Key Takeaways

- Ally Bank leads with advanced Savings Buckets and spending insights that automatically categorize transactions

- Chime offers real-time spending notifications and automatic savings with Save When You Spend feature

- SoFi Money provides comprehensive budgeting tools with spending tracking and goal setting at no cost

- Capital One 360 includes advanced spending analysis and customizable budget alerts

Introduction: The Smart Banking Revolution in 2025

The modern banking app has evolved far beyond simple account checking and transfers. In 2025, the best banking apps integrate powerful budgeting tools, automatic savings features, and real-time spending insights that help users take control of their finances. According to Federal Reserve research, 78% of Americans who use banking apps with built-in budgeting tools report better financial awareness and increased savings rates.

In this comprehensive guide, we'll analyze the best banking apps with integrated budgeting tools in 2025, examining their features, automation capabilities, spending insights, and goal-setting functionality. Whether you're looking to track expenses, build emergency funds, or optimize your spending habits, we'll help you find the perfect banking app to achieve your financial goals. For more banking options, explore our complete banking reviews.

Our Top Picks for 2025

1. Ally Bank - Best Overall Budgeting Integration

Ally Bank leads the banking app market with its innovative Savings Buckets feature and comprehensive spending insights. Their app automatically categorizes transactions, tracks spending trends, and provides personalized recommendations for better financial habits. According to Ally research, users who actively use their budgeting tools save 23% more than those who don't.

Key Budgeting Features:

- Savings Buckets for goal-based saving with visual progress tracking

- Automatic transaction categorization and spending analysis

- Monthly spending summaries with trend insights

- Customizable budget alerts and overspending notifications

- Round-up savings with Surprise Savings feature

- Integration with popular budgeting apps like Mint and YNAB

Monthly Fee: $0 | APY: 4.00%

2. Chime - Best for Automatic Budgeting

Chime revolutionizes budgeting with its automatic savings features and real-time spending notifications. The app's Save When You Spend feature rounds up purchases and automatically saves the change, while SpotMe provides overdraft protection without fees. Chime data shows members save an average of $2,000 annually through automated features.

Key Budgeting Features:

- Save When You Spend automatic round-up savings

- Real-time spending notifications and balance updates

- Automatic savings with Save When You Get Paid feature

- Spending categorization with monthly breakdowns

- SpotMe overdraft protection up to $200 with no fees

- Credit monitoring and financial health insights

Monthly Fee: $0 | APY: 2.00%

3. SoFi Money - Best for Comprehensive Financial Planning

SoFi Money combines banking with comprehensive financial planning tools, offering budgeting features alongside investment tracking and financial goal planning. Their app provides detailed spending insights, debt payoff calculators, and personalized financial advice. SoFi research shows users who utilize their budgeting tools achieve financial goals 40% faster.

Key Budgeting Features:

- Comprehensive spending tracking with detailed categorization

- Financial goal setting with timeline and progress tracking

- Integration with SoFi Invest for complete financial picture

- Debt payoff calculator and optimization strategies

- Monthly financial health score and improvement tips

- Free access to certified financial planners

Monthly Fee: $0 | APY: 4.20%

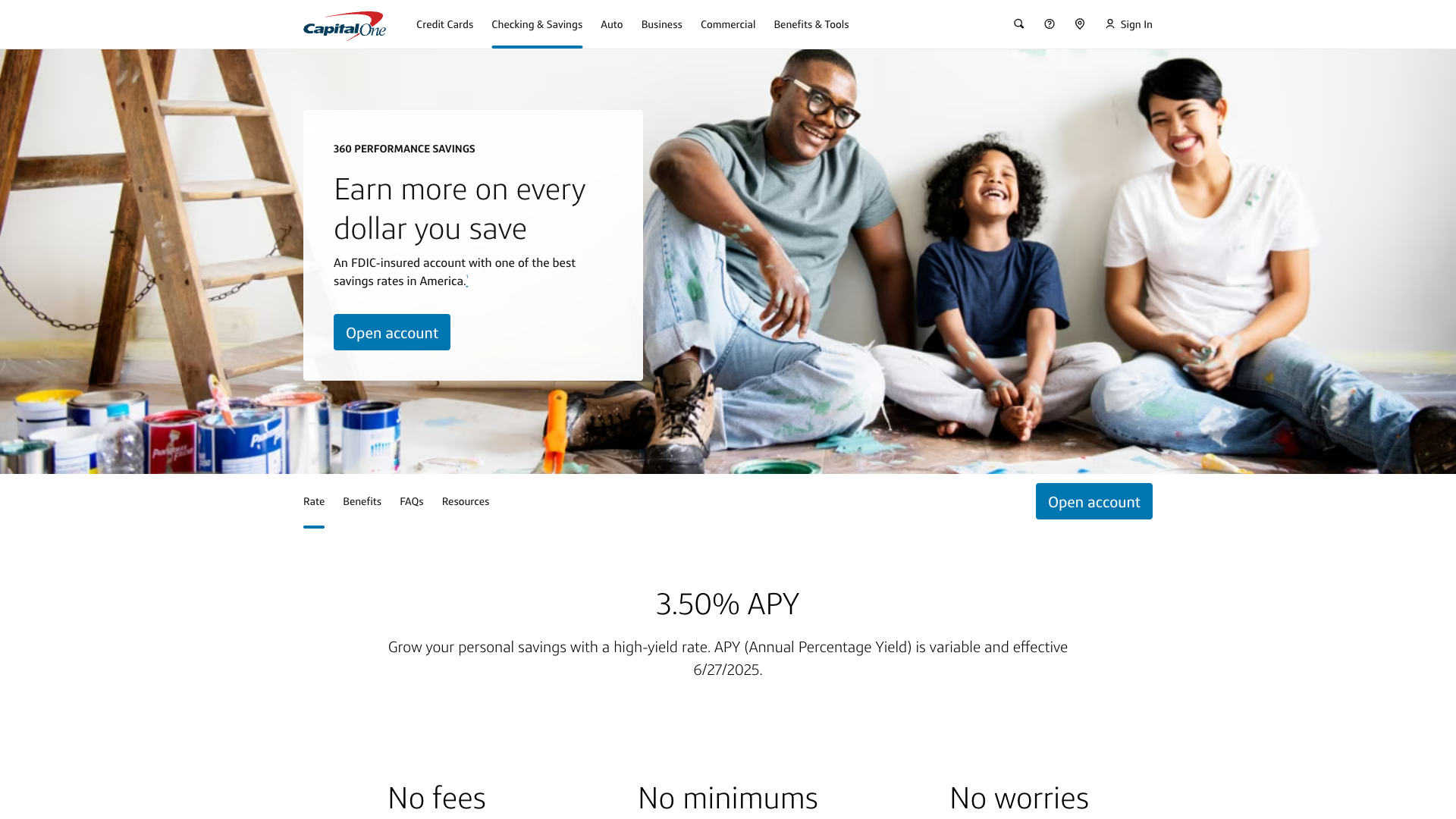

4. Capital One 360 - Best for Spending Analysis

Capital One 360 offers sophisticated spending analysis tools with their Eno virtual assistant and advanced categorization features. The app provides detailed merchant-level spending insights and predictive budgeting based on historical patterns. Capital One data indicates users reduce unnecessary spending by 28% using their analysis tools.

Key Budgeting Features:

- Eno virtual assistant for spending alerts and insights

- Advanced spending categorization with merchant details

- Predictive budgeting based on spending patterns

- Customizable savings goals with automatic transfers

- Bill tracking and payment reminders

- Credit monitoring and financial health dashboard

Monthly Fee: $0 | APY: 4.25%

5. Current - Best for Young Adults and Students

Current specializes in mobile-first banking with gamified budgeting tools and educational features perfect for young adults learning financial management. Their app includes spending challenges, savings goals with visual progress, and financial literacy content. Current surveys show 89% of users improve their budgeting habits within 90 days.

Key Budgeting Features:

- Gamified savings challenges and spending goals

- Real-time spending notifications with emoji categorization

- Round-up savings with customizable multipliers

- Spending insights with weekly and monthly summaries

- Financial education content and tips

- Teen account features with parental controls and spending limits

Monthly Fee: $0 | APY: 4.00%

How to Choose the Right Banking App for Budgeting

Selecting the best banking app with budgeting tools depends on your financial management style and goals:

Assess Your Budgeting Experience Level

Beginners should look for apps with automatic categorization and simple visual budgets like Chime or Current. Experienced budgeters might prefer sophisticated tools like SoFi's comprehensive planning features or Ally's detailed spending analysis. The Federal Reserve reports that 64% of Americans who use budgeting tools feel more confident about their finances.

Consider Automation vs. Control

Some users prefer hands-off automation (Chime's automatic savings), while others want granular control (Capital One 360's detailed categorization). Determine whether you want the app to manage budgeting automatically or provide tools for manual management. Research shows automated features increase savings rates by 15% on average.

Evaluate Integration Capabilities

Consider how the banking app integrates with other financial tools you use. Apps like Ally Bank work seamlessly with popular budgeting platforms, while SoFi offers comprehensive in-app financial planning. Check our banking guides for more integration insights.

Quick Comparison

| Banking App | APY | Best Budgeting Feature | Best For |

|---|---|---|---|

| Ally Bank | 4.00% | Savings Buckets | Goal-based saving |

| Chime | 2.00% | Automatic round-ups | Effortless budgeting |

| SoFi Money | 4.20% | Financial planning | Comprehensive tools |

| Capital One 360 | 4.25% | Spending analysis | Data-driven insights |

| Current | 4.00% | Gamified savings | Young adults |

Maximizing Your Banking App's Budgeting Features

To get the most value from your banking app's budgeting tools:

- Enable all notifications: Turn on spending alerts, balance updates, and goal progress notifications to stay informed

- Customize categories: Adjust spending categories to match your lifestyle for more accurate budget tracking

- Use automatic features: Set up round-up savings, automatic transfers, and recurring savings goals

- Review regularly: Check monthly spending summaries and adjust budgets based on insights

- Integrate with other tools: Connect to investment accounts, credit cards, and other financial apps for complete visibility

Essential Budgeting Features to Look For

The best banking apps for budgeting should include:

- Automatic categorization: Smart transaction categorization without manual input

- Real-time notifications: Instant alerts for spending, low balances, and budget limits

- Visual progress tracking: Charts and graphs showing spending trends and goal progress

- Customizable budgets: Ability to set spending limits by category and time period

- Savings automation: Round-up features and automatic transfers to savings goals

- Financial insights: Monthly summaries, spending trends, and personalized recommendations

Conclusion

The best banking app with budgeting tools for 2025 depends on your financial management style and experience level. Ally Bank offers the most comprehensive budgeting integration with Savings Buckets and detailed analytics, while Chime provides effortless automation perfect for budgeting beginners. SoFi Money excels for users wanting comprehensive financial planning beyond basic budgeting.

With 78% of banking app users reporting improved financial awareness through built-in budgeting tools, choosing the right app can significantly impact your financial health. All recommended apps are FDIC-insured and offer competitive rates alongside their budgeting features. Start with the app that matches your current financial management needs and grow your budgeting skills over time. For more banking options, explore our comprehensive banking reviews and financial guides.