What to Watch in 2026: 7 AI Companies Transforming Industries

The artificial intelligence landscape has fundamentally transformed. What began as a race to build better language models has evolved into a sophisticated ecosystem of specialized AI companies solving real business problems across every industry. 2026 marks an inflection point: AI is no longer experimental—it’s becoming essential infrastructure.

Enterprise AI spending tripled from $11.5 billion in 2024 to $37 billion in 2025, with 78% of companies actively deploying AI systems. But here’s the critical insight: only 31% of AI projects are reaching full production deployment. This gap between AI potential and AI reality defines the opportunity landscape for 2026.

The companies profiled in this guide represent where AI innovation is headed. They’re not chasing hype—they’re delivering measurable outcomes at scale. From a code editor that reached $1 billion in annual revenue in less than two years to robotics foundation models backed by Jeff Bezos and OpenAI, these seven companies illustrate AI’s evolution from demos to deployment, from pilots to production, from promise to profit.

The 2026 AI Landscape: Key Themes

Before diving into individual companies, understanding the broader trends shaping 2026 is essential:

Vertical AI is Winning

Generic AI tools are losing to domain-specific solutions. Vertical AI companies focusing on legal, healthcare, finance, and other specialized domains are achieving 400% year-over-year growth with 65% gross margins—dramatically outperforming horizontal AI platforms. Regulation, compliance, and domain expertise create moats that general-purpose models cannot easily cross.

Agentic AI Goes Mainstream

The shift from AI assistants to autonomous agents is accelerating. Rather than simply suggesting answers, AI agents now execute multi-step tasks independently—from resolving customer service issues to generating production code to handling medical documentation. 23% of organizations are scaling agentic AI systems, with another 39% experimenting. 2026 will see autonomous agents transition from novelty to necessity.

Developer Tools Having Their Moment

AI-powered developer tools represent one of the fastest-growing segments. With estimates suggesting 90% of code at leading companies is now AI-generated (up from 10-15% in 2024), tools that make developers more productive are experiencing explosive growth. The AI developer tools market is projected to expand from $4.8 billion (2023) to $17.2 billion by 2030.

The Implementation Gap Creates Opportunity

While headlines focus on model capabilities, the real bottleneck is implementation. Enterprises have purchased AI tools but struggle to deploy them in production. Companies solving the “last mile”—turning purchased software into working systems—are seeing extraordinary growth. Implementation expertise has become as valuable as innovation itself.

Foundation Models Expand Beyond Language

Large language models for text were just the beginning. 2026 is witnessing the emergence of foundation models for robotics, legal reasoning, medical documentation, and other specialized domains. Multimodal models that understand vision, language, and physical interactions represent the next frontier.

Selective but Massive Funding

While overall startup funding has cooled, elite AI companies are raising unprecedented amounts. Several companies in this guide have secured valuations exceeding $5 billion within 2-3 years of founding. The message is clear: investors are massively backing proven AI leaders while being highly selective about everyone else.

7 AI Companies Defining 2026

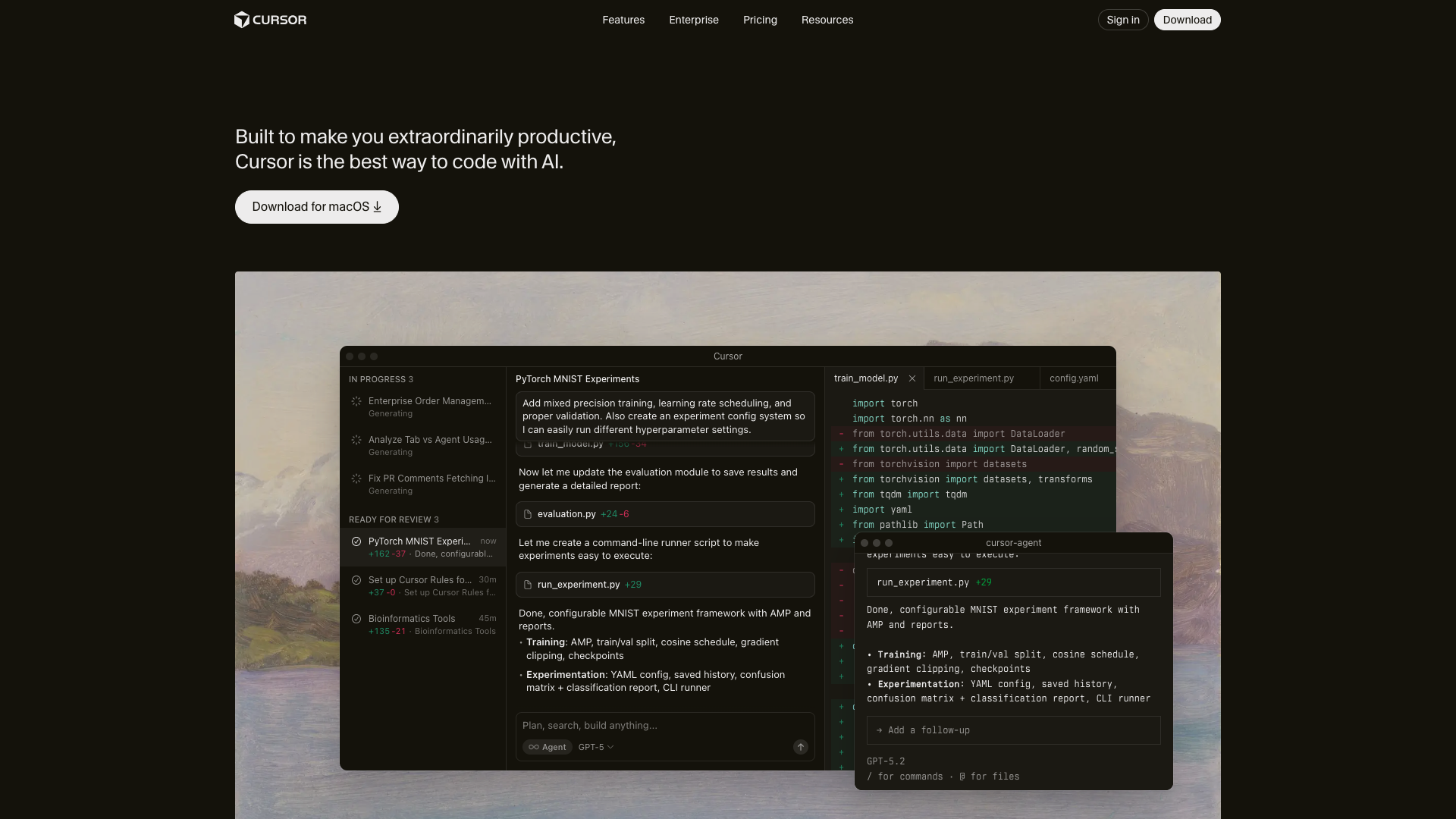

1. Anysphere (Cursor)

Category: AI-Powered Developer Tools

At a Glance:

- Founded: 2022 by MIT students

- Latest Valuation: $29.3 billion (November 2025)

- Latest Funding: $2.3 billion Series D

- Annual Revenue: Exceeded $1 billion ARR (November 2025)

- Key Backers: Accel, Coatue, Google, Nvidia, Thrive Capital, Andreessen Horowitz, DST Global

The Founding Story

During late-night hackathons at MIT, four computer science students—Michael Truell, Sualeh Asif, Arvid Lunnemark, and Aman Sanger—grew increasingly frustrated with the repetitive, fragmented nature of coding. Existing tools focused mainly on syntax completion rather than understanding complex codebases holistically. Instead of finishing their degrees at MIT, they left in 2022 to build Cursor, an AI-native development environment that fundamentally reimagines how developers write code.

Their bold bet paid off spectacularly: Cursor crossed $100 million in annual recurring revenue within 20 months of launch, reportedly without any marketing spend. By November 2025, the company had surpassed $1 billion ARR and achieved a $29.3 billion valuation—making it one of the fastest-growing companies in software history.

What Makes Cursor Unique

Cursor is not just autocomplete with AI—it’s a complete reimagining of the development environment. Unlike competitors that offer line-by-line suggestions, Cursor understands entire codebases and can generate, edit, and review code across multiple files simultaneously.

The company has built proprietary large language models specifically optimized for coding tasks. These in-house models now generate more code than almost any other LLMs in the world, giving Cursor a significant competitive advantage over tools relying solely on third-party AI models.

Key Capabilities:

- Whole-Codebase Understanding: Analyzes and comprehends entire projects, not just individual files

- Composer Mode: Orchestrates coordinated multi-file edits across complex codebases

- Conversational Interface: Natural language chat for code discussions, debugging, and problem-solving

- Tab Autocomplete: Context-aware suggestions that understand project structure and conventions

- Multi-Model Integration: Leverages GPT-4, Claude, and custom models for optimal performance

- Proprietary AI: Custom-built models trained specifically for software development workflows

Market Position and Traction

Cursor has emerged as GitHub Copilot’s strongest competitor in the exploding AI developer tools market. While GitHub Copilot maintains 42% market share with 15+ million users and presence in 90% of Fortune 100 companies, Cursor has captured approximately 18% market share—up from near zero just 18 months ago.

Current Scale:

- Over 1 million daily active users

- $1 billion+ annual recurring revenue

- $29.3 billion valuation (3.2x increase in just 5 months from June to November 2025)

- Priced at $20/month (vs. GitHub Copilot’s $10/month)—users pay double for superior capabilities

Strategic Advantages:

- Superior codebase understanding and multi-file editing capabilities

- Rapid iteration philosophy with constant feature development

- Strategic partnerships with Google and Nvidia providing compute and distribution

- Proprietary AI models reducing dependence on third-party providers

- Elite founding team (all former MIT CSAIL researchers with Google internships and OpenAI accelerator experience)

Why Watch Cursor in 2026

Developer Productivity Revolution: Software development is experiencing a step-change in productivity. Some CTOs report 90% of their code is now AI-generated, up from 10-15% in 2024. Cursor is at the center of this transformation. A recent survey found 85% of developers now use at least one AI tool in their workflow—Cursor aims to be that tool.

Proprietary AI Investment: Rather than pursuing an IPO despite unicorn status, Cursor is doubling down on product development with significant investment in custom LLMs optimized specifically for coding tasks. This reduces dependence on OpenAI and Anthropic while creating differentiated capabilities competitors cannot easily replicate.

Enterprise Expansion: While Cursor initially captured individual developers and small teams, 2026 will see aggressive enterprise adoption. The company is building offline/on-premise options, SSO integration, fine-grained access controls, and comprehensive audit logs to serve regulated industries.

Market Timing: The AI developer tools market is projected to grow from $4.8 billion (2023) to $17.2 billion by 2030. As the clear #2 player behind GitHub Copilot (and arguably technically superior), Cursor is positioned to capture significant market share from this expansion.

Unprecedented Valuation Trajectory: A $29.3 billion valuation for a 3-year-old developer tool company is extraordinary. This places Cursor in an elite club with OpenAI, Anthropic, xAI, and Safe Superintelligence. The valuation reflects investor conviction that Cursor is building not just a product but a platform that will define how software is created for the next decade.

2. Sierra

Category: AI Customer Experience Agents

At a Glance:

- Founded: 2023

- Latest Valuation: $10 billion (September 2025)

- Latest Funding: $350 million

- Annual Revenue: $100 million ARR in just 21 months (November 2025)

- Key Backers: Greenoaks Capital, Sequoia, Benchmark

The Founding Story

Bret Taylor and Clay Bavor met at a coffee shop in 2023 and decided to build Sierra together. Their partnership brings together two of Silicon Valley’s most accomplished product leaders:

Bret Taylor (Co-CEO) co-created Google Maps, founded FriendFeed (acquired by Facebook where he became CTO), founded Quip (acquired by Salesforce where he became co-CEO), served as Chairman of Twitter, and currently serves as Chairman of OpenAI. He started his career as an Associate Product Manager at Google in 2005.

Clay Bavor (Co-CEO) spent 18+ years at Google, starting as an APM alongside Bret in 2005. He ran product for Gmail, Drive, and Docs (all of Google Workspace), led Google Labs and AR/VR efforts including Project Starline and Google Lens, and served as VP of Product Management before leaving to start Sierra.

What Makes Sierra Unique

Sierra builds conversational AI agents that deliver empathetic, brand-aligned customer service across all channels, including voice. Unlike traditional chatbots that simply answer FAQs from a knowledge base, Sierra’s agents can authenticate patients, process returns, order replacement credit cards, help with mortgage applications, and handle complex multi-step tasks—all while maintaining brand voice and personality.

The key differentiator: Sierra’s agents are outcome-focused, not conversation-focused. They’re measured on successful issue resolution, not chat volume.

Key Capabilities:

- Multi-Channel Operation: Seamless experience across web, messaging apps, and voice

- Multilingual Support: Serving global customer bases in multiple languages

- Complex Problem-Solving: Handling exchanges, subscriptions, returns, account management

- System Integration: Connects to CRM, order management, billing, and other enterprise systems

- Voice AI: Natural phone conversations enabling voice-first customer service

- Built-in Guardrails: Security, compliance, and brand safety controls

- Cross-Channel Learning: Single agent learns from every interaction across all channels

Recent Product Launches:

- Voice Sims: AI-powered tool to train and refine voice bots before deployment

- Agent Data Platform: Unified system enabling agent learning and continuous improvement

- Cross-channel agent architecture enabling consistent experiences

Market Position and Traction

Sierra operates in the AI customer service market, projected to grow from $12.06 billion (2024) to $47.82 billion (2030) at 25.8% CAGR.

Current Scale:

- Hundreds of enterprise customers (30+ documented case studies)

- $100 million ARR reached in just 21 months from founding

- One of only 6 companies in customer service AI generating $100M+ ARR

- Notable customers include SiriusXM (34M subscribers), Sonos (15M customers), SoFi, Ramp, Brex, Rocket Mortgage, Redfin, WeightWatchers, Casper, Safelite

Customer Results:

- Casper: 74% resolution rate with >20% CSAT improvement

- Industry data shows ROI of $3.50 for every $1 invested in AI customer service

- Demonstrating ability to handle millions of conversations with high customer satisfaction

Strategic Advantages:

- Elite founding team with decades of product leadership at Google, Salesforce, and OpenAI

- Early mover in autonomous AI agents with outcome-based pricing model

- Voice AI integration positioning for voice-first future

- Rapid customer acquisition (hundreds of enterprise customers in 18 months)

Why Watch Sierra in 2026

Voice AI Revolution: Advances in voice AI are making it the emerging primary interface for customer service. Sierra’s voice capabilities position them to lead this shift. By 2025, 95% of customer interactions are expected to be AI-powered, with voice becoming the dominant modality. Sierra’s investment in voice technology from day one provides a significant head start.

Autonomous Agents Mainstream: The market is transitioning from chatbots (which answer questions) to autonomous agents (which resolve issues end-to-end without human escalation). Sierra’s architecture is purpose-built for this autonomous model, while competitors built chatbots and are retrofitting autonomy.

Outcome-Based Pricing: Sierra charges per successful resolution rather than per seat or per conversation. This aligns incentives with customer success and enables new business models. As enterprises demand measurable ROI from AI investments, outcome-based pricing becomes increasingly attractive.

Founder Credibility: Bret Taylor’s role as OpenAI Chairman provides unique insights into AI capabilities and roadmaps. His track record (Google Maps, Facebook CTO, Salesforce co-CEO) demonstrates ability to build category-defining products. Clay Bavor’s 18 years at Google building Workspace, AR/VR, and Google Lens shows deep product and technical expertise.

Growth Trajectory: From $0 to $100 million ARR in 21 months represents one of the fastest growth rates in enterprise software history. With $635 million in funding and a $10 billion valuation, Sierra has the runway and resources to dominate the conversational AI agent market.

Enterprise AI Adoption: 95% of customer interactions expected to be AI-powered by 2025, with Sierra capturing the premium segment focused on complex, high-value interactions rather than simple FAQ deflection.

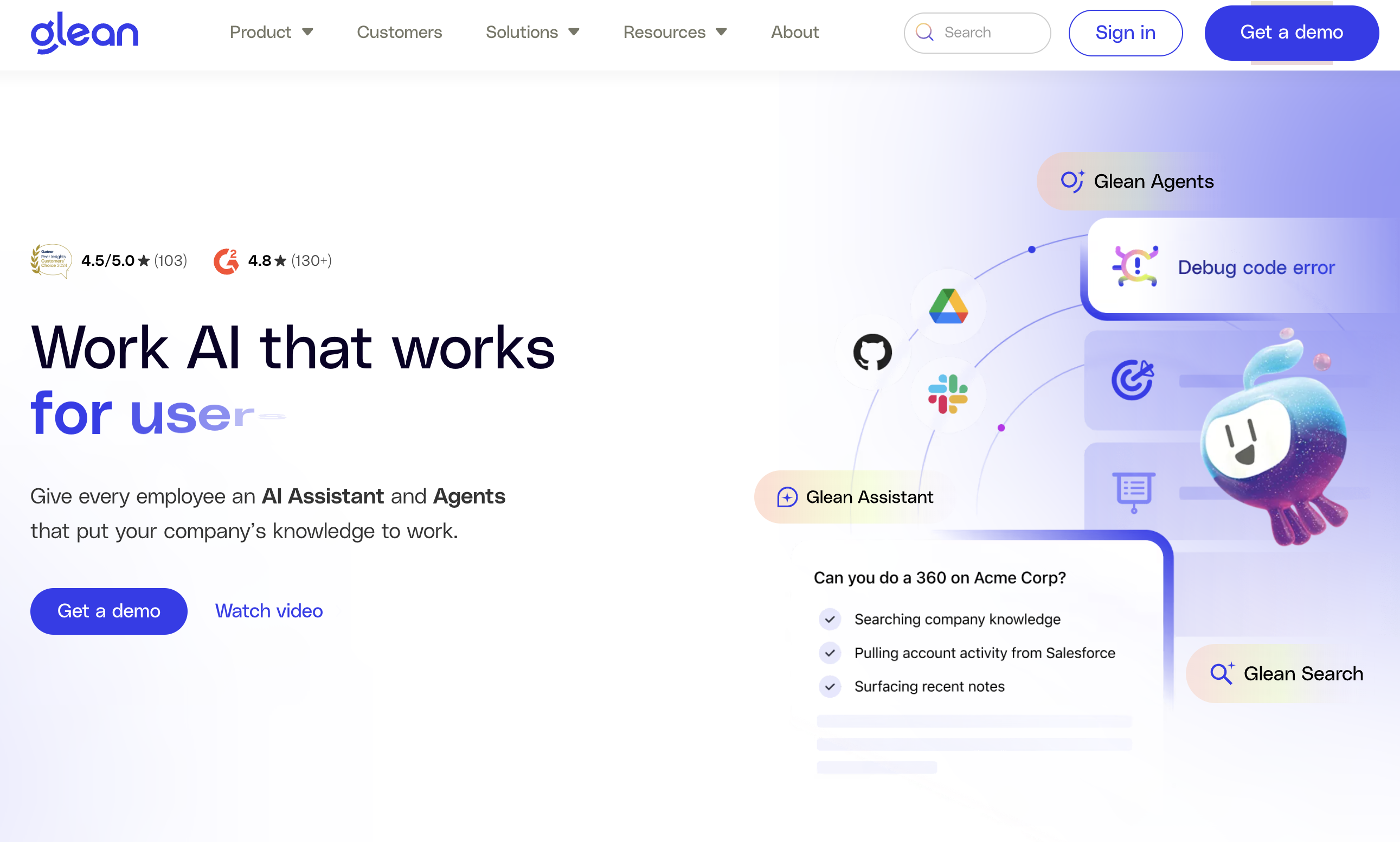

3. Glean

Category: Enterprise AI Work Assistant

At a Glance:

- Founded: 2019

- Latest Valuation: $7.2 billion (June 2025), up from $4.6B in September 2024

- Latest Funding: $150 million Series F

- Annual Revenue: Surpassed $100 million ARR in less than 3 years from launch

- Key Backers: Wellington Management, Khosla Ventures, Altimeter, Coatue, DST Global, General Catalyst, ICONIQ, IVP, Kleiner Perkins, Sequoia Capital

The Founding Story

Glean was founded in 2019 by four technology veterans who experienced firsthand the frustration of not being able to find information at scale within large organizations:

Arvind Jain (CEO) spent 10+ years at Google as a distinguished engineer leading teams in Search, Maps, and YouTube, then co-founded Rubrik (now a publicly-traded data security leader). Tony Gentilcore spent 10 years at Google modernizing the web search results page and founding Chrome’s Speed Team. T.R. Vishwanath (CTO) spent nearly 10 years as Principal Software Engineer at Facebook working on News Feed ranking, Ads, and Developer Platform. Piyush Prahladka brings engineering leadership experience from top tech companies.

The team brought together expertise from Google, Facebook, and Microsoft to solve enterprise search—a problem each had experienced at massive scale. They recognized that while consumer search had been revolutionized, enterprise knowledge work remained fragmented across dozens of disconnected tools.

What Makes Glean Unique

Glean provides a unified AI platform combining intelligent search, AI assistants, and automated agents built on a proprietary “Enterprise Graph” that indexes and understands data across 100+ connected applications while enforcing real-time permissions. Unlike generic AI tools, Glean is specifically designed for enterprise knowledge work with deep understanding of company-specific context.

The killer feature: Glean eliminates AI hallucinations through Retrieval-Augmented Generation (RAG), grounding every AI response in verified company data rather than making up answers.

Core Products:

-

Glean Search

- Enterprise search across 100+ connected applications

- Real-time permission controls ensuring users only see data they’re authorized to access

- Understanding of company-specific context, terminology, and relationships

-

Glean Assistant

- Personalized AI assistant adapting to individual users and roles

- Generates trustworthy content based on verified company knowledge

- Eliminates hallucinations through grounding in actual data

-

Glean Agents

- Pre-built and customizable AI agents for departmental workflows

- Automated multi-step task execution across sales, support, engineering, IT, HR

- Department-specific configurations understanding unique processes

-

Glean Protect

- Governance and security layer for enterprise AI

- Real-time permissions enforcement

- Compliance controls and comprehensive audit trails

Technology Foundation:

- Enterprise Graph: Proprietary knowledge graph connecting all company data and understanding relationships

- RAG Architecture: Dramatically reduces hallucinations by grounding AI in verified information

- 100+ Integrations: Connects to all major enterprise applications (Salesforce, Slack, Google Workspace, Microsoft 365, Jira, Confluence, etc.)

Market Position and Traction

Glean operates in the enterprise AI search market valued at $4.61 billion (2023), projected to reach $9.31 billion by 2032. The broader enterprise AI market reached $97.2 billion in 2025, expected to hit $229.3 billion by 2030.

Current Scale:

- Surpassed $100 million ARR milestone in less than 3 years from launch

- Powering 100+ million agent actions annually

- Serving thousands of companies including many Fortune 500 enterprises

- 93% adoption achieved within 2 years at customer organizations

- Weekly usage metrics showing strong engagement and expansion

Business Impact (Customer-Reported):

- Saves approximately 110 hours annually per user

- 6-month ROI timeline

- 20% reduction in internal support requests

- Significant productivity gains across engineering, support, sales, HR, and IT teams

Recognition & Awards:

- 2025 CNBC Disruptor 50

- Fast Company’s Top 10 Most Innovative Companies of 2025 (only enterprise AI company in top 10)

- Gartner Peer Insights Customers’ Choice 2024

Strategic Advantages:

- Purpose-built for enterprise with security and compliance at the core

- Enterprise Graph technology providing superior context understanding vs. point-in-time indexing

- Elite founding team with proven track record at Google, Facebook, and Rubrik

- Strong venture backing ($410M+ raised) enabling R&D investment and global expansion

- First-mover advantage in enterprise AI knowledge platforms using RAG architecture

Why Watch Glean in 2026

Agentic AI Adoption: 23% of organizations are scaling agentic AI systems, with 39% experimenting. Glean Agents is perfectly positioned to capture this demand with pre-built agents for common departmental workflows and the flexibility to build custom agents.

Enterprise Search as Top Use Case: Internal enterprise search has been identified as the #1 AI use case alongside data analysis and customer support. Knowledge workers spend 2.5 hours daily searching for information—Glean directly addresses this massive productivity drain.

RAG Architecture Dominance: RAG is becoming the standard architecture for enterprise AI to reduce hallucinations and ground responses in verified data. Glean was built on RAG from day one, while competitors are retrofitting this capability. This architectural advantage compounds over time.

Software Development Integration: With 90% of code at leading companies now AI-generated, Glean’s engineering tools for code search, debugging, and problem-solving are perfectly timed. Developers spend significant time searching existing code to understand systems—Glean makes this instant.

Valuation Momentum: A 56% valuation increase in 9 months (September 2024 to June 2025) during a period when many tech valuations fell demonstrates exceptional execution and market validation. The $7.2 billion valuation reflects confidence in Glean’s ability to become the AI layer for enterprise knowledge work.

International Expansion: Using Series F funding to accelerate global growth beyond North America, expanding into Europe, Asia-Pacific, and emerging markets where enterprises are rapidly adopting AI tools.

Platform Evolution: Glean is evolving from search + assistant to a comprehensive work platform with agents, workflow automation, and department-specific solutions. This platform expansion significantly increases total addressable market and customer lifetime value.

Market Timing: Enterprise AI spending tripled from $11.5 billion (2024) to $37 billion (2025), with internal knowledge search identified as a critical productivity bottleneck. 87% of large enterprises are implementing AI solutions—Glean is positioned to be the knowledge foundation for these implementations.

4. Harvey

Category: Legal AI Platform

At a Glance:

- Founded: 2022 (launched early 2023)

- Latest Valuation: $8 billion (December 2025)

- 2025 Funding: Over $760 million raised across three rounds

- Annual Revenue: Surpassed $100 million ARR (August 2024)

- Active Users: 74,000+ lawyers across 700+ organizations

- Key Backers: Andreessen Horowitz, Sequoia, Kleiner Perkins, OpenAI Startup Fund, Elad Gil, Sarah Guo

The Founding Story

Harvey has one of tech’s most unique founding stories: a first-year legal associate partnering with an AI researcher to transform legal services.

Winston Weinberg (CEO) was a securities and antitrust litigator at O’Melveny & Myers—one of the world’s premier law firms—when he experimented with OpenAI’s GPT-3 and recognized its transformative potential for legal work. He had been an associate for only one year. He partnered with Gabriel Pereyra, a research scientist at Google DeepMind with deep expertise in large language models.

On July 4th, Weinberg cold-emailed OpenAI leadership Sam Altman and general counsel Jason Kwon. This audacious outreach led to a pitch call, and Harvey became one of the first recipients of investment from the OpenAI Startup Fund, followed by introductions to prominent angel investors.

What Makes Harvey Unique

Harvey positions itself as “Professional Class AI”—domain-specific systems engineered for complex professional work rather than general-purpose models. The platform includes custom models built specifically for legal domain expertise, trained on legal reasoning, regulations, and case law.

Harvey emphasizes agentic workflows that produce work product without constant manual prompting, going beyond simple Q&A to actually complete sophisticated legal tasks like contract analysis, due diligence, legal research, and document drafting.

Core Features:

-

Assistant

- AI-powered document analysis and Q&A

- Legal drafting tailored to specific practice areas

- Context-aware suggestions based on legal expertise and precedent

-

Vault

- Secure document storage meeting legal industry standards

- Bulk document analysis using generative AI

- Zero training on client data (critical for attorney-client privilege)

-

Knowledge

- Research tool for complex legal, regulatory, and tax questions

- Cited sources ensuring reliability and verifiability

- Up-to-date case law and regulatory information across jurisdictions

-

Workflows

- Pre-built multi-model agents for specialized legal work

- Customizable workflows for firm-specific processes and precedents

- Agentic automation reducing manual effort on routine tasks

-

Microsoft Integrations

- Word plugin for contract review and drafting

- Outlook integration for email analysis and response

- SharePoint connectivity for document management

Technology Approach:

- Custom models trained on legal domain data

- Multi-model architecture selecting optimal model for each specific task

- Proprietary legal reasoning capabilities beyond general-purpose AI

- Enterprise-grade security with zero data training on client materials

- 24/7 white-glove customer support

Market Position and Traction

Harvey operates in the vertical AI legal technology market, which has grown to $650 million and is expected to expand dramatically as law firms accelerate AI adoption.

Current Scale:

- 50 of AmLaw 100 firms (top 100 law firms by revenue)—50% market penetration

- 700+ leading law firms and enterprises globally

- 74,000+ active lawyers on the platform

- Surpassed $100 million ARR in August 2024 (less than 2 years from launch)

Notable Use Cases:

- Innovation Teams: Driving firmwide AI transformation initiatives

- In-House Counsel: Managing high-volume work at corporations

- Transactional Teams: Accelerating M&A due diligence and deal execution

- Litigation Teams: Reducing manual legal research and document review

Performance Metrics:

- Harvey Assistant achieved 94.8% accuracy in document Q&A tasks, higher than general-purpose AI models

- Significant time savings on contract review, research, and drafting tasks

Recent Innovation:

- Shared Spaces: Secure collaboration between law firms and clients in unified workspaces, improving matter coordination and outcomes

Why Watch Harvey in 2026

Vertical AI Dominance: General-purpose models struggle in heavily regulated domains requiring precision and citing sources. Vertical AI companies like Harvey focusing on specific professional services are showing 400% year-over-year growth and 65% gross margins. Harvey is the category leader in legal AI.

Extraordinary Funding Momentum: Three major rounds in 2025 totaling $760 million demonstrates unprecedented investor conviction. The trajectory from $3 billion (February 2025) to $5 billion (June 2025) to $8 billion (December 2025) valuation—167% increase in 10 months—signals exceptional execution and market opportunity.

AmLaw 100 Penetration: Serving 50 of the top 100 law firms by revenue provides validation and an expansion platform. These firms are the most sophisticated legal buyers—their adoption signals Harvey has achieved product-market fit for the most demanding customers.

Professional Services Transformation: Legal services are priced on outcomes and value rather than billable hours. AI enables new business models by dramatically reducing the time required for research, due diligence, and document review. Harvey is influencing how legal education, training, and service delivery models evolve.

Global Expansion Opportunity: International growth beyond the U.S. market, particularly in the UK, Europe, and Asia-Pacific where large law firms operate, represents significant opportunity. Legal AI must handle jurisdiction-specific laws and regulations—Harvey’s custom models are being trained for additional jurisdictions.

Enterprise Integration: Deeper Microsoft 365 integration, additional enterprise system connections (billing, matter management, document management), and expanded research capabilities covering more jurisdictions will drive adoption and usage.

Market Transformation: The legal industry represents a $900 billion+ market size. Harvey’s rapid penetration of top firms (50 AmLaw 100 in less than 2 years) suggests they’re building a category-defining company that will fundamentally change how high-stakes legal work is performed.

Agentic Workflows Evolution: More sophisticated multi-agent collaboration, predictive legal analytics, matter outcome prediction, and automated brief generation will move Harvey from assistant to autonomous legal work executor.

Harvey represents the future of professional services—AI that doesn’t just assist but actually completes sophisticated knowledge work requiring deep domain expertise, precision, and accountability.

5. Abridge

Category: Healthcare AI Documentation

At a Glance:

- Founded: 2018

- Latest Valuation: $5.3 billion (June 2025)

- 2025 Funding: $550 million across two rounds (Series D and Series E)

- Scale: 150+ health systems, 50+ million medical conversations annually

- Key Backers: Andreessen Horowitz, Khosla Ventures

Company Overview & Mission

Abridge is an enterprise-grade AI platform transforming patient-clinician conversations into clinically useful, billable AI-generated notes in real time. The company is pioneering ambient AI for healthcare—technology that works in the background during medical encounters to capture, structure, and document clinical information without burdening physicians.

Founded in Pittsburgh with operations expanding to Cambridge, Massachusetts, Abridge has grown from a startup to a healthcare AI unicorn in just over six years.

What Makes Abridge Unique

Abridge has developed a proprietary Contextual Reasoning Engine—specialized AI infrastructure trained on 1.5+ million medical encounters. This domain-specific approach enables the system to:

- Understand medical terminology across 55 specialties

- Support conversations in 28 languages

- Generate documentation that is simultaneously clinically useful AND billable

- Integrate seamlessly into Epic EHR systems (the dominant hospital system software)

- Maintain HIPAA compliance and healthcare-grade security

Unlike general-purpose AI, Abridge’s models are purpose-built for the complexities of medical documentation—understanding clinical context, specialty-specific workflows, and revenue cycle requirements.

Core Platform:

-

For Clinicians

- Real-time clinical note generation during patient encounters

- Contextually aware documentation matching specialty workflows

- Ambient listening requiring no workflow changes (physicians can focus on patients)

- Integration directly within Epic EHR (where doctors already work)

- Multi-specialty support (55 specialties from cardiology to psychiatry)

-

For Revenue Cycle Teams (NEW - Major 2025 Expansion)

- Closes revenue cycle gaps at the point of conversation

- Real-time code validation and evidence capture

- Eliminates manual post-visit clinician queries that delay reimbursement

- Reduces claim denials through accurate, complete documentation

- Faster reimbursement cycles improving cash flow

-

For Nurses (Emerging Focus)

- Pioneering nursing documentation automation

- Specialty workflows for nursing care documentation

- Enormous market opportunity (nurses outnumber physicians 3:1)

Technology Capabilities:

- Proprietary data set from 1.5+ million medical encounters

- Support for 55 medical specialties with specialty-specific templates

- 28 language capabilities serving diverse patient populations

- Epic EHR native integration (critical for enterprise health systems)

- Real-time processing during clinical encounters

- HIPAA-compliant infrastructure with healthcare-grade security

- Zero hallucination tolerance through healthcare-specific training

Market Position and Traction

Abridge operates in the healthcare AI market, which reached $1.4 billion in 2025 (nearly triple 2024’s investment)—more than any other vertical AI segment including legal, financial services, and media.

Current Scale:

- 150+ health systems using Abridge (50% increase from Series D to Series E in just 4 months)

- 50+ million medical conversations annually projected for 2025

- 55 specialties supported

- 28 languages enabled

Notable Healthcare Systems:

- Mayo Clinic

- Kaiser Permanente

- Johns Hopkins

- Duke Health

- Christus Health

- Corewell Health

- Lee Health

- University of Vermont Medical Center

Measured Clinical Impact:

- 78% decrease in cognitive load (Christus Health)

- 90% of clinicians give more undivided attention to patients (Corewell Health)

- 86% of clinicians report less after-hours work (Lee Health)

- 53% improvement in professional fulfillment (University of Vermont)

Recognition & Awards:

- Best in KLAS 2025 for Ambient AI (industry’s most prestigious customer satisfaction award)

- Fast Company Most Innovative Companies

- TIME Best Inventions

- Forbes AI 50

Competitive Landscape:

Abridge competes in the ambient AI clinical documentation market against Microsoft-owned Nuance DAX (market leader by install base), Suki AI, Augmedix, DeepScribe, and emerging competitors.

Competitive Advantages:

- 1.5 million+ medical encounter training data set (proprietary asset competitors cannot easily replicate)

- Epic EHR native integration (critical for enterprise health systems)

- 55 specialty coverage vs. primary care focus of many competitors

- Revenue cycle capabilities (most competitors focus only on clinical documentation)

- Proven enterprise scale (150+ health systems)

- Healthcare AI unicorn status ($5.3 billion valuation)

Why Watch Abridge in 2026

Physician Burnout Crisis: Administrative burden is the #1 cause of physician burnout, with documentation consuming 2+ hours daily. Ambient AI has proven to reduce after-hours work by 86%. As physician shortages worsen and burnout increases, health systems are investing heavily in solutions like Abridge that demonstrably improve clinician well-being.

Healthcare AI Investment Surge: Healthcare AI spending hit $1.4 billion in 2025 (3x 2024), with 8 healthcare AI unicorns created. This represents more investment than any other vertical AI category. Abridge is the category leader in ambient clinical documentation.

Revenue Cycle Management Expansion: Launched in 2025, Abridge’s revenue cycle capabilities represent a major growth opportunity for 2026. Healthcare organizations face increasing reimbursement challenges and rising claim denials. AI-enabled revenue cycle intelligence that validates billing codes in real-time and eliminates documentation gaps represents billions in potential value recovery.

Nursing Documentation Pioneer: Abridge announced plans to pioneer nursing documentation automation. Nurses outnumber physicians 3:1 and have different documentation workflows. This currently underserved market represents enormous expansion potential.

Valuation Momentum: Doubling valuation in 4 months (February to June 2025) and increasing health system deployments by 50% in the same period demonstrates exceptional execution. With $800 million total funding, Abridge has runway for aggressive expansion.

EHR Integration Requirements: Epic dominance (50%+ market share in hospital systems) makes Epic integration critical for enterprise adoption. Abridge’s native Epic integration provides a significant competitive advantage as competing solutions require workarounds.

Population Health Capabilities: As Abridge processes 50+ million conversations, aggregated insights enable population health management, quality improvement initiatives, and clinical decision support—expanding beyond documentation to strategic healthcare insights.

Market Timing: The convergence of physician burnout crisis ($4.6 billion annual cost), revenue cycle pressure, and proven AI capabilities creates perfect conditions for ambient AI adoption. Abridge’s Best in KLAS recognition signals customer satisfaction leadership in this rapidly growing category.

Abridge represents healthcare AI’s transition from experimental to essential infrastructure—solving real clinical problems with measurable outcomes while expanding into revenue-critical use cases that unlock billions in value for health systems.

6. Physical Intelligence

Category: Robotics Foundation Models

At a Glance:

- Founded: 2024

- Latest Valuation: $5.6 billion (November 2025)

- Latest Funding: $600 million

- Total Funding: ~$1.07 billion

- Key Backers: CapitalG (Alphabet’s growth fund), Jeff Bezos, OpenAI, Lux Capital, Thrive Capital, Index Ventures, T. Rowe Price

- Team: 60+ engineers, scientists, and roboticists

The Founding Story

Physical Intelligence was founded in 2024 by a dream team of robotics AI researchers from the world’s leading institutions:

Karol Hausman (CEO) - Former Staff Research Scientist at Google DeepMind and Adjunct Professor at Stanford with deep expertise in robotic learning and manipulation.

Sergey Levine (Chief Scientist) - Associate Professor at UC Berkeley whose lab pioneered deep reinforcement learning methods for robotic manipulation and control. One of the world’s foremost authorities on robot learning.

Chelsea Finn - Professor at Stanford University and leading researcher in meta-learning and robot learning.

Brian Ichter - Former Google research scientist expert in motion planning and robot learning.

Lachy Groom - Former Stripe executive bringing company-building and go-to-market expertise.

The team brings together academic excellence (Berkeley, Stanford), industry experience (Google DeepMind), and startup execution capabilities (Stripe).

What Makes Physical Intelligence Unique

Physical Intelligence aims to bring general-purpose AI into the physical world by developing foundation models for robots—the robotics equivalent of GPT for language. Their vision: build a general intelligence “brain” that can power any robot or physical device for any application, enabling robots to learn and perform a wide range of tasks across different robot platforms.

This represents a fundamental shift from traditional robotics (where each robot is programmed for specific tasks) to AI-native robotics (where general foundation models enable robots to learn new tasks through demonstration and reasoning).

Foundation Models Released:

-

π0 (Pi Zero) - October 2024

- First generalist policy for robotic manipulation

- Open-sourced in February 2025

- Trained on multi-task, multi-robot data

- Novel vision-language-action (VLA) architecture

-

π0.5 (Pi Zero Point Five)

- Extended model for mobile manipulators

- Enables open-world generalization

- Robots can navigate and manipulate in novel environments

-

π0.6 (Pi Zero Point Six) - Latest Release

- Incorporates reinforcement learning

- Improves real-world task success rates

- Enhanced reasoning for complex task execution

Supporting Technologies:

- FAST: Action tokenizer enabling 5x faster training of generalist policies—critical for scaling robot learning

- Real-time Chunking: System maintaining precision despite high-latency operations in real-world conditions

- Human-to-Robot Transfer: Techniques enabling robots to learn from human demonstrations

- Step-by-Step Reasoning: Breaking down complex tasks into executable sub-tasks

Market Position and Competition

Physical Intelligence operates in the robotics AI foundation models market experiencing explosive growth. VC investment in robotics reached $22.2 billion in 2025 (69% year-over-year increase), with expectations that funding could double again in 2026.

Market Context:

- Global AI robots market: $6.11 billion (2025) → $33.39 billion (2030) at 40.4% CAGR

- Morgan Stanley estimates $5 trillion humanoid robot TAM by 2050

- 2026 focused on practical AI integration for manufacturing, healthcare, and homes

Competitive Landscape:

Physical Intelligence competes with several approaches to robot intelligence:

-

Vertical Robotics Companies (building both hardware and software):

- Tesla (Optimus humanoid)

- Figure AI (Figure 01, Figure 02 humanoids)

- 1X Technologies (EVE, NEO humanoids)

- Boston Dynamics (Atlas, Spot)

-

Foundation Model Competitors (software/AI focus):

- Skild AI ($300M Series A, July 2025)

- Field AI (~$405M, August 2025)

- Covariant (warehouse robotics AI)

-

Tech Giants:

- NVIDIA (Isaac GR00T foundation model)

- Google DeepMind (RT-1, RT-2 models)

- Tesla AI team

Competitive Advantages:

- World-class research team from Berkeley, Stanford, Google DeepMind

- Open-source strategy (π0 released) building community and accelerating research

- Foundation model focus enabling all robots vs. building specific robots

- Rapid model iteration (π0 → π0.5 → π0.6)

- Strategic investors (CapitalG/Alphabet, OpenAI, Bezos) providing capital and distribution

- 133% valuation increase in ~9 months ($2.4B → $5.6B)

Why Watch Physical Intelligence in 2026

Foundation Model Moment: Just as 2023 was the year of language foundation models, 2026 could be the year of robotics foundation models. Physical Intelligence is the clear leader in this category with three major model releases and an open-source strategy.

Open-Source Strategy: Unlike closed competitors, π0’s open-source release builds community and establishes standards—similar to Meta’s Llama strategy in language models. This creates ecosystem effects that compound over time.

Platform Opportunity: Physical Intelligence isn’t building one robot but enabling all robots. Every manufacturing robot, warehouse robot, service robot, and humanoid could run π models. This creates massive total addressable market—they’re selling “picks and shovels” for the robot revolution.

Market Timing: Robotics investment up 69% in 2025, expected to double in 2026. Physical Intelligence is riding this wave with $1 billion+ in funding, positioning to capture disproportionate share of market expansion.

Strategic Backing: Investment from CapitalG (Alphabet), OpenAI, and Jeff Bezos isn’t just capital—it’s strategic validation and access to compute resources, distribution channels, and deep AI expertise. These backers are betting Physical Intelligence will define robotics AI.

Rapid Execution: Founded in 2024, already at $5.6 billion valuation with three major model releases. Execution velocity is exceptional, suggesting strong technical and organizational capabilities.

Commercial Partnerships Expected: 2026 will likely see licensing of π models to robot manufacturers, integration with leading robot hardware platforms, and manufacturing partnerships for deployed solutions. The foundation model is proven—commercialization is next.

Application Expansion: Manufacturing/logistics (picking, packing, assembly), healthcare (assisted living, rehabilitation), hospitality (food service, cleaning), agriculture (harvesting, monitoring), and construction (assembly, inspection) represent near-term opportunities.

The Bigger Picture: Physical Intelligence represents AI’s next frontier—bringing the intelligence of language models into the physical world. While language AI has transformed knowledge work, robotics AI could transform manufacturing, healthcare, logistics, agriculture, and daily life. Physical Intelligence’s foundation model approach positions them as the Anthropic/OpenAI of robotics—providing the “brains” that power the robot revolution.

As AI agents move from digital to physical tasks, Physical Intelligence is building the core technology that could define how intelligent machines interact with the real world for decades to come.

7. Distyl AI

Category: Enterprise AI Transformation

At a Glance:

- Founded: 2022

- Latest Valuation: $1.8 billion (September 2025)

- Latest Funding: $175 million Series B

- Valuation Growth: 9x increase in 10 months ($200M → $1.8B)

- Total Funding: $200+ million

- Key Backers: Khosla Ventures, Lightspeed Venture Partners, Coatue, Dell Technologies Capital, DST Global

- Team: Former Palantir executives and engineers

The Founding Story

Distyl AI was founded by two Palantir veterans who spent nearly a decade deploying complex data and AI solutions for the world’s most sophisticated organizations:

Arjun Prakash (CEO) spent nearly a decade at Palantir Technologies leading commercial strategy, managing teams of 30+ engineers and strategists. He subsequently served as Director of Solutions at Snorkel AI and advisor at Innovaccer. At Palantir, he witnessed firsthand how AI could transform enterprise businesses.

Derek Ho (COO) brings financial services expertise from Credit Suisse and Citadel as a Fixed Income Trader, combined with business development leadership at Palantir Technologies and business roles at Mendel.ai.

Origin Story: Working behind closed doors at Palantir, Prakash and Ho witnessed AI’s transformative potential for Fortune 500 companies. After leaving Palantir, they identified a critical gap: enterprises didn’t know how to create value from AI tools. Most companies were buying AI point solutions but lacked the integration expertise, implementation knowledge, and strategic vision to deploy AI at scale.

Distyl was founded to bridge this gap—combining powerful AI building blocks with expert implementation to solve core business problems for global enterprises.

What Makes Distyl Unique

Distyl AI is an “AI-native services company” that helps Fortune 500 companies become “AI-native.” Unlike pure-play software vendors or traditional consulting firms, Distyl combines:

- AI Technology Platform: Proprietary tools and integrations with leading AI models

- Implementation Expertise: Teams of former Palantir engineers and AI specialists

- Strategic Consulting: Business transformation guidance for AI adoption

- End-to-End Delivery: From strategy to deployment to optimization

The Palantir DNA is critical. Palantir pioneered the “forward-deployed engineer” model where technical experts work directly with customers to solve complex problems. Distyl applies this proven approach to enterprise AI transformation.

OpenAI Partnership: Distyl formed a services alliance with OpenAI in 2023, positioning them as a strategic implementation partner for OpenAI’s enterprise customers.

Service Model:

Distyl works with companies across multiple sectors:

- Healthcare

- Telecommunications

- Insurance

- Manufacturing

- Financial Services

Approach:

- Assessment & Strategy: Identify highest-value AI use cases for specific business context

- Solution Architecture: Design AI systems using best-in-class models and tools

- Implementation: Deploy production-ready AI systems with elite engineers

- Integration: Connect AI systems to existing enterprise infrastructure

- Optimization: Continuously improve performance and expand use cases

Delivery Model: Combines software platform with high-touch professional services—often embedding teams at customer sites for weeks or months (similar to Palantir’s forward-deployed model).

Market Position and Traction

Distyl operates in the enterprise AI consulting and implementation market, which is exploding as companies struggle to move from AI experimentation to production deployment.

Market Context:

- Enterprise AI spending: $37 billion in 2025 (3.2x increase from $11.5 billion in 2024)

- 78% of companies actively deploying AI systems

- Only 31% of AI use cases reaching full production (doubled from 2024 but still low)

- Implementation gap: Companies buying AI tools but lacking expertise to deploy effectively

Growth Metrics:

- 5x revenue growth in 2024

- 8x revenue growth projected for 2025

- 100% production record (every project reaching production)

- 120+ million end users reached through customer deployments

Competitive Landscape:

- Traditional Consulting Firms: Accenture, Deloitte, McKinsey, BCG (large scale but less technical AI depth)

- AI-Native Consulting: Emerging competitors in specialized AI consulting

- Software Vendors with Services: Databricks, Snowflake, C3.ai offering professional services

- System Integrators: Cognizant, Infosys, Wipro adding AI capabilities

Competitive Advantages:

- Palantir DNA: Proven forward-deployed engineer model

- OpenAI Partnership: Strategic alliance with leading AI provider

- 100% Production Record: Exceptional track record of successful deployments

- Vertical Expertise: Deep knowledge in healthcare, telecom, insurance, manufacturing

- Elite Team: Former Palantir engineers, top-tier AI researchers

- Rapid Growth: 9x valuation increase in 10 months

Why Watch Distyl in 2026

Implementation Bottleneck: Companies have bought AI tools but struggle with production deployment. Only 31% of use cases are in production despite 78% of companies deploying AI. This massive implementation gap creates enormous demand for Distyl’s expertise.

Palantir Playbook at Scale: Palantir spent 20 years proving that complex technology requires embedded expertise to deliver value, building a multi-billion dollar business. Distyl is applying this proven playbook to the much larger enterprise AI market.

Fastest-Growing Enterprise AI Company: 9x valuation increase in 10 months ($200M → $1.8B) is extraordinary, even in the hot AI market. This signals exceptional execution and massive market demand.

Services-to-Platform Opportunity: Similar to Palantir’s evolution from services to software platform, Distyl could productize implementation expertise into packaged solutions, dramatically expanding margins and scale. The 100% production record suggests they’ve discovered repeatable patterns.

Revenue Growth Trajectory: 5x growth in 2024, 8x projected for 2025—if sustained, could reach $100 million+ ARR in 2026, positioning for eventual IPO or strategic acquisition.

Elite Backing: Khosla Ventures and Lightspeed Venture Partners leading $175 million Series B signals top-tier VC conviction in Distyl’s model and team. These firms have track records of identifying category-defining companies early.

AI Services Market Validation: Accenture’s partnership with Anthropic (training 30,000 professionals) validates AI services as a major market opportunity. Traditional consulting firms investing heavily in AI capabilities demonstrates market size and urgency.

Vertical AI Expertise Required: Healthcare, financial services, and manufacturing have unique regulatory, data, and process requirements. Generic AI tools require significant customization—Distyl’s vertical expertise becomes increasingly valuable as AI moves beyond simple use cases to mission-critical applications.

ROI Pressure: Enterprises demanding measurable returns on AI investments. Distyl’s 100% production record and 120 million+ end users demonstrates they deliver value, not just consulting reports. Outcome-based delivery model aligns with enterprise needs.

Market Timing: Enterprise AI spending tripled in 2025 but implementation expertise remains scarce. Distyl is positioned as the essential partner for Fortune 500 AI transformation—solving the “last mile” problem that prevents AI investments from delivering returns.

The Strategic Narrative: Distyl represents a critical insight: AI technology alone doesn’t transform enterprises—implementation expertise does. While everyone focuses on model capabilities, Distyl recognized that helping organizations actually deploy AI in production creates enormous value. The Palantir pedigree validates this approach—Palantir proved that embedded expertise can build a multi-billion dollar business. Distyl is applying the same model to a much larger market opportunity.

As enterprises move from experimentation to scaling AI across operations, Distyl’s combination of technical expertise, vertical knowledge, and proven delivery model positions them as the essential partner for AI transformation.

Key Themes: What These 7 Companies Tell Us About AI in 2026

These seven companies collectively illustrate the maturation and diversification of AI innovation. Together, they reveal the patterns defining AI’s evolution from hype to essential infrastructure:

1. From Infrastructure to Application

The companies span the AI stack:

- Physical Intelligence building foundational robotics AI (infrastructure layer)

- Cursor creating developer tools that accelerate AI development (tooling layer)

- Glean providing enterprise AI infrastructure (platform layer)

- Sierra, Harvey, Abridge applying AI to specific high-value use cases (application layer)

- Distyl helping enterprises actually implement AI at scale (services layer)

This demonstrates AI’s maturity—the stack is being filled in from bottom to top, with each layer enabling the layers above.

2. Vertical AI is Winning

Three companies (Harvey, Abridge, Distyl) focus on specific industries with deep domain expertise. Vertical AI companies are achieving 400% year-over-year growth with 65% gross margins—significantly outperforming horizontal AI solutions.

Why vertical AI works:

- Regulations create moats (HIPAA in healthcare, attorney-client privilege in legal)

- Domain expertise is not easily replicated

- Willingness to pay is higher for specialized solutions

- Data network effects within verticals

- Lower customer acquisition costs within industries

2026 will be the year vertical AI proves its superiority in regulated, high-stakes domains where general-purpose models cannot meet precision, compliance, and liability requirements.

3. The Implementation Gap Creates Massive Opportunity

Distyl’s explosive growth (9x valuation in 10 months) highlights a critical bottleneck: enterprises struggle to deploy AI in production. While much attention focuses on model capabilities, companies solving implementation are capturing enormous value.

The gap exists because:

- Enterprises lack in-house AI expertise

- Integration with legacy systems is complex

- Change management and training are challenging

- ROI measurement requires business context

- Security and compliance add complexity

This implementation gap won’t close quickly—it represents a multi-year opportunity for companies that can bridge the chasm between AI tools purchased and AI systems deployed.

4. Developer Tools Having an Unprecedented Moment

Cursor’s journey from $0 to $1 billion+ ARR in under 2 years, reaching $29.3 billion valuation, demonstrates how AI is transforming software development itself.

The transformation is profound:

- 90% of code at leading companies now AI-generated (up from 10-15% in 2024)

- Developer productivity increasing 5-10x with AI tools

- Shift from writing code to reviewing and directing AI-generated code

- AI developer tools market growing from $4.8B to $17.2B by 2030

This has implications beyond just coding—it suggests any knowledge work involving creation could see similar step-change productivity gains from AI tools. Writing, design, analysis, and research are all candidates for “Cursor moments.”

5. Agentic AI Goes Mainstream

Sierra’s conversational agents and Glean’s workflow automation show AI moving from assistants to autonomous agents.

The shift from copilots to agents:

- Copilots suggest; agents execute

- Copilots require human-in-the-loop for every action; agents work autonomously

- Copilots assist with tasks; agents complete entire workflows

- 23% of enterprises scaling agentic systems; 39% more experimenting

2026 will be the year AI agents move from novelty to necessity, handling customer service, documentation, research, data analysis, and increasingly complex multi-step workflows without human intervention.

6. Foundation Models Expanding Beyond Language

Physical Intelligence’s robotics foundation models and Harvey’s legal-specific models show AI expanding beyond language into specialized domains and physical interactions.

The pattern:

- Language foundation models (GPT, Claude, Llama) established the template

- Now seeing domain-specific foundation models (legal, medical, robotics)

- Multimodal foundation models combining vision, language, and action

- Specialized models outperforming general-purpose in specific domains

This suggests the future isn’t one massive foundation model for everything, but an ecosystem of specialized foundation models optimized for different domains and modalities.

7. Enterprise Adoption Accelerating Dramatically

All seven companies serve enterprise customers, with several (Sierra, Harvey, Abridge, Glean) achieving $100 million+ ARR within 2-3 years of launch.

Enterprise AI spending trajectory:

- $11.5 billion (2024)

- $37 billion (2025) - 3.2x increase

- Projected continued acceleration in 2026

Adoption metrics:

- 78% of companies actively deploying AI (up from 54% in 2024)

- 87% of large enterprises implementing AI solutions

- 31% of use cases in full production (doubled from 2024)

The enterprise AI market has moved from pilots to production, from experimentation to essential infrastructure. CFOs and boards now view AI as strategic necessity, not optional innovation.

8. Selective but Massive Funding for Proven Leaders

While overall startup funding has cooled, elite AI companies are raising unprecedented amounts:

- Cursor: $2.3 billion round at $29.3 billion valuation

- Physical Intelligence: $600 million at $5.6 billion

- Harvey: $760 million across three 2025 rounds

- Abridge: $550 million in two 2025 rounds

The message: Investors are massively backing proven AI leaders (demonstrating revenue, retention, and outcomes) while being highly selective about the rest. “AI washing” is over—results matter.

9. From Experimentation to Production at Scale

The common thread across all seven companies is moving AI from pilots to production at meaningful scale:

- Cursor generating production code for 1 million+ daily users

- Sierra handling millions of customer conversations

- Glean powering 100+ million agent actions annually

- Harvey serving 74,000+ lawyers across 700+ organizations

- Abridge documenting 50+ million medical encounters

- Physical Intelligence training foundation models on 1.5 million+ robot tasks

- Distyl deploying AI for 120+ million end users

These aren’t demos or research projects—they’re production systems delivering real business value at enterprise scale. 2026 will be remembered as the year AI became essential enterprise infrastructure rather than experimental technology.

What This Means for Businesses and Professionals

The seven companies profiled here offer strategic insights for organizations and individuals navigating the AI revolution:

For Business Leaders:

-

Vertical Solutions Over General Tools: If you operate in healthcare, legal, finance, or other regulated industries, vertical AI solutions will deliver better outcomes than general-purpose tools. Domain expertise and compliance built-in provide significant advantages.

-

Implementation is the Bottleneck: Buying AI tools is easy; deploying them in production is hard. Budget for implementation expertise, not just software licenses. Consider partners like Distyl that can bridge the gap between purchase and production.

-

Agentic AI Requires Different Architecture: Moving from copilots to agents requires rethinking workflows, governance, and human-AI collaboration. Start experimenting with autonomous agents in controlled environments to learn before scaling.

-

Developer Productivity is Step-Changing: If you build software, AI-powered development tools like Cursor are not optional—they’re essential for competitive engineering productivity. Expect 5-10x improvements in output.

-

ROI Demands Measurement: The days of “AI experimentation budgets” are over. Enterprise AI projects must demonstrate clear ROI through time savings, cost reduction, revenue growth, or customer satisfaction improvements.

For Technology Professionals:

-

Specialization Wins: Deep expertise in vertical AI (healthcare, legal, finance) or specific modalities (robotics, voice) is more valuable than general AI knowledge. Become expert in domain + AI rather than just AI.

-

Implementation Skills Critical: Expertise in deploying AI in production, integrating with enterprise systems, and optimizing performance is scarce and highly valued. Focus on the “last mile” between demo and deployment.

-

Foundation Model Thinking: Understanding how to fine-tune, evaluate, and deploy foundation models for specific use cases is increasingly important. RAG, prompt engineering, and model evaluation are practical skills with high demand.

-

Regulatory Knowledge Matters: Understanding HIPAA, attorney-client privilege, financial regulations, and other compliance frameworks is critical for deploying AI in regulated industries. Combine technical and regulatory expertise.

-

Agent Orchestration is Next: As AI moves from tools to agents, skills in designing multi-agent systems, workflow orchestration, and autonomous task execution will be highly valued.

For Investors:

-

Vertical AI Outperforming: 400% YoY growth and 65% gross margins in vertical AI vs. horizontal solutions. Domain-specific models with regulatory moats are compelling investments.

-

Services-to-Platform Opportunity: Companies like Distyl starting as services can evolve to platforms by productizing expertise. Look for services companies with repeatable delivery models and 100% production rates.

-

Implementation Layer Undervalued: While model providers get attention, companies solving the implementation gap (Distyl) are growing faster with better margins. The “last mile” is a massive market opportunity.

-

Rapid Revenue Growth Possible: Multiple companies achieved $100M+ ARR in 2-3 years (Cursor, Sierra, Harvey, Abridge). AI enables unprecedented growth rates when product-market fit is achieved.

-

Foundation Models Beyond Language: Robotics (Physical Intelligence), legal (Harvey), healthcare (Abridge) foundation models represent new investment categories with massive TAM.

Conclusion: AI’s Inflection Point

2026 marks the transition from AI as experimental technology to AI as essential infrastructure. The seven companies profiled in this guide—Cursor, Sierra, Glean, Harvey, Abridge, Physical Intelligence, and Distyl—represent different aspects of this transformation, but they share a common thread: they’re delivering measurable outcomes at scale.

The key takeaways:

✅ Vertical AI is outperforming general-purpose solutions with 400% growth and 65% margins

✅ Agentic AI is going mainstream with 23% of enterprises scaling autonomous agents

✅ Developer tools experiencing step-change with 90% of code now AI-generated at leading companies

✅ Implementation expertise is scarce creating opportunities for companies bridging the gap

✅ Foundation models expanding beyond language into robotics, legal, healthcare, and specialized domains

✅ Enterprise adoption accelerating with AI spending tripling from $11.5B to $37B

✅ Selective but massive funding for proven leaders demonstrating production deployment

The question is no longer whether AI will transform industries—it’s which companies will lead that transformation. The seven profiled here have demonstrated exceptional execution, achieved remarkable traction, and are positioned to capture disproportionate value as AI becomes ubiquitous.

For businesses, the imperative is clear: move from experimentation to production deployment, focus on measurable outcomes, and partner with specialists who understand your domain. For professionals, the opportunity is to develop deep expertise in vertical AI, implementation, and agentic systems. For investors, the signal is that vertical AI, implementation services, and domain-specific foundation models represent compelling opportunities with proven business models.

2026 will be remembered as the year AI stopped being a technology trend and became essential business infrastructure. The companies worth watching aren’t promising future potential—they’re delivering present value at scale. And that makes all the difference.

Next Steps

Ready to understand how AI innovations impact your industry? Here’s your action plan:

- Assess your AI readiness by evaluating current tools, implementation gaps, and ROI from existing initiatives (1-2 days)

- Identify vertical AI solutions specific to your industry that solve high-value problems (3-5 days)

- Evaluate implementation partners if deployment expertise is lacking internally (1 week)

- Start with focused pilots in specific departments or use cases with clear success metrics (4-8 weeks)

- Measure and iterate based on actual outcomes, expanding successful pilots to broader deployment (ongoing)

Contact ClearPick for insights on emerging technologies and trends shaping your industry - completely free for you.

Last updated: December 30, 2025 | Read time: 15 minutes