions

- Direct bank account connectivity

Cost: $14.99/month or $109/year

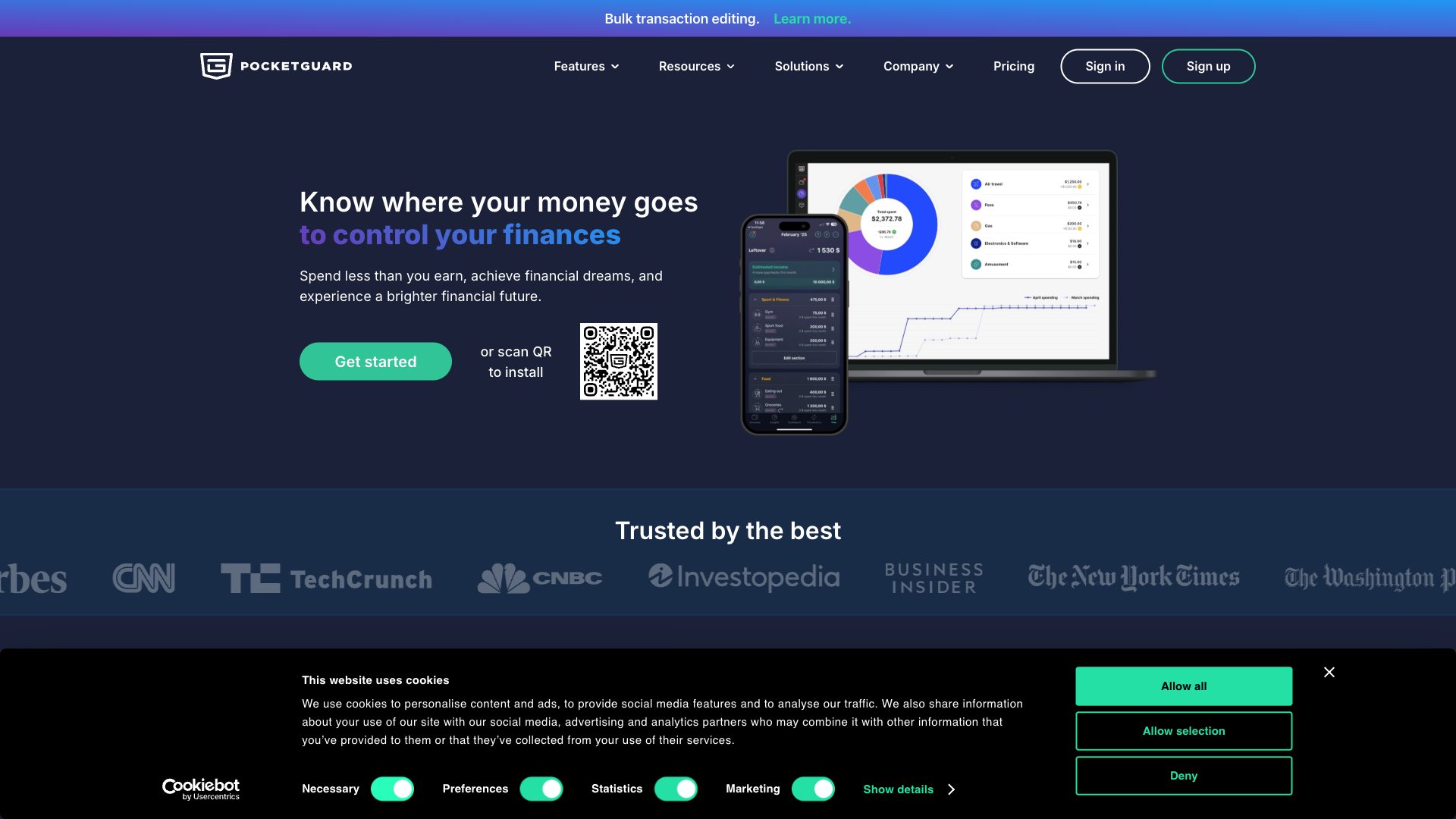

2. PocketGuard - Best AI Overspending Prevention

PocketGuard uses advanced AI algorithms to prevent overspending by analyzing your income, bills, and goals to show exactly how much you have left to spend. Its unique "In My Pocket" feature uses machine learning to predict upcoming expenses and optimize your spending decisions. PocketGuard research shows users reduce overspending by 73% within the first month.

Key Benefits:

- AI-powered overspending prevention

- Automatic bill tracking and reminders

- Smart subscription management

- Personalized saving opportunities

- Free basic features with premium upgrades

Cost: Free basic, $7.99/month premium

3. Mint - Best Free AI-Powered Platform

Mint by Intuit offers comprehensive AI-driven financial management completely free. With over 25 million users, Mint's machine learning algorithms categorize transactions, identify trends, and provide personalized recommendations for saving money. Intuit data shows Mint users save an average of $1,000 annually through its AI-powered insights and bill negotiation features.

Key Benefits:

- Completely free with premium features

- AI-powered transaction categorization

- Credit score monitoring and alerts

- Bill tracking and payment reminders

- Investment tracking and portfolio analysis

Cost: Free

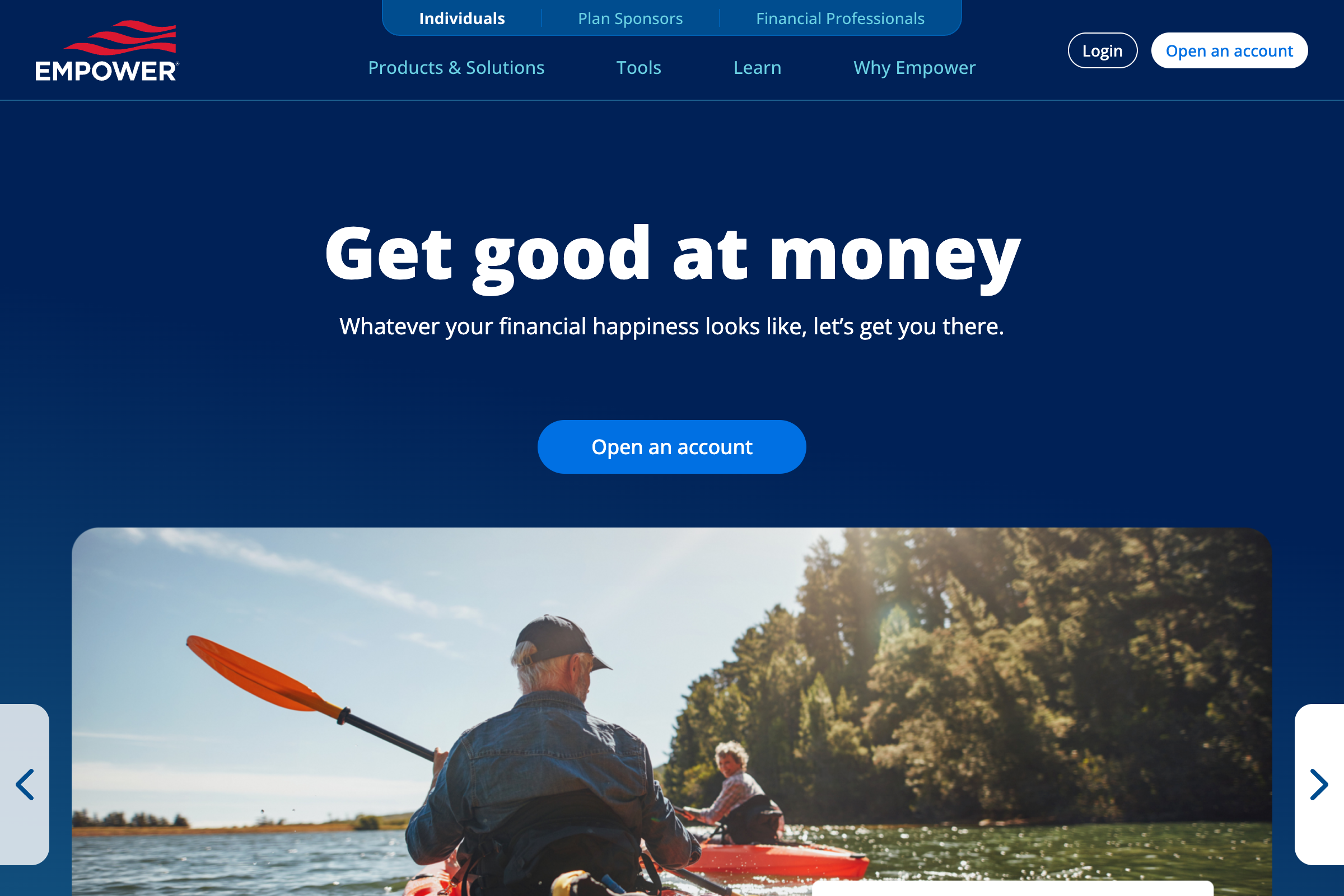

4. Personal Capital - Best for Investment AI and Wealth Management

Personal Capital combines AI-powered investment tracking with professional wealth management services. Their sophisticated algorithms analyze portfolio performance, optimize asset allocation, and provide retirement planning projections. According to Personal Capital research, users with managed accounts see 2.91% higher annual returns compared to self-directed investors.

Key Benefits:

- Advanced AI investment analysis

- Free financial dashboard and tools

- Professional wealth management services

- Retirement planning with AI projections

- Fee analyzer for investment accounts

Cost: Free tools, 0.49%-0.89% for managed accounts

5. Tiller - Best AI-Powered Spreadsheet Solution

Tiller combines the power of AI automation with the flexibility of spreadsheets, automatically updating your financial data in Google Sheets or Excel. Perfect for users who want granular control over their financial tracking while benefiting from AI-powered transaction categorization and insights. Tiller surveys show 92% of users prefer their spreadsheet approach over traditional apps for detailed financial analysis.

Key Benefits:

- AI-automated transaction imports to spreadsheets

- Customizable templates and workflows

- Works with Google Sheets and Excel

- Advanced reporting and analysis capabilities

- Bank-level security with automated updates

Cost: $79/year

How to Choose the Right AI Finance Tool

Selecting the best AI-powered finance tool depends on your specific financial goals and preferences:

Assess Your Financial Complexity

Simple budgeters should start with PocketGuard or Mint's free offerings, while those with complex investment portfolios benefit from Personal Capital's advanced AI analysis. According to Federal Reserve surveys, 67% of Americans have less than $1,000 in savings, making basic budgeting tools the priority for most users.

Consider Your Learning Style

YNAB requires a learning curve but provides the most comprehensive financial education, while Mint offers instant setup with AI doing the heavy lifting. Users preferring spreadsheet control should consider Tiller's hybrid approach. Consumer Financial Protection Bureau data shows that users who engage with educational content save 40% more effectively.

Evaluate AI Features vs. Cost

Free tools like Mint offer basic AI categorization, while premium services provide predictive analytics and personalized recommendations. Consider whether advanced AI features justify the monthly cost based on your potential savings. Check our banking guides for more money-saving strategies.

Quick Comparison

| AI Finance Tool | Price | Main AI Feature | Best For |

|---|---|---|---|

| YNAB | $14.99/month | Goal tracking predictions | Serious budgeters |

| PocketGuard | Free/$7.99 | Overspending prevention | Preventing overspending |

| Mint | Free | Transaction categorization | Comprehensive free tool |

| Personal Capital | Free/0.49-0.89% | Investment AI analysis | Wealth management |

| Tiller | $79/year | Automated spreadsheets | Spreadsheet lovers |

Essential AI Finance Features to Look For

When evaluating AI-powered finance tools, prioritize these key capabilities:

- Smart Transaction Categorization: AI should automatically categorize expenses with 95%+ accuracy

- Predictive Analytics: Look for tools that forecast cash flow and identify spending patterns

- Personalized Insights: The best AI adapts to your habits and provides custom recommendations

- Goal-Based Planning: AI should help optimize savings strategies for specific financial goals

- Security & Privacy: Ensure bank-level encryption and transparent data usage policies

Common AI Finance Tool Mistakes to Avoid

Learn from common user experiences:

- Not connecting all accounts: AI needs complete data to provide accurate insights

- Ignoring manual categorization: Help train the AI by correcting misclassified transactions

- Setting unrealistic goals: AI recommendations work best with achievable targets

- Switching tools too quickly: Give AI time to learn your patterns (typically 2-3 months)

Conclusion

The best AI-powered personal finance tool for 2025 depends on your financial complexity and goals. YNAB remains unmatched for serious budgeters willing to invest in comprehensive financial education, while Mint provides excellent free AI features for most users. PocketGuard excels at preventing overspending, Personal Capital leads in investment AI analysis, and Tiller offers the perfect blend of automation and customization.

With AI technology revolutionizing personal finance, there's never been a better time to leverage these tools for achieving your financial goals. Start with a free option like Mint or PocketGuard to experience AI-powered insights, then consider upgrading based on your specific needs. The key is consistency—the more you use these tools, the smarter they become at helping you build wealth. For more financial technology insights, explore our banking guides and credit card reviews.